EBC Markets Briefing | Crude price slide this week; AI hype cooled

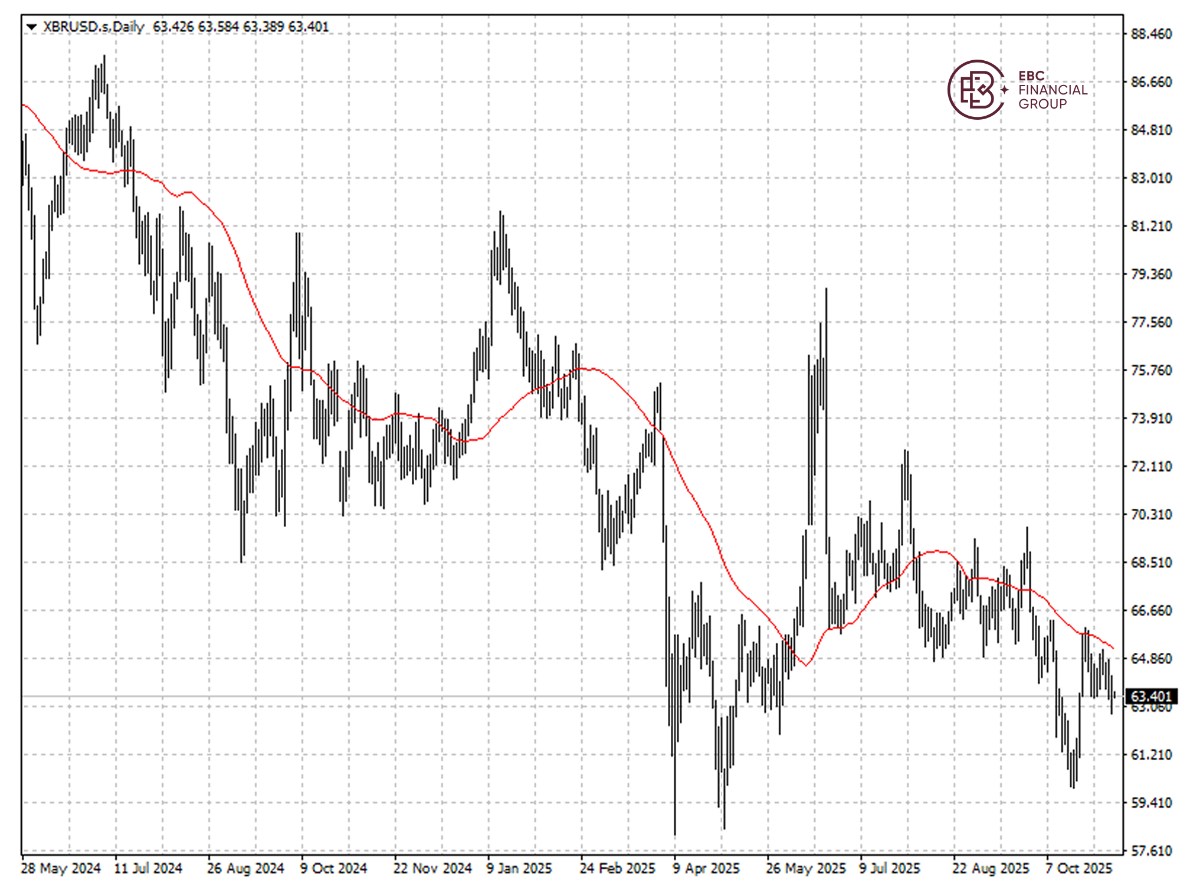

Oil prices were stable on Friday but were still headed for a weekly loss after news of potential increases to OPEC+ supply. For the week, Brent was trading 8.2% down and WTI was on course for a 7.6% decline.

OPEC+ could agree at an online meeting on Sunday to raise production in November by 274,000-411,000 bpd, or two or three times higher than the October increase, according to sources familiar with the matter.

The policy shift, slowing global crude refinery runs owing to maintenance and a seasonal dip in demand in the months ahead are set to weigh on market sentiment, analysts say.

Layoff announcements soared in October as companies recalibrated staffing levels during the AI boom, a sign of potential trouble ahead for the labour market, according to Challenger, Gray & Christmas.

There are also signs of economic weakness in Asia. Big manufacturing hubs struggled to fire up in October, business surveys showed, as weak demand and tariffs under Trump hit factory orders across the region.

US oil inventories rose by around 5.2 million barrels last week, against market prediction of a 2.4 million-barrels decrease, the EIA said. Meanwhile, gasoline inventories decreased to the lowest level since November 2022.

Brent crude traded below 50 SMA, with lower highs and lower lows signalling continuation of weak momentum. A retest of $62.75 is thus in the wind.

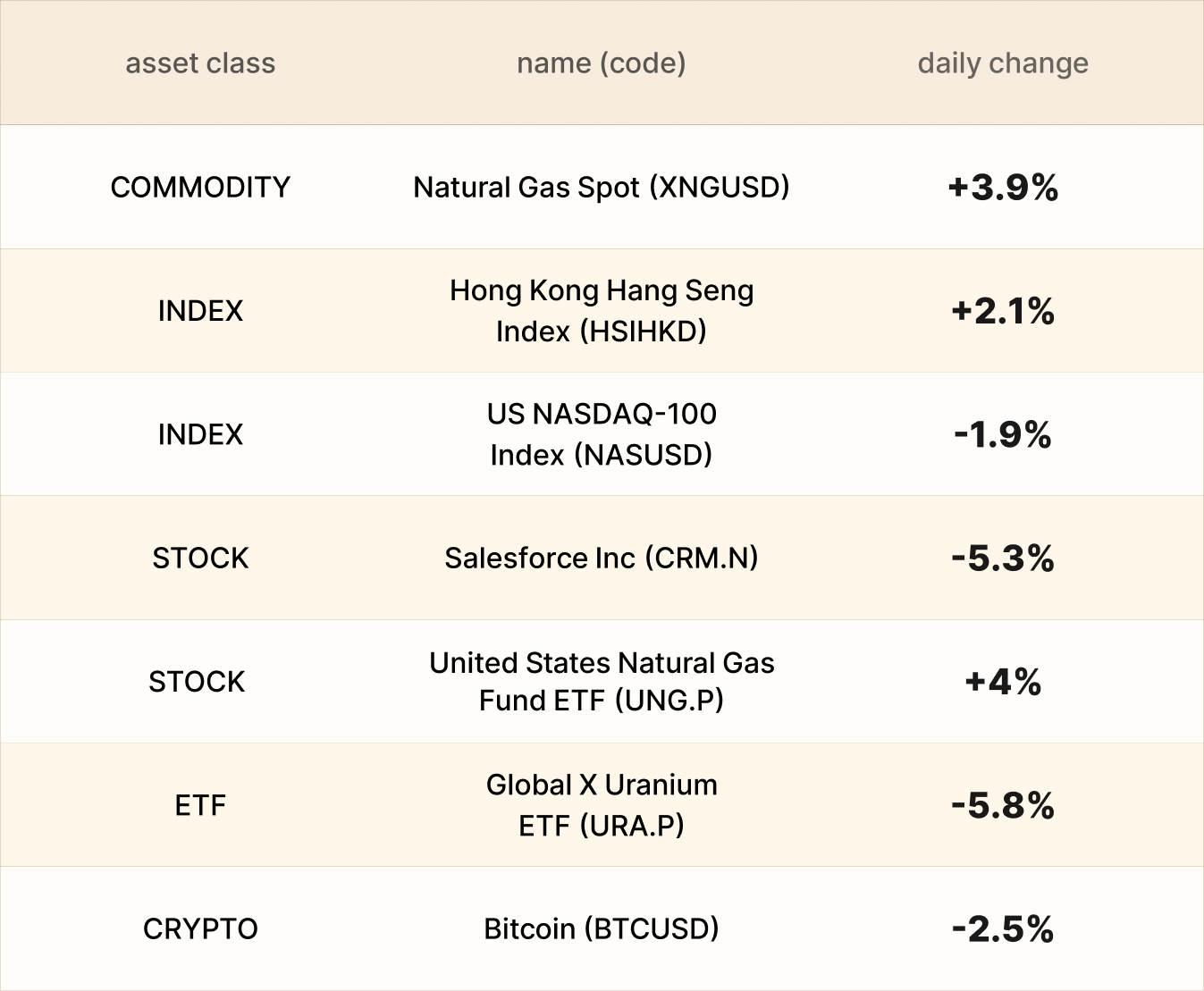

Asset recap

As of market close on 6 November, among EBC products, United States Natural Gas Fund ETF led gains as the coming cold weekend raises near-term demand expectations.

US stocks closed in negative territory in the previous session, with a resumption of Tuesday's tech selloff as investors contended with mounting economic uncertainty and stretched valuations.

RBC reduced their price target on Salesforce from $275.00 to $250.00 and set a "sector perform" rating. The company issued weak revenue guidance in September.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.