Fear and Greed: How to Catch Falling Knives?

Fear and Greed: How to Catch Falling Knives?

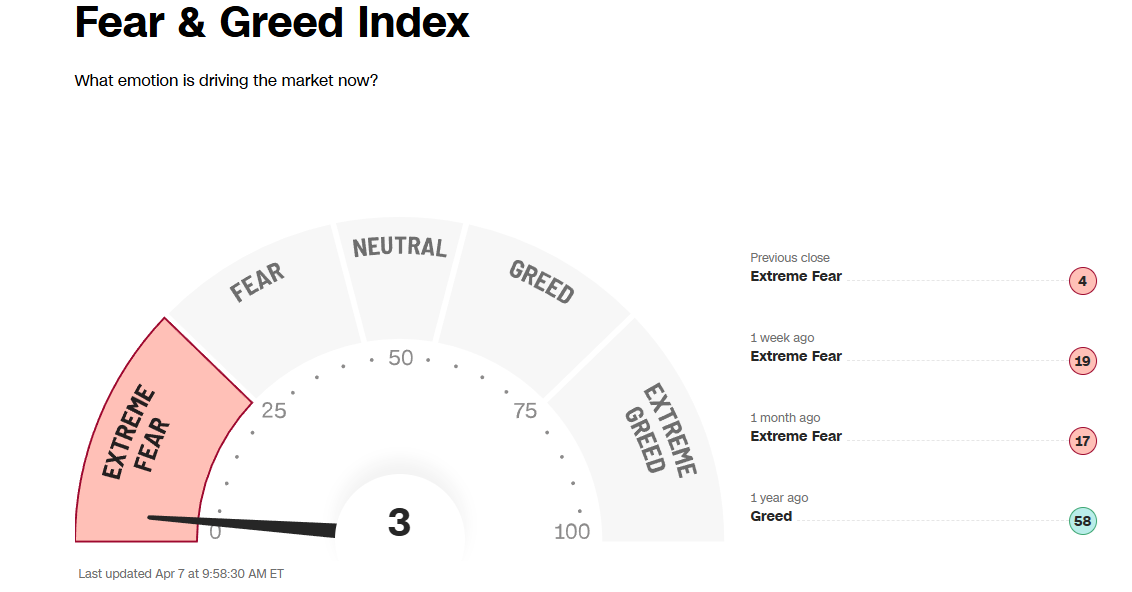

Sentiment in financial markets has hit its lowest point in more than five years. The Fear and Greed Index fell to 4 on Friday and remains at that level at the start of trading in the new week. In recent history, only a return of the index above 10 was the first early signal of a rebound in growth. We consider a move out of the extreme fear zone, i.e., above the 25 level, to be a more reliable indicator.

Today's index levels are the lows since the end of March 2020, when covid lockdowns stormed markets. Back then, the index's period of single-digit levels lasted from 5 to 23 March. The result was a drop of more than 30% in the S&P 500.

Even earlier, in late 2018, the market’s sharp recovery began just before fear levels rose into double digits—similar to the sell-off in August 2015. However, a return to such fear levels typically occurs near the index’s lowest points.

It is important not to rush and to wait for at least the first signs of a reversal in sentiment. Fluctuations at low, single-digit levels may not last long, but markets can fall painfully deep during this time.

For longer-term investors, a more reliable indicator is a recovery from extreme fear, i.e. a rise in the indicator above 25. Very often, this is followed by a long recovery, and buying near the bottom gives a good return-to-risk ratio.

However, a more reliable and timelier signal is a change in politicians' rhetoric. The Fed's actions primarily helped the markets. So many are hoping for a quick or even immediate change ‘right now’. In the current circumstances, this could well be a change in Trump's narrative or that of other leaders.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)