Crude Oil’s tactical retreat, unlikely turn around

Oil is losing more than 1% on Monday, below $84 a barrel for WTI and below $89 for Brent after Friday's rollercoaster, when prices peaked above $87 and $91.6, respectively. The drivers were geopolitics, where fears of an escalation of the conflict between Israel and Palestine fueled the growth. The decline was helped by the relatively conciliatory rhetoric of the US and the strengthening of the dollar.

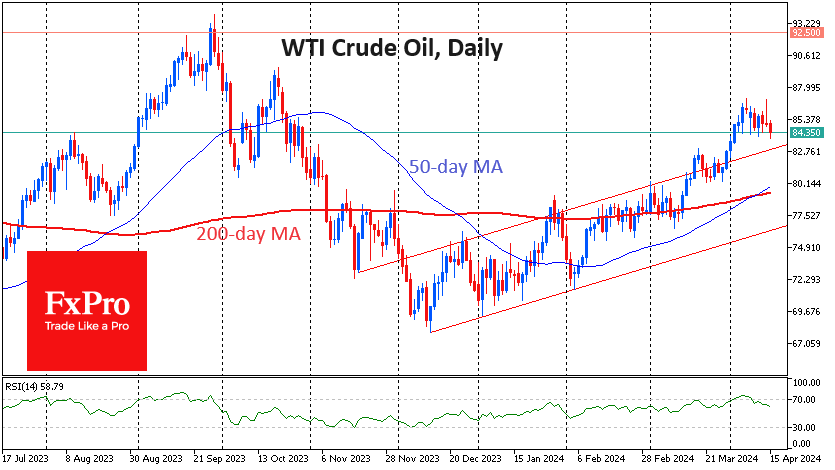

A double top - a reversal technical pattern - was recorded on the oil charts. The RSI exit from the overbought zone on daily timeframes also supports the idea of further price decrease. In addition, a short-term downward trend can be identified from the fifth of April.

The strengthening of the dollar due to the shift in expectations for the key Fed rate has been visibly eating away at risk appetite since the beginning of April, leaving oil no escape from this trend.

Nevertheless, there are still doubts that we are seeing the start of a downtrend rather than short-term profit-taking.

Firstly, we saw an acceleration in oil growth at the end of March, and the current pullback so far fits into the uptrend. It is worth watching closely the price dynamics near the previous peak ($82.50-83.0) and the previous local bottom ($80.50). A rebound from one of these support levels will reinforce the idea that this is still a bull market for oil.

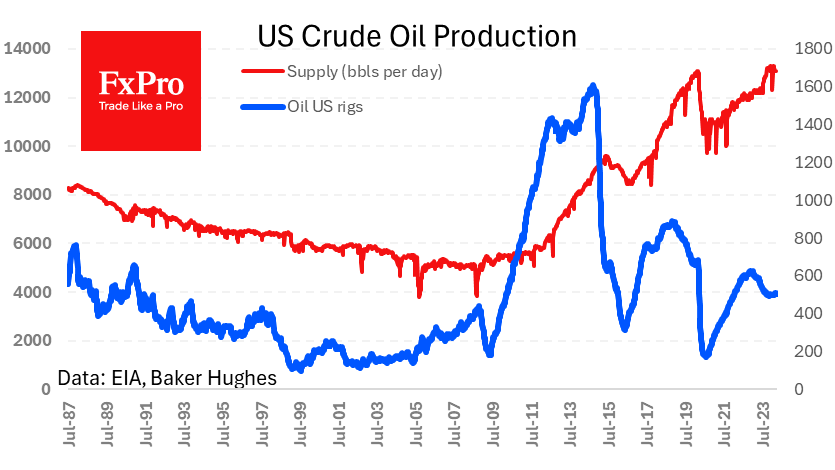

Secondly, the supply and demand balance is on the bulls' side. Economic growth in Europe is still gaining momentum, America is not slowing down, and China is in the stimulus phase. Oil supply is in no hurry to expand despite the recent price increase. The US has been producing at a rate of 13.1M B/D for the past five weeks, and the number of oil rigs is just over 500, de facto stagnating so far this year.

Simply put, we're sticking with the idea for now that WTI crude won't easily fall below $80 in the coming days. The chances are much higher that it will find buyer support somewhere between $80.50 and $82.5 on a combination of geopolitics, strong demand and stagnant production.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)