EURUSD takes a breather, but bullish bias intact

EURUSD surged to a three-and-a-half-year high of 1.1630, following weaker-than-expected U.S. inflation data and a relatively more hawkish commentary from ECB policymakers. However, the outbreak of bombings between Israel and Iran has rekindled risk aversion, pushing the pair to the sidelines.

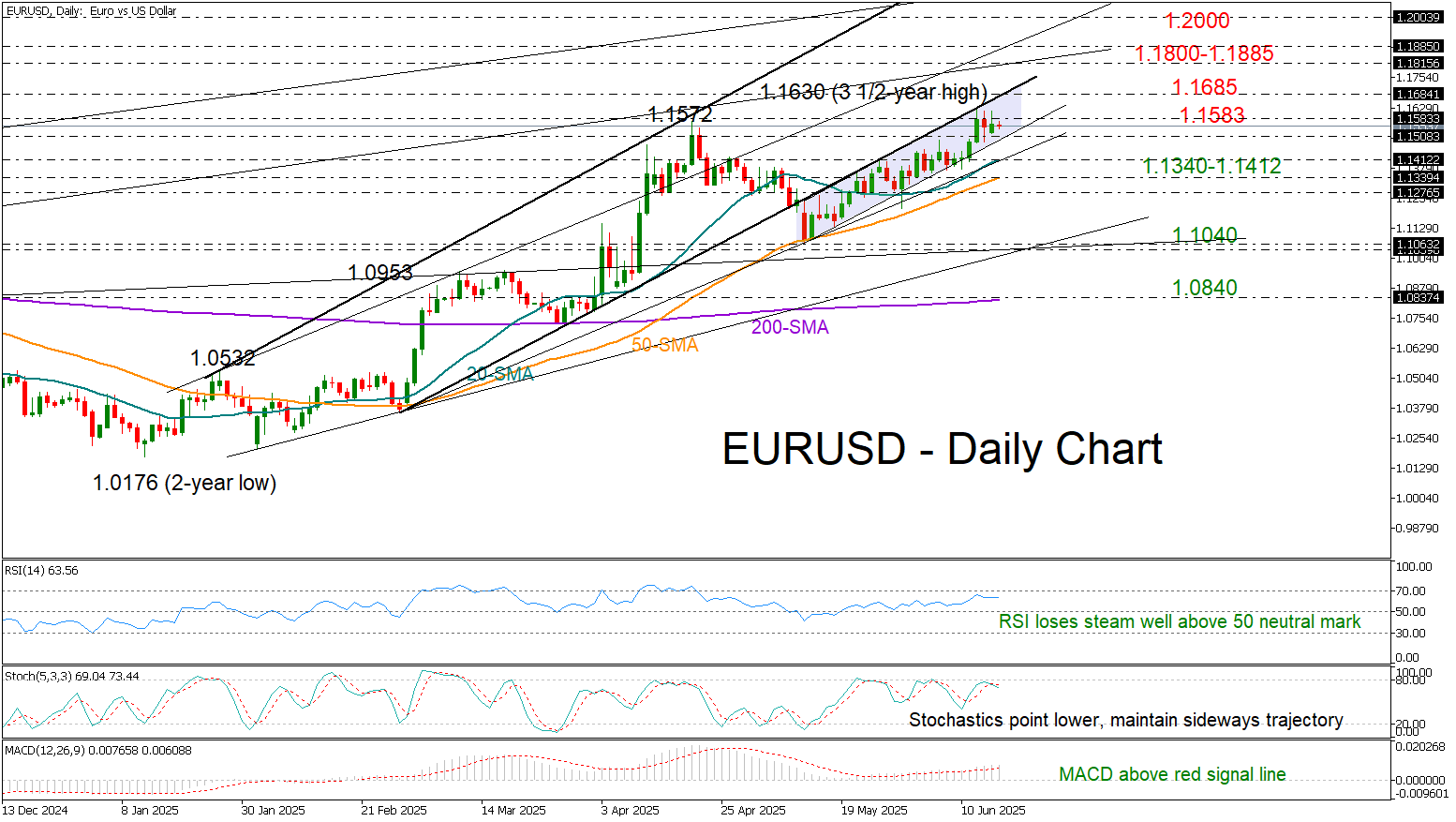

Yet, the sideways movement has not eliminated hopes for a bullish continuation. Although the RSI and MACD have lost some momentum, both indicators remain comfortably above their neutral levels. Meanwhile, the upward trajectory of the simple moving averages (SMAs) continues to support the bullish trend.

Upcoming U.S. retail sales data will be in focus, with euro bulls hoping for a negative surprise to break above the nearby 1.1583 barrier and advance toward the support-turned-resistance line at 1.1685. Beyond that, the trendline zone between 1.1800 and 1.1885 could delay any further extensions toward the psychological 1.2000 level, last seen in June 2021.

On the downside, a break below the support trendline at 1.1500 could prompt the 20- and 50-day SMAs to provide support in the 1.1340–1.1412 region. If those levels fail to hold and the 1.1275 base also gives way, the sell-off could deepen toward May’s trough and the 1.1040 support zone.

Overall, EURUSD is retaining its bullish appeal despite its recent consolidation phase. A close above 1.1583 could strengthen the uptrend, while a drop below 1.1500 may trigger some profit-taking.

.jpg)