Three blows to oil in three days

Three blows to oil in three days

Oil has been under triple pressure since the end of last week, losing more than 7% per barrel of WTI since 31 July, reaching the important psychological level of $65. The latest wave of oil sell-offs began with the realisation that US trade tariffs from August will be higher than initially expected, as higher tariffs are associated with an economic slowdown and weaker demand for energy. Fears of an economic slowdown intensified after the release of unexpectedly weak US employment data on Friday. Over the weekend, concerns were heightened by OPEC+'s increase in production quotas, which was reflected in the markets on Monday.

After its latest meeting, OPEC+ announced that it would increase production quotas for eight countries by 547,000 barrels per day starting in September. Considering the quota increases since April, the entire voluntarily reduced volume of 2.2 million barrels per day will return to the market. This is a rather bold decision, given the growing fear that the global economy is slowing down.

Some link such steps by the cartel to the risks of supply disruptions due to potential sanctions from the US and the EU. In our opinion, it is also worth considering the cartel's intention to regain its market share from the US in this way.

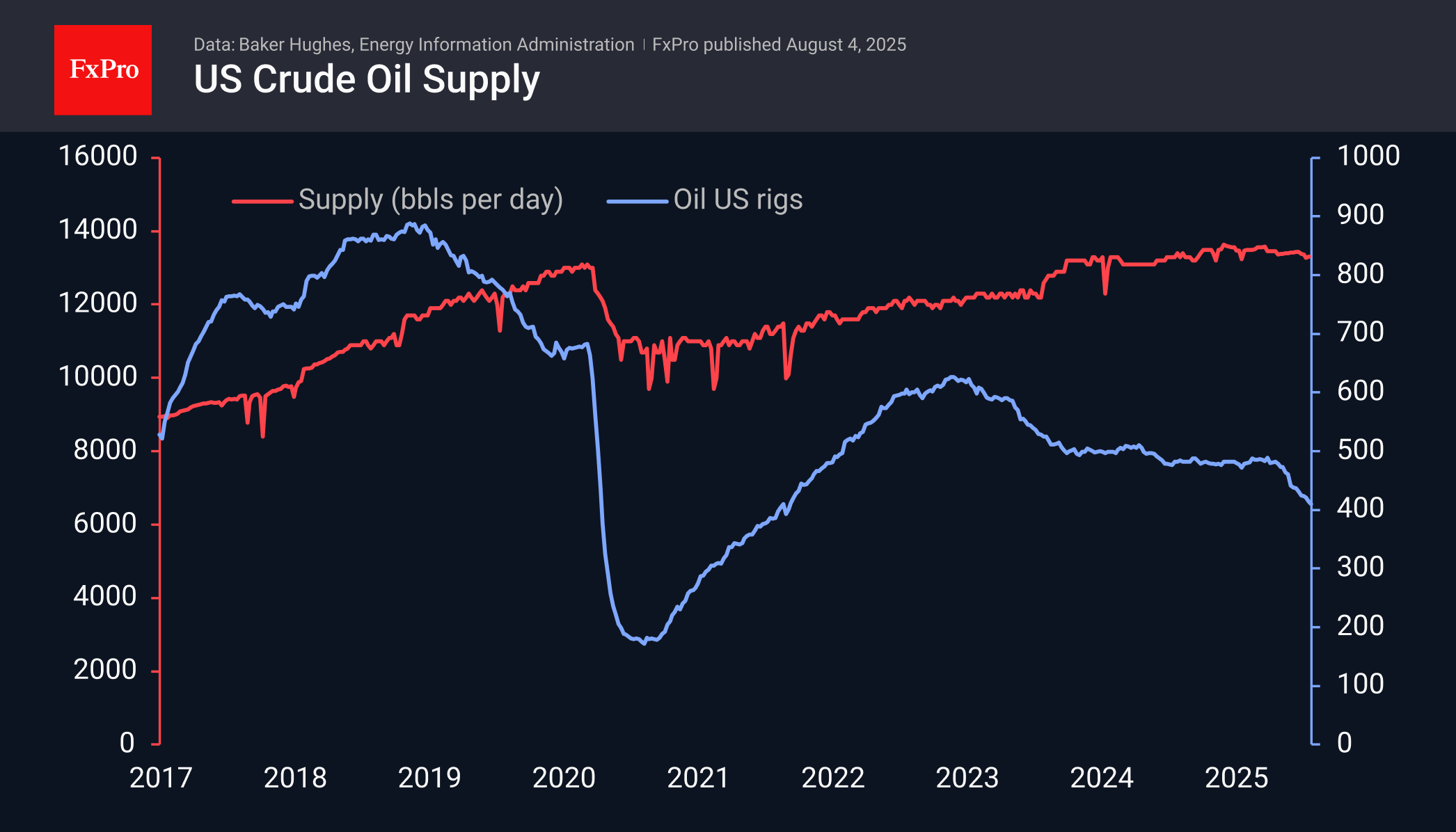

Oil producers in the US are very sensitive to price, sharply cutting investment when prices fall. At the beginning of April, there were 489 oil rigs in operation, but according to data published on Friday, this number has fallen to 410. In the long term, a gradual increase in production efficiency should be considered, but at intervals of six months, it is unlikely that there will be any sharp progress. Therefore, we can expect some US production reduction and a gradual recovery in the share of traditional oil producers such as Saudi Arabia, Russia and the UAE.

The price of WTI crude oil, which rose to close to $70 at its peak last week, has returned to the lower end of the range since early June at $65. Closing the day below 66 will mark a failure below the 200- and 50-day moving averages, increasing the potential for further declines.

If OPEC+ really plans to increase its share of the oil market, it may not oppose further price declines. The intensification of negative trends in the global and US economies could bring the price back to this year's lows of $55 by the end of September and to the lower end of the downward corridor of $50 by the end of the year. However, further trends will depend heavily on the reaction of monetary authorities and oil producers.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)