The Fed has cheated expectations

The Fed has cheated expectations

In recent months the Fed has repeatedly taken a more hawkish stance than the markets expect. However, the markets' preparation for yesterday's meeting and the signal we read in the official commentary were too strikingly different from the markets' interpretation of the press conference.

Initially, buyers were encouraged by words that the Fed would consider the time lag between the decision and its impact on financial markets in its future meetings. This innovation in the commentary was taken as a hint of a slower pace in further rate hikes and was the signal buyers had been waiting for.

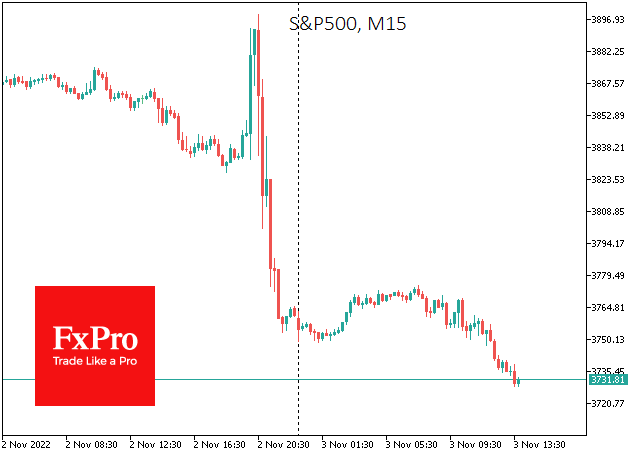

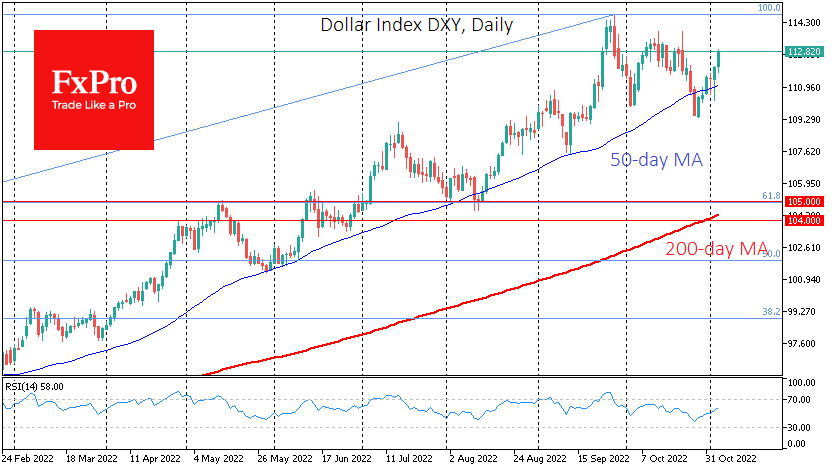

As a result, the S&P500 jumped 1.4% in the half-hour between the decision's release and the press conference. But that jump only amplified the decline. From the peak to date, the Nasdaq100 has lost 5%, the S&P500 has lost over 4%, and the Dollar Index has added 2.5%.

During the press conference, the markets, in our view, reacted quite nervously to Powell's words that it is not yet a time to consider a pause in a rate hike. The markets had not expected one, underlying the base case scenario of a 50-point hike in December and two 25-point hikes in January and March next year.

Also striking is the phrase that, finally, rates will come to a higher level than previously expected by the committee. In our opinion, there should not be a significant rate hike since the market has priced at a peak rate of 5% compared to 4.5% at the last meeting.

Furthermore, comments that a smaller move has already been discussed at the recent meeting have gone underappreciated.

Outside of the stock and currency market, there was also a much calmer movement. The VIX index rose modestly, remaining in a downtrend for more than three weeks. Cryptocurrencies have generally ignored events, and the rate futures market is marking a 48% chance of a fifth rate hike of 75 points in December compared to 50% at the start of the week.

Either way, the market has broken the uptrend in the S&P500 since late September and the downtrend in the dollar index. Strictly speaking, this signals the end of the bear market rally and the start of momentum towards new extremes. However, it cannot be ruled out that someone from the Fed will start to point out that the market has not quite got the chairman's words right in the coming days.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)