EUR/USD Stabilises as US Inflation Cools Without Major Surprises

By RoboForex Analytical Department

Following a nervous session last night, the EUR/USD pair is trading near 1.0285 on Thursday morning. The market is now stabilising.

Key developments influencing EUR/USD

US inflation data showed moderate growth, aligning with expectations. As forecast, the Consumer Price Index (CPI) rose by 0.4% m/m in December, maintaining an annualised rate of 2.9% y/y. Core CPI, excluding volatile goods, offered a slight surprise with a ‘cooling’ effect. It increased by 0.2% m/m (3.2% y/y), below the forecasted 0.3% m/m (3.3% y/y).

US Treasury yields declined, negatively impacting the USD. However, the currency market’s reaction remained subdued.

The release of inflation statistics prompted investors to modestly revise their expectations for Federal Reserve interest rate cuts in 2025. Lending costs are now expected to drop by an average of 37 basis points throughout the year.

The USD demonstrated resilience in January and performed better than in December. If this trend continues, the current week will mark the fourth consecutive week of USD strengthening.

In contrast, European statistics provided little support for the euro. Industrial production in the Eurozone rose by 0.2% m/m in November, following stagnation in October. However, year-on-year figures revealed a deeper contraction, with production falling by 1.9%.

Investors now await key US economic data, including December retail sales and weekly jobless claims, which could further influence the pair.

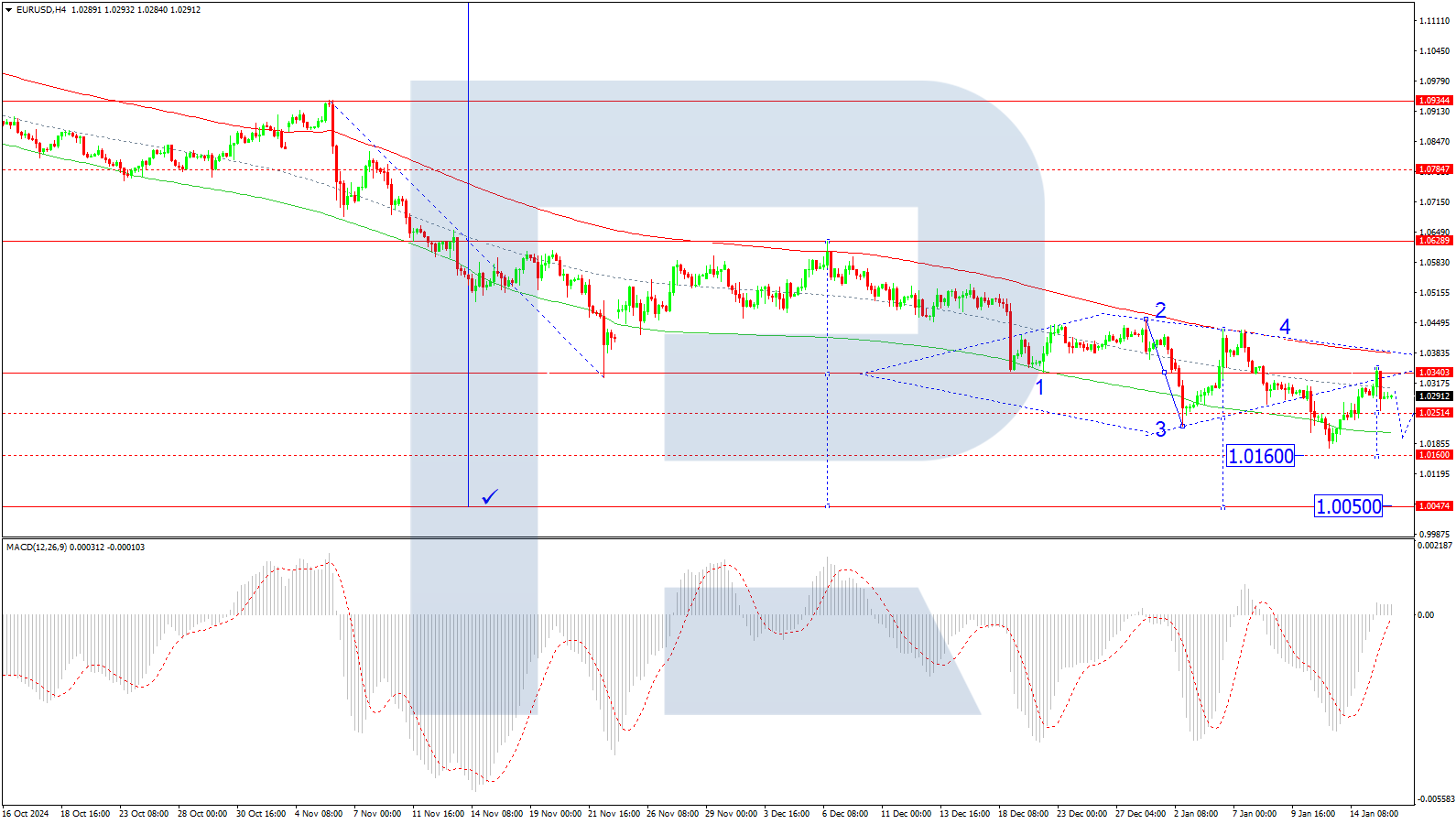

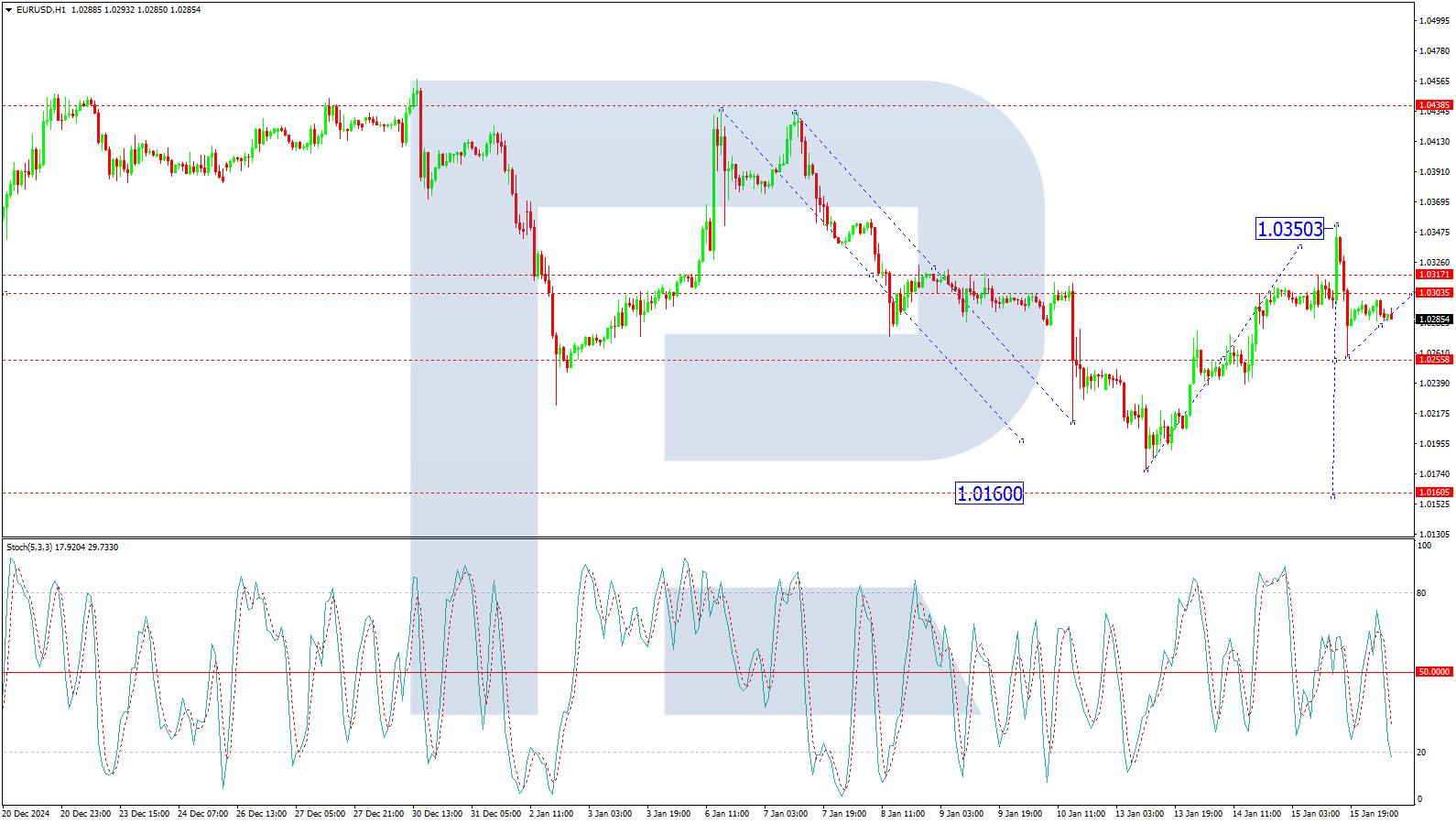

Technical analysis of EUR/USD

On the H4 chart, EUR/USD completed a corrective wave to 1.0350 before forming a new downward impulse to 1.0258. The current outlook suggests the potential development of a new downward wave targeting 1.0160. After reaching this level, a corrective move towards 1.0250 is likely, with a possible further decline to 1.0050. This scenario is supported by the MACD indicator, with its signal line below zero and trending downwards, indicating the likelihood of renewed lows.

On the H1 chart, the pair formed a downward impulse to 1.0258, with a correction expected to target 1.0300. Once this level is reached, the downward wave may resume, aiming for 1.0210 and potentially extending to 1.0160. The Stochastic oscillator supports this outlook, with its signal line below the 50 mark and heading towards 20, suggesting continued downward momentum.

Conclusion

EUR/USD remains under pressure as US inflation data bolstered the dollar’s resilience. While technical indicators point to further downside potential, the pair’s movements will largely depend on upcoming US retail sales and jobless claims data, as well as the overall strength of the USD. On the euro’s side, weak industrial production data highlights ongoing challenges in the eurozone, adding further weight to the bearish outlook.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.