Calm before the storm in markets ahead of pivotal US data

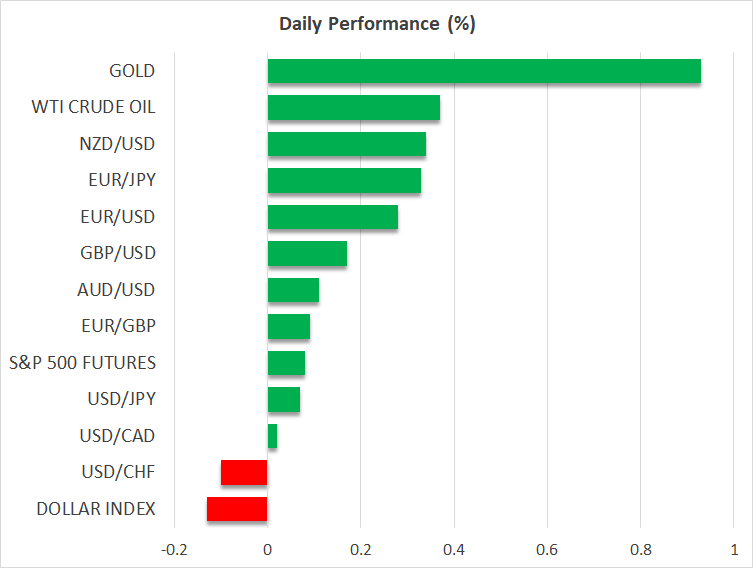

Dollar suffering continues

The US dollar has started the new month on the back foot, continuing the move recorded in August. Driven by the increased chances of a resumption of the Fed’s easing cycle, the dollar lost around 2.4% against the euro in August, with the dollar index dropping by a sizable 2.2%. The latter is down 10% on an annual basis, with the most notable adjustments seen in euro/dollar (+13%) and dollar/Swiss Franc (-12%).

US equity indices have been successfully ignoring the dollar’s weak performance this year, despite the heavy newsflow and many negative developments arising from US President Trump’s second term at the White House. August was an eventful month, with equities barely managing to remain in positive territory.

The 0.8% monthly rise in the Nasdaq 100 index could be seen as a sign of fading AI euphoria, although this has to be examined in conjunction with developments on the tariffs front. For example, Nvidia suffered in the latter part of last week on reports that Alibaba developed a new AI chip to help fill Nvidia’s void in China.

Trump tariffs face court battle

Last Friday, the US Court of Appeals for the Federal Circuit ruled that many of Trump’s tariffs are illegal. These tariffs will remain in place until October 14 to give the Trump administration time to appeal, but most commentators are confident that this issue will eventually reach the US Supreme Court. With six of the nine members appointed by Republican presidents, most assume that Trump will prove victorious once again.

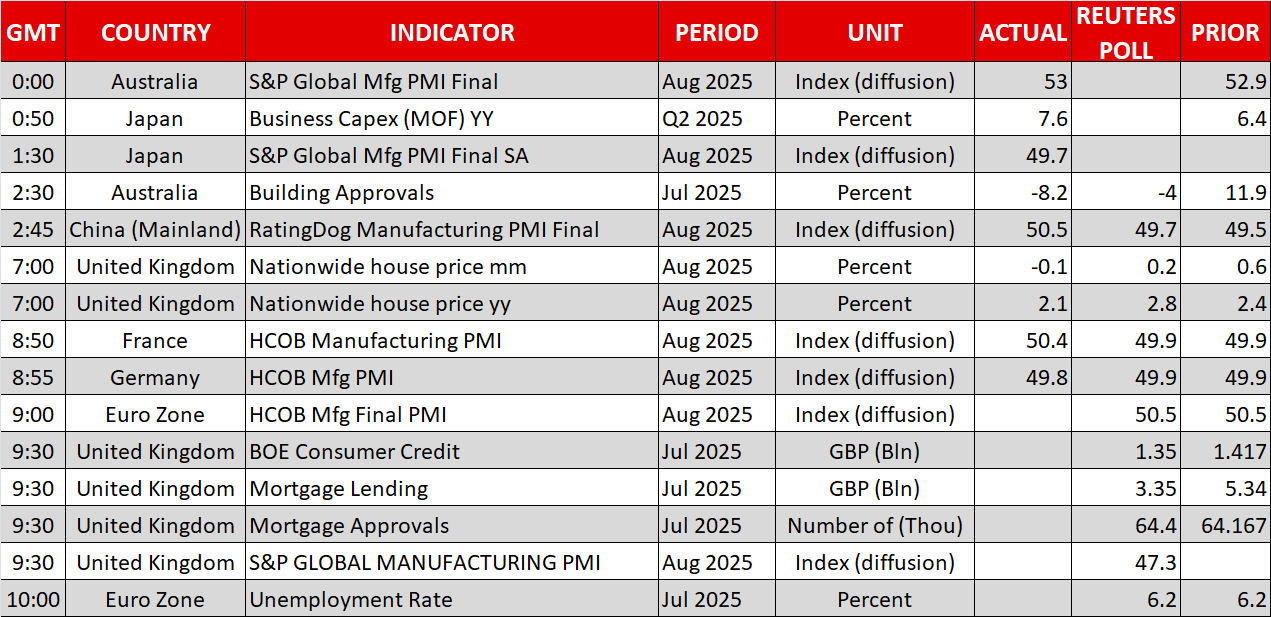

Meanwhile, the impact of tariffs continues to be felt across the globe, despite the mixed PMI Manufacturing surveys from China. South Korea’s exports in August showed a sharp decline, while the Japanese PMI Manufacturing export orders fell at the sharpest pace in nearly 18 months.

Critical US data ahead

While most US-based investors are enjoying the US Labor Day holiday, the countdown for this week’s critical labour market data has already commenced. Tuesday’s ISM Manufacturing PMI survey will probably be an appetizer for Thursday’s ADP employment report and ISM Services PMI survey, and more importantly, Friday’s nonfarm payrolls report. With a 25bps Fed rate cut already baked into the cake, could a 50bps rate move become a serious contender for the September 16-17 Fed meeting?

The Fed doves would surely be interested in a more aggressive move. San Francisco Fed President Daly repeated on Friday that “it will soon be time to recalibrate policy”, reiterating the doves’ main argument that tariff-related price increases will have a one-off impact on prices, and not lead to persistent inflation.

Meanwhile, the next episode in the Lisa Cook saga will take place on Tuesday, when Cook’s attorneys have been invited to submit their written arguments on the unlawfulness of Trump’s decision to fire the Fed board member. Similar to the tariffs case, this legal fight will most likely end up at the Supreme Court.

Gold and silver climb; cryptos under pressure

The continued uncertainty over tariffs, the Fed’s independence and global growth is fueling demand for precious metals. After almost four months of range-trading, gold has climbed above the upper boundary of $3,440 and is flirting with the April 22 all-time high of $3,500. Similarly, silver is trading above the $40 level for the first time since September 2011.

On the flip side, bitcoin remains under pressure after dropping around 6.5% in August, with demand dented by the weakness seen in US equities recently. Following a 20% rally in August, ether is hovering just above the $4,400 level, with most investors remaining extremely confident about the second largest crypto’s outlook.

.jpg)