What policy divergence and politics mean for EUR USD in September 2025

Key takeaways

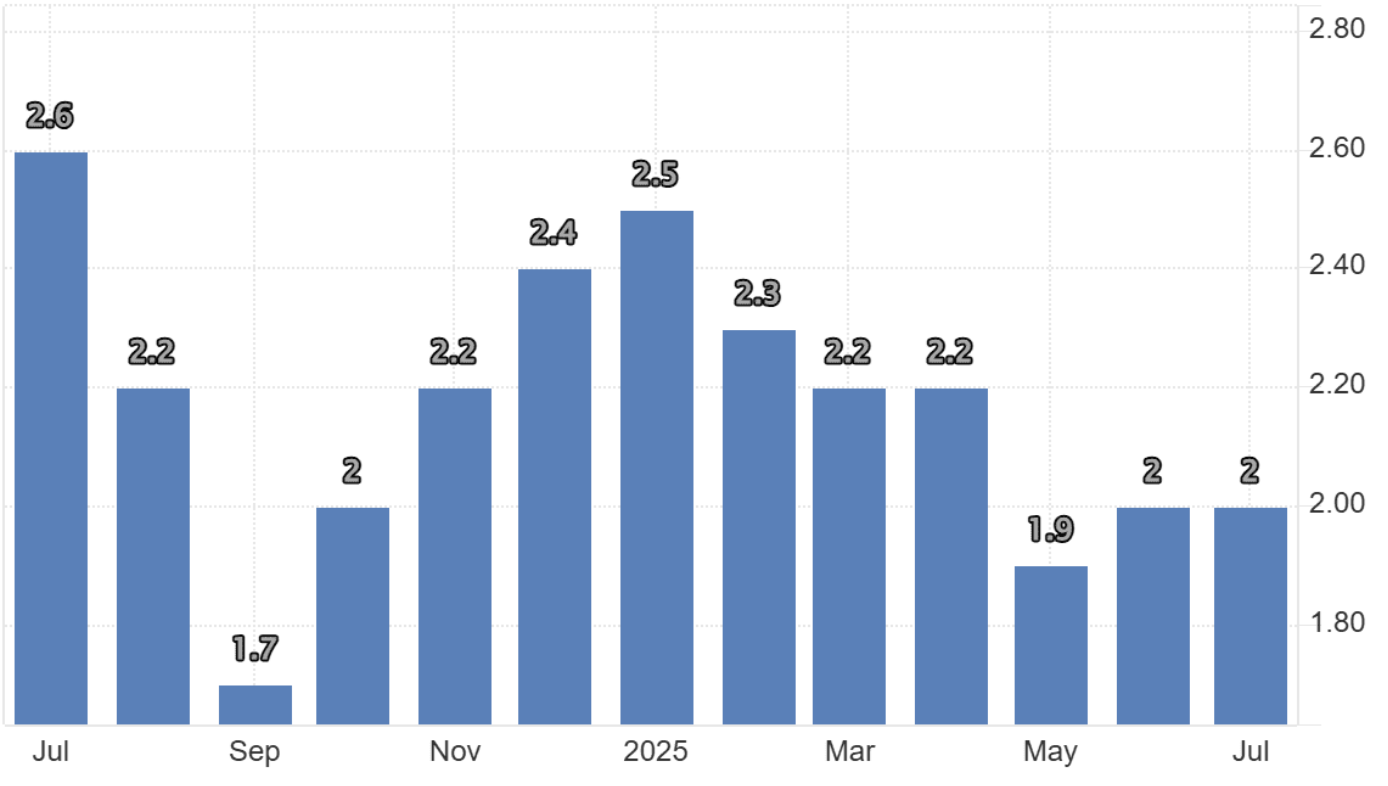

- ECB expected to hold its deposit rate at 2.00 on 10 September after inflation slowed to the target.

- Fed probability models show an 86 per cent chance of a cut to 4.25 on 17 September.

- Weak US labour data versus upcoming CPI and PCE reports will determine if easing begins.

- The French government faces a critical 9 September confidence vote over its budget plan.

- EUR USD range-bound for now, but September’s policy and political events could trigger a breakout.

The ECB’s neutral stance

The European Central Bank is signalling patience rather than urgency. Inflation in the eurozone eased to 2 per cent in July, hitting the target for the first time since the energy price shock of 2022.

Christine Lagarde highlighted that higher interest rates are now restraining demand, while structural supports like migration are helping to stabilise the labour market.

Markets overwhelmingly expect no change at the 10 September meeting, with the deposit rate pinned at 2.00. In effect, the ECB has parked policy, choosing to observe how growth and inflation evolve before committing to any cuts. This neutral posture limits immediate downside risk for the euro but also removes rate support as a driver.

Fed moves closer to cutting

The Federal Reserve, by contrast, is edging toward easing. July’s nonfarm payrolls showed just 73,000 new jobs and unemployment rising to 4.2 per cent, the weakest labour report in two years. Jerome Powell acknowledged the slowdown at Jackson Hole, suggesting that inflation is no longer the primary concern and that sustaining growth is now central to policy.

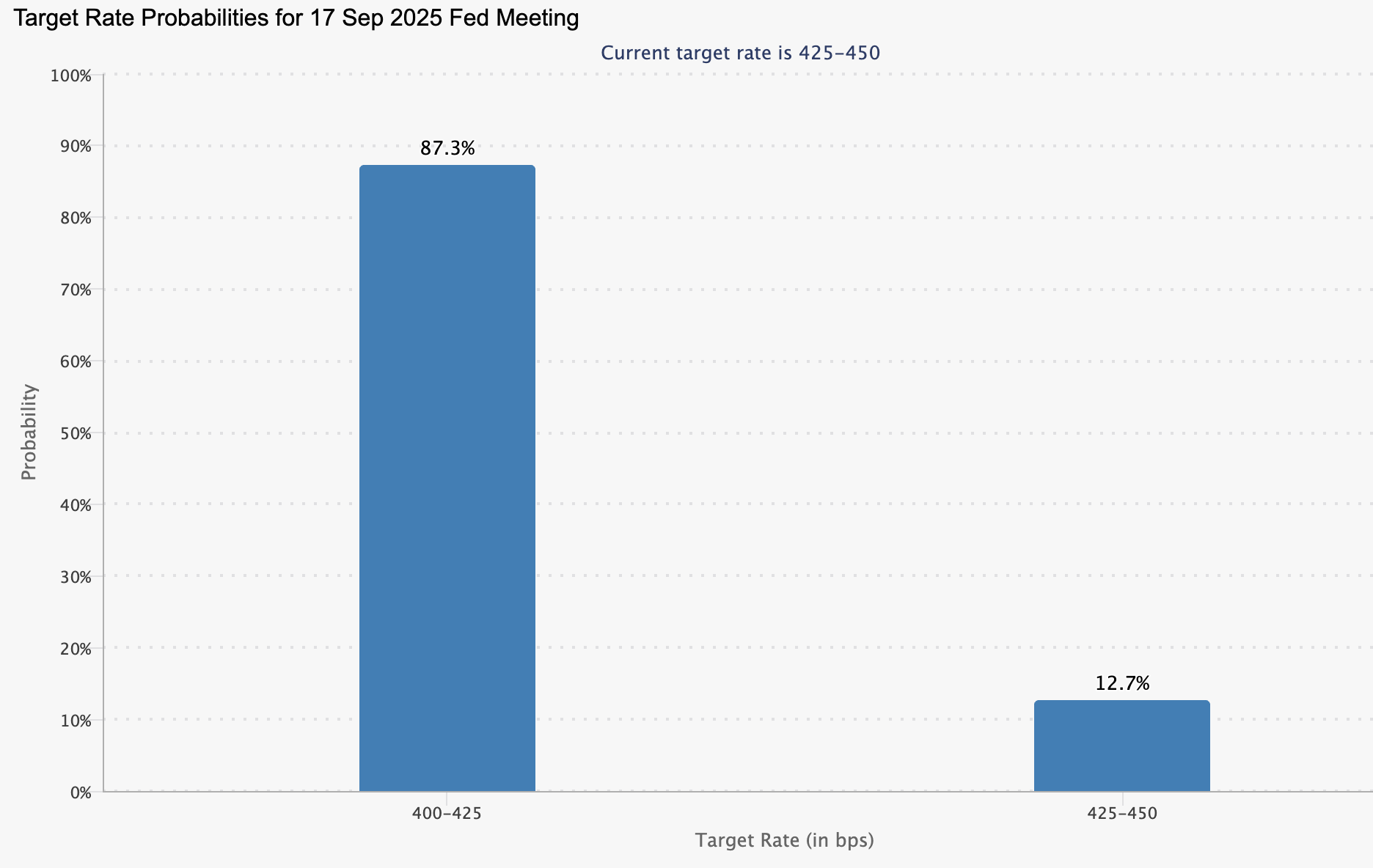

According to CME data, markets see an 87 per cent probability of a 25bp cut on 17 September.

Source: CME

Source: CME

If delivered, this would be the first rate reduction of the 2025 cycle and a critical signal that the Fed has pivoted. Such a move would begin narrowing the rate differential with Europe, weakening the dollar’s advantage. The extent of euro upside will depend on whether the Fed frames September as the start of a full easing cycle or as a one-off adjustment.

Political risks in focus

Beyond policy divergence, politics are once again shaping currency markets. In France, Prime Minister François Bayrou faces a confidence vote on 9 September over his €44 billion budget plan. Opposition parties have already signalled they will not support it, raising the risk of government collapse or renewed instability. French stocks dropped 1.7 per cent earlier this week, reflecting investor nerves, and the euro has absorbed some of the fallout.

Across the Atlantic, US politics is intruding into monetary affairs. President Donald Trump’s decision to remove Federal Reserve Governor Lisa Cook over mortgage allegations has raised concerns about the Fed’s independence. While markets have so far treated this as noise, if political interference becomes a pattern, it could erode longer-term credibility.

Data that will decideThe euro-dollar story in September will ultimately be data-driven. A sequence of US releases is lined up before the Fed meets:

- This week: PCE inflation gauge.

- Next week: August nonfarm payrolls.

- Week of Fed meeting: CPI, the final major input for policymakers.

Weakness across these data points would cement expectations of a September cut and potentially trigger more aggressive easing calls. Stronger results would complicate the narrative, suggesting the Fed may delay.

Scenarios for EUR USD

- Bullish euro case: Fed cuts in September, US data weakens further, and ECB stays steady. The narrowing gap in yields lifts EUR USD towards 1.18.

- Bearish euro case: US data proves resilient, Fed hesitates on cuts, and French politics rattle markets. EUR USD tests support near 1.16 or lower.

- Balanced case: Fed cuts once but signals caution, ECB neutral, and French politics unresolved. EUR USD remains range-bound, awaiting further confirmation.

For now, traders are holding back, suppressing volatility - but positioning is light, meaning September surprises could produce sharp moves.

EUR USD technical analysis

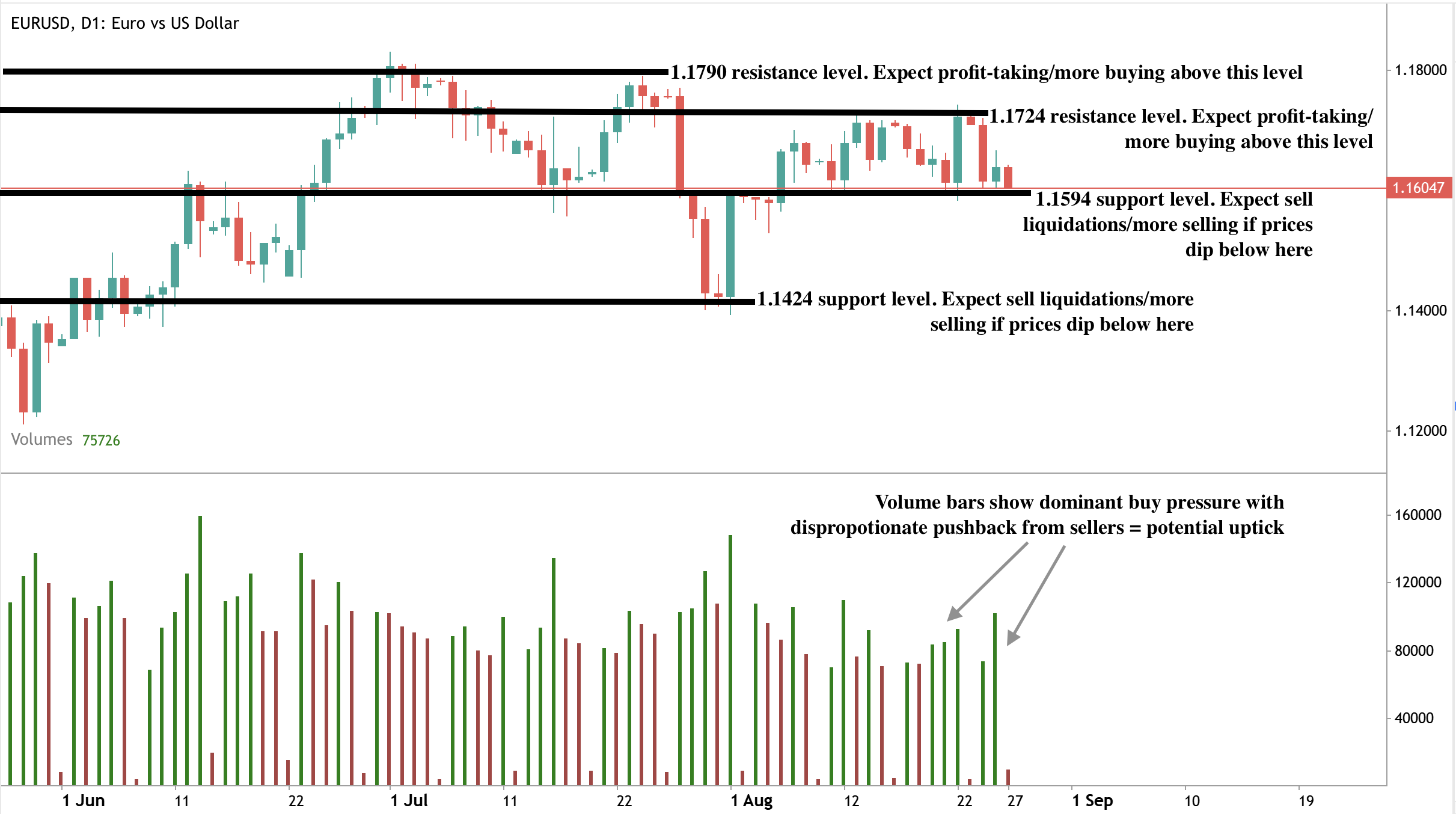

Technically, EUR USD is consolidating after retreating from last week’s highs. Support is forming around 1.1594, a level that has held in previous sell-offs. A sustained break lower could open the door to 1.1424. On the upside, resistance lies near 1.1724 and 1.1790, which coincides with the recent rally peak.

Momentum indicators suggest that volatility is compressed, with traders waiting for a catalyst. Once September’s data and meetings hit, a breakout in either direction is likely.

Source: Deriv MT5

Investment implications

For traders, EUR USD is positioned for volatility rather than stability. Short-term strategies may focus on trading within the 1.16–1.18 range, with stop-losses tight given the risk of breakout. Medium-term positioning should prepare for policy-driven shifts: if Fed cuts begin, the euro has room to strengthen; if US data surprises strongly, the dollar could extend its advantage.

The combination of policy divergence, political turmoil, and high-impact US data makes September a decisive month for EUR USD. The current calm is unlikely to last.

Frequently asked questions

Why is EUR USD trading sideways?

Markets are waiting for clarity on Fed policy and watching French politics. With neither resolved, traders are cautious.

What is the biggest driver in September?

The Fed’s 17 September meeting. A cut would narrow the yield gap and pressure the dollar.

Why does France matter for the euro?

Political instability can reduce investor confidence in eurozone assets, weakening the currency.

Which technical levels are important?

1.1600 is support, 1.1800 is resistance. A break on either side would set the next trend.

Disclaimer:

The information contained within this article is for educational purposes only and is not intended as financial or investment advice. We recommend you do your own research before making any trading decisions.

This information is considered accurate and correct at the date of publication. Changes in circumstances after the time of publication may impact the accuracy of the information.

The performance figures quoted are not a guarantee of future performance.