The crypto market shows no sign of stopping

Market picture

Negative momentum in equities after the US inflation report triggered a quick correction but only attracted new buyers who saw it as an opportunity to buy cheaper.

In 24 hours, the crypto market added another 1.5% to reach $1.91 trillion. Now, buying is concentrated in a narrow range of the largest coins. We are still in the relatively early stages of the global rally, where second and third-tier coins are not yet in high demand. The story is different for the top coins.

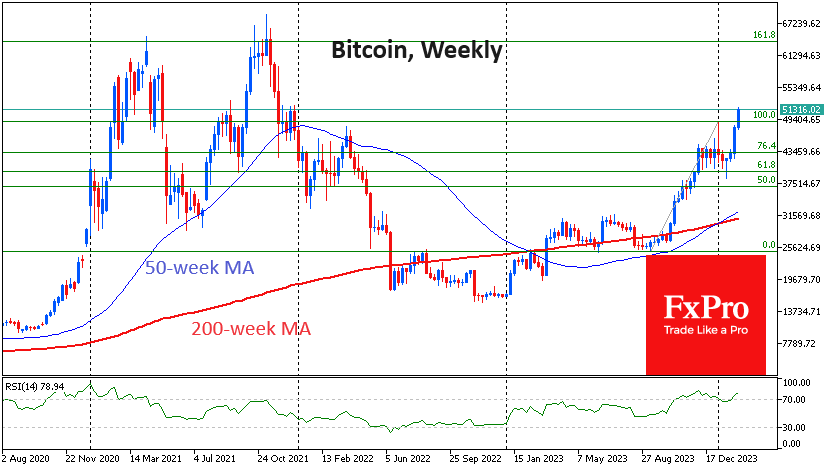

Bitcoin rose 2.2% in 24 hours to $51.2K and peaked at $51.7K. This is the upper limit of the December 2021 consolidation. Bitcoin may well see a shakeout in this area, as it did in September and December 2021. However, we believe this is part of a powerful bullish wave that could resume growth very quickly.

Ethereum has broken above $2700 for the first time since May 2022. The 15% rise in less than nine days suggests impressive buying interest after the bulls reloaded their positions in January. Possibly as part of a new wave of growth, ETH could quickly find itself approaching $3500 - returning to the April 2022 peak.

News Background

According to Deribit, bitcoin options traders have been betting on a rally to the $65K - $75K level before the end of the second quarter.

Michael van de Poppe, founder of MN Trading, noted that net inflows into spot bitcoin ETFs have exceeded $1.5 billion in the last three days and have reached $3.26 billion since 11 January.

CryptoJelleNL pointed out that BTC broke through the 0.618 Fibonacci retracement level for the first time ever before halving. According to him, this is "the strongest start to a new bull cycle in history".

Since November 2023, long-term investors (hodlers) have taken around 148,000 BTC out of their wallets. According to Glassnode, this situation signals the start of profit-taking by this category of market participants.

The absence of spot bitcoin ETFs for ten years has held back investor demand for digital gold, said Michael Saylor, founder of MicroStrategy. He said: "BTC is in demand because it is not correlated to traditional risk assets, nor is it tied to any country, company, weather, supply chain, market cycle or competitor."

The sentencing of Binance founder Changpeng Zhao on money laundering charges was postponed until 30 April. Zhao faces a maximum sentence of 18 months in prison. Prosecutors had previously announced their intention to seek a harsher sentence of up to 10 years.

Cryptocurrency market maker Wintermute, together with The Block, will launch the Global Markets Crypto Intelligence (GMCI) index to track the top 30 cryptocurrencies.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)