ECB set to continue the fight against inflation despite its weakening

The euro is hovering around the $1.07 level, barely recovering above that mark on Thursday morning despite a sharper-than-expected drop in inflation.

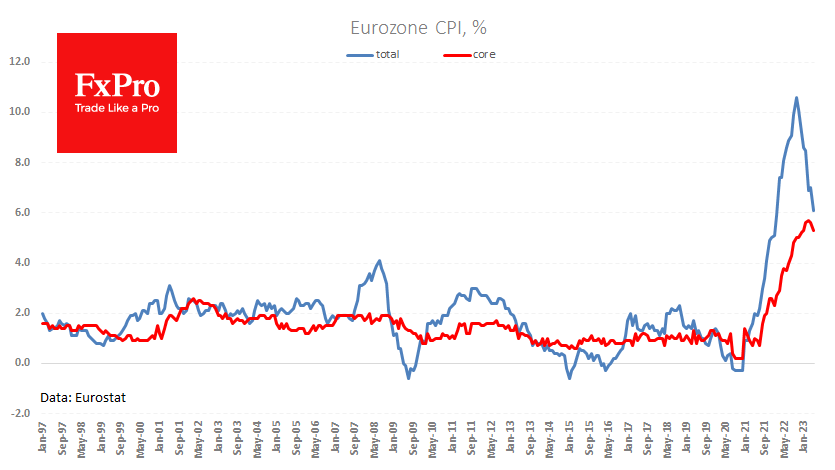

Eurostat’s preliminary estimate showed a decline in annual inflation in May to 6.1% from 7.0% in April. Economists had forecasted a smaller decrease to 6.3% y/y. Core inflation, which excludes volatile energy and food prices, also slowed down from 5.6% to 5.3%, confirming a downward trend.

Earlier statistics from other indicators and CPI data from the major countries suggested similar outcomes, but it is still helpful to have confirmation from the consolidated data.

However, we would like to stress that in these critical times, the regulator’s perception of these facts is more important than the facts themselves. As the statistics were released, ECB President Lagarde reaffirmed in her speech in Hannover that she wanted to continue the cycle of further rate hikes.

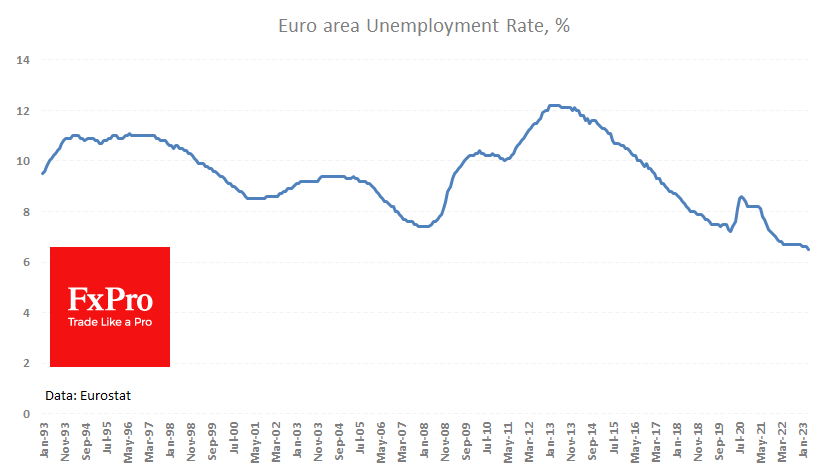

She also said that it needed to be clarified whether the already implemented hikes were enough. The hawkish stance of the ECB is also supported by data from the labour market, where the unemployment rate fell to 6.5% in April, the lowest level since 1993. The tight labour market could create additional price pressures despite falling energy prices and slower growth in food prices.

A strong labour market and a hawkish ECB attitude favour the single currency. We also note that the ECB only has a mandate for an inflation target, while the Fed must maintain maximum employment.

The euro area may be less sensitive to monetary policy than inflation in the US. This was evident in higher rates than in the US before 2008 and lower rates afterwards. Zero-rates era is over, so we expect a return of positive key rate differentials between Europe and the US in the coming years.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)