EBC Markets Briefing | Wall St back in green with Nvidia jumping

The S&P 500 and the Nasdaq 100 closed higher on Tuesday for a second straight day after softer-than-expected inflation numbers added to investor optimism from easing US-China trade tensions.

Tuesday's gain has put the Nasdaq 100 out of the red for 2025. Shares of Nvidia advanced 5.6% on news the company would send 18,000 of its top artificial intelligence chips to Saudi Arabia.

Still the market underperforms its major peers significantly. The DAX 40 hit a fresh record high on Friday, while the Hang Seng index has been the best performer of the year on China's drive for tech advancement.

Right after a trade deal between the US and the UK was struck, Trump told reporters it was time to scoop up stocks in the Oval Office, adding the economy "will be like a rocket ship that goes straight up."

Goldman Sachs strategists see the S&P 500 Index reaching 6,500 in the next 12 months, up from 6,200 previously. The new estimate implies about a gain of about 10% from Tuesday's close.

The bank also warns "despite the recent improvement in the growth outlook, tariff rates will likely be substantially higher in 2025 than they were in 2024, putting pressure on profit margins."

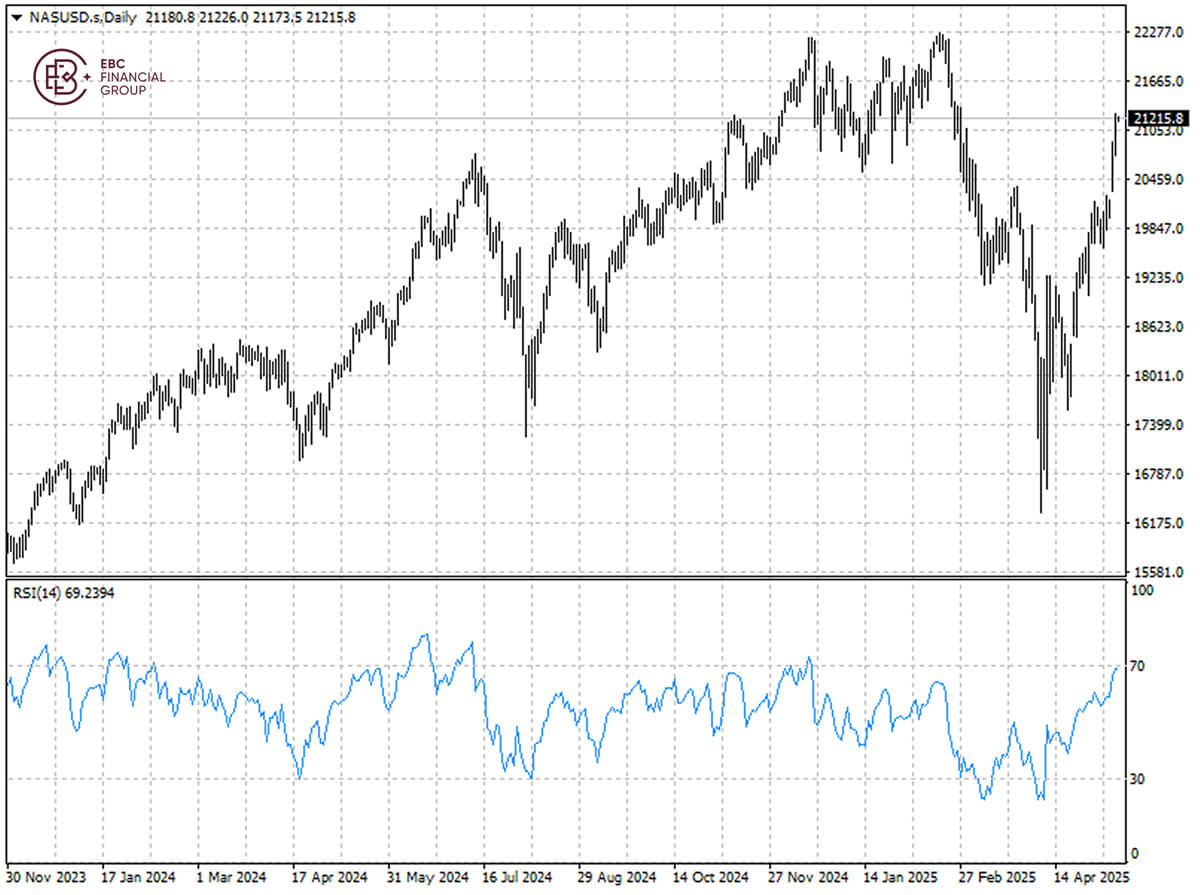

The Nasdaq 100 is closing in on the high around 21,250 hit in November. Given RSI indication of overbought condition, the index could recoil in the short term.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.