US Indices nears all-time highs despite Fed, inflation

US Indices nears all-time highs despite Fed, inflation

US stock indices continued to stabilize and showed strength toward the end of the week. Notably, buyers reacted positively to the news.

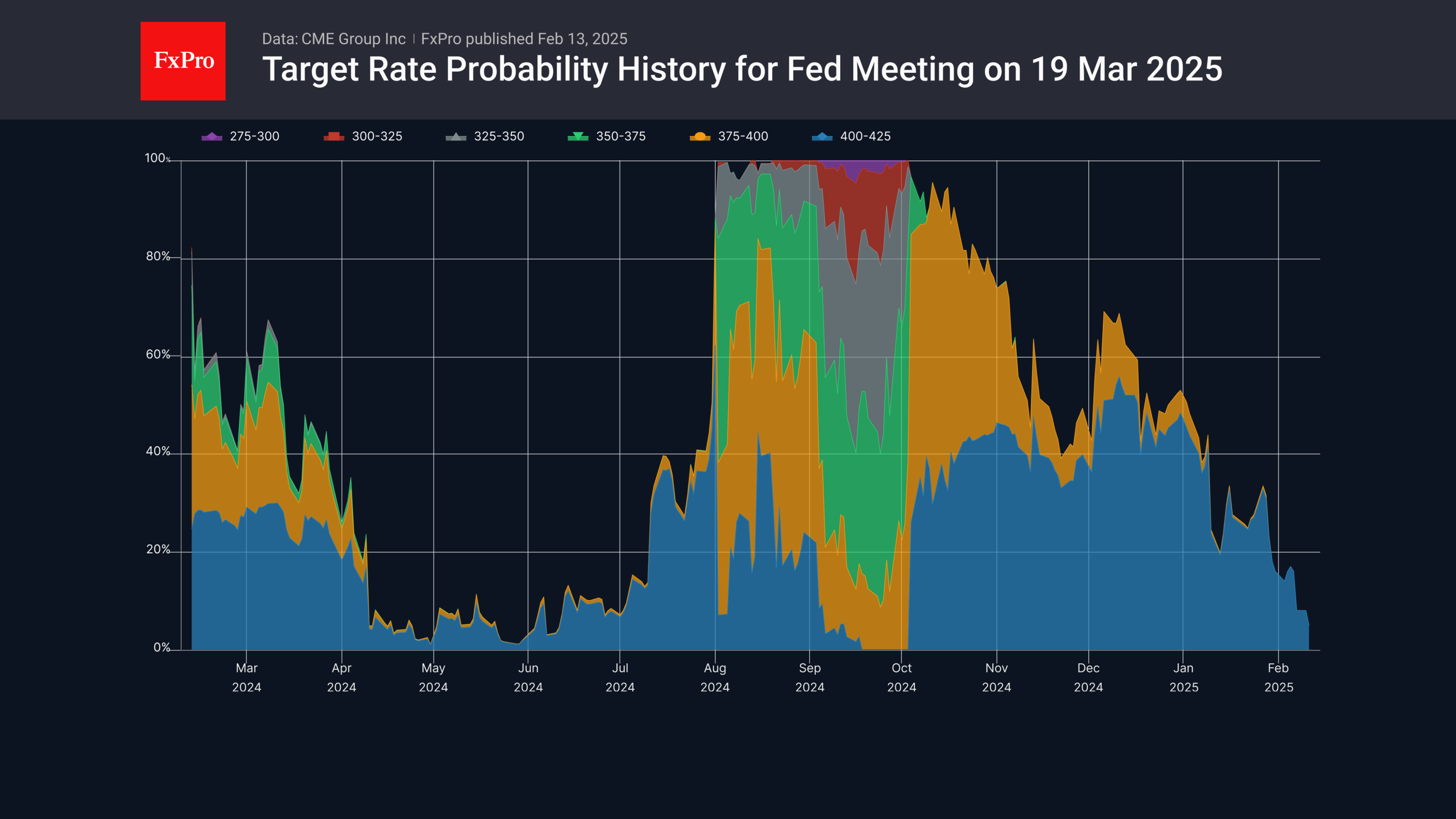

At the beginning of the week, Federal Reserve Chair Powell assured lawmakers that there was no urgency to cut the interest rate. Considering the pause for a cut in January, the markets price a 95% probability that there would be no rate cut in March either. Consumer inflation and producer price indicators, which were significantly higher than expected, reinforced this sentiment.

Interestingly, this did not trigger a sell-off in equities. Instead, the initial decline was quickly reversed, and on Thursday, the Nasdaq100 approached the 22,000 level. In January, this index had received support on dips to the 50-day moving average.

A similar trend was observed with the S&P500, which saw active buying below the 50-day average since mid-January. By the end of the week, there were attempts to regain ground.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)