Oil jumps amid a bear market

Oil jumps amid a bear market

Several pieces of bullish news converged on oil on Wednesday, causing prices to jump more than 6% during the day, but a 3% pullback on Thursday shows that bears are still in charge.

Among the important drivers for oil at the end of the day on Wednesday were reports of the evacuation of part of the US embassy in Iraq due to instability in the region. This is a reaction to Israel's intensified preparations for an attack on Iran, which sharply increases the risks of retaliatory measures and a reduction in oil supplies from the region.

In addition, news of a trade agreement between China and the US is positively impacting oil, potentially increasing energy demand and overall risk appetite.

Soft US inflation data also contributed to the dollar's weakening, facilitating oil price growth.

However, important industry indicators also emerged. Commercial crude oil inventories fell by 3.6 million barrels last week after declining by 4.3 million and 2.8 million barrels in the previous two weeks.

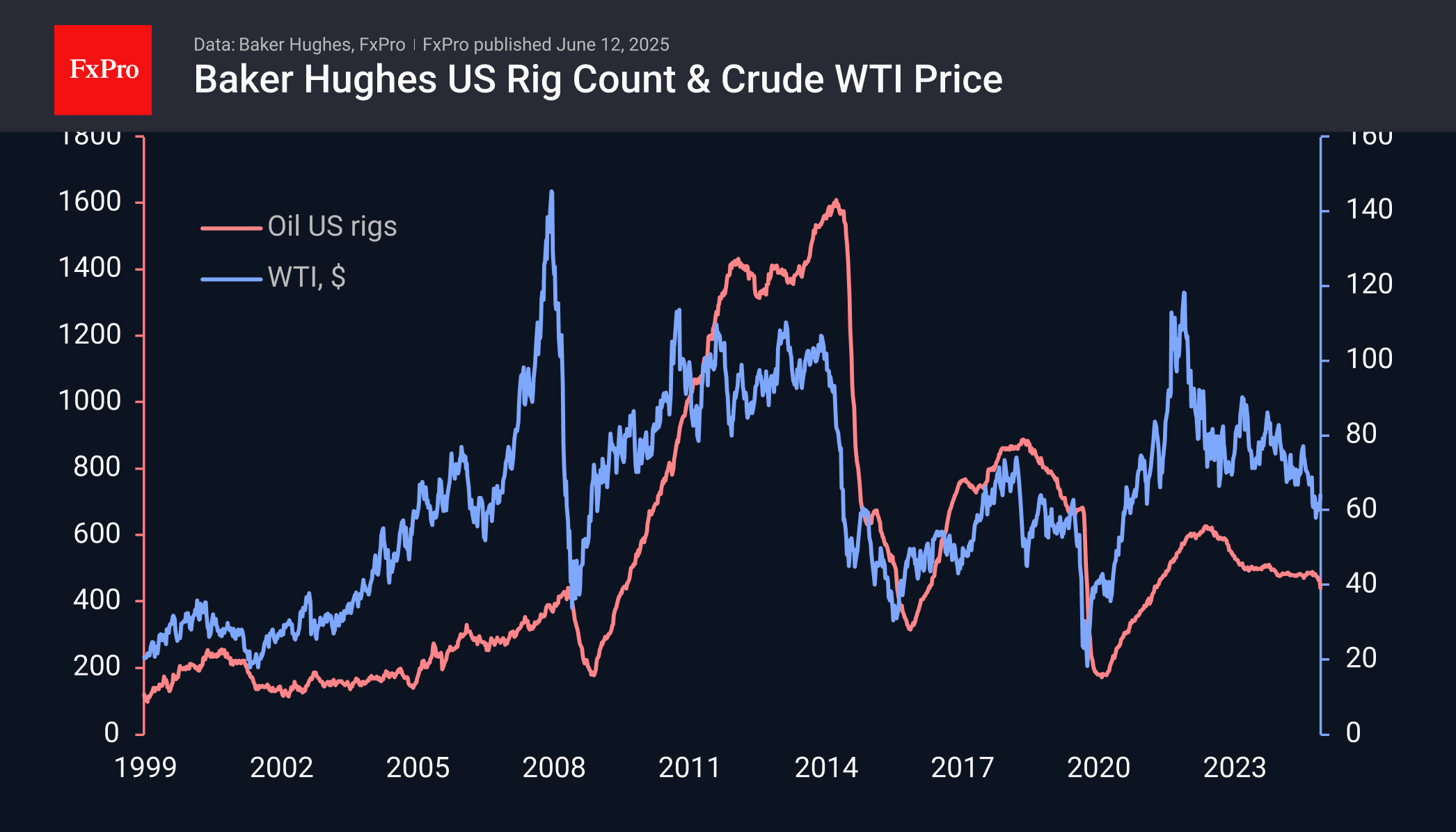

Earlier reports from Baker Hughes pointed to a significant reduction in active oil rigs to 442 (the lowest in almost four years) compared to an average of approximately 486 in March-April. This is a clear shift towards reduction after a period of stabilisation, which promises a decline in production in the coming quarters. It appears that America will return to Saudi Arabia or OPEC+, which is the market share gained after 2020.

In its rise, the price of WTI crude oil approached the 200-day average, as we saw at the beginning of April. The impressive sell-off as it approached this level suggests that bears remain in control of the market, regardless of the news. Except for a couple of weeks at the beginning of the year, this downward trend line has acted as effective resistance since August last year. The bears' territory extends all the way to the $70 level, which, if broken, would be an important signal of a change in sentiment. Until then, the rise of oil may remain an opportunity to sell at a higher price.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)