EBC Markets Briefing | Crude prices rally ahead of Trump-Putin meeting

Oil prices edged up on Thursday, regaining ground after a sell-off in the previous session, with the upcoming meeting between Trump and Putin raising risk premiums in the market.

Trump has threatened "severe consequences" if Putin does not agree to peace in Ukraine. He did not specify what the consequences could be, but it likely involves secondary tariffs on Russian oil buyers.

The market is putting the odds of a quarter-percentage point cut at the Fed's September meeting at 99.9%, according to the CME FedWatch tool. A 50-bp is seen as possible following weak employment reports.

The IEA forecast that 2025 and 2026 world oil supply would rise more rapidly than expected, as the OPEC+ increase output and production from outside the group grows.

But OPEC+ raised its global oil demand forecast for next year and trimmed estimates of supply growth from the US and other producers outside the wider group, pointing to a tighter market.

US crude stocks rose by 3 million barrels last week, compared with a 275,000-barrel draw analysts had expected, the EIA said on Wednesday. Meanwhile, net imports rose by nearly 700k bpd.

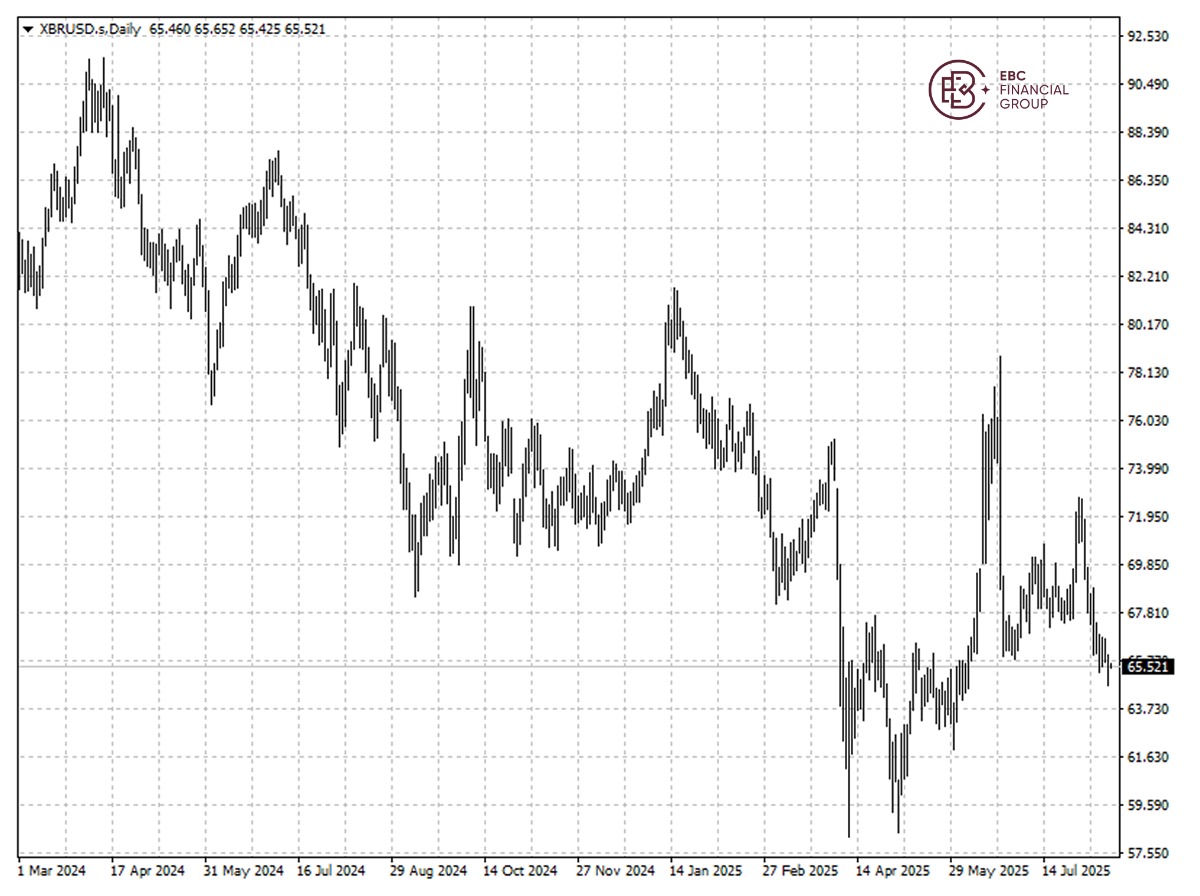

Brent crude has trended lower since the end of July, more than wiping out all its gains for the month. We expect it to keep falling and retest the low of $64.73.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.