Trump threatens 50% tariffs on Brazil but stocks shrug it off, dollar steady

Trump stuck in tariff mode

The original July 9 deadline for the reciprocal tariffs has come and gone with no new trade deals in sight and all hopes now resting on the new date of August 1. The European Union is racing to finalize its deal with the United States, with intense discussions focusing on reducing tariffs on cars, which is a critical industry for the bloc.

Japan is also making a desperate bid to unlock the impasse in the trade talks and negotiators are trying to set up a face-to-face meeting with Trump’s Treasury Secretary Scott Bessent.

An agreement with India is looking more doubtful, however, following Trump’s tirade this week against the BRICS organization, which India is a member of.

Sectoral tariffs are also back in the spotlight, with the President late yesterday confirming that the 50% tariffs on copper imports would go into effect on August 1.

Brazil comes under the wrath of Trump

But that’s not the only overnight development as Trump has just threatened Brazil with 50% tariffs and somewhat lesser duties on several smaller trading partners. Brazil was not included in the reciprocal tariff list unveiled on April 2 and was instead in line for the 10% universal levy. But what makes this move to slap the country with a steep rate of 50% more of a surprise is the fact that the US currently runs a trade surplus with Brazil.

The decision seems to be political rather than one purely based on trade grounds, as Trump is demanding Brazil’s president, Luiz Inacio Lula da Silva, to stop the “Witch Hunt” against former president, Jair Bolsonaro.

Trump, who considers Bolsonaro as his “great friend”, is unhappy about how he’s being treated by Brazil’s justice system regarding the charges against him for an attempted coup in 2022. But da Silva is not backing down and has said he will respond with counter measures.

The other countries affected by Trump’s latest announcement are Iraq, Libya, Algeria and Sri Lanka, which all face 30% tariffs, Brunei and Moldova have been slapped with 25% levies, and the Philippines with 20% duties, all of which take effect from August 1.

Stocks mostly positive amid muted reaction to Trump tariffs

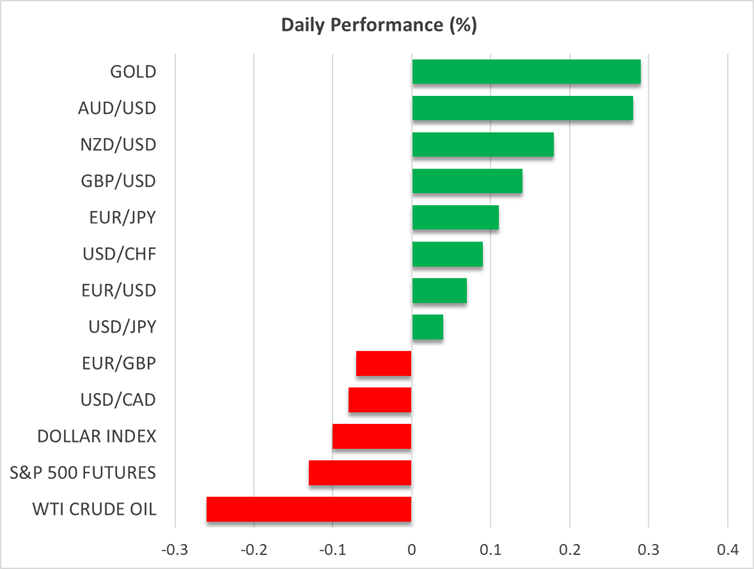

Yet, aside from the more than 2% slide in the Brazilian real and a more modest 1.3% drop in Brazil’s benchmark stock index, the reaction elsewhere has been muted. Gold is edging higher for a second day, but that’s more likely due to the dollar’s recent rebound levelling off.

Investors probably don’t think that these high tariff rates will be permanent, but more importantly, they believe that a deal will be struck, one way or another, with the bigger trading partners like the EU, Japan and India.

Thus, equity markets in general are perked up today, as Wall Street yesterday shrugged off Trump’s latest threats to reach for all-time highs. However, only the Nasdaq Composite managed to close at a fresh record, while the Russel 2000 hit the highest since late February when the trade war was just getting started.

Apart from the ongoing trade uncertainty, receding expectations of aggressive rate cuts by the Fed are also maintaining some caution in the markets and preventing a runaway rally in risk assets. Although this doesn’t seem to apply to AI-related stocks, with Nvidia leading the charge, ending Wednesday at a new all-time high of $162.88. Earlier in the day, Nvidia briefly topped the $4 trillion valuation mark, becoming the first company to do so.

Dollar trades in narrow range, Bitcoin eyes $112,000

The Fed published the minutes of its June policy meeting yesterday, and despite recent speculation of a growing split within the FOMC, the majority of officials are aligned with the consensus view for some further policy easing later in the year. Those more worried about the downside risks to the labor market than others and those more concerned about the upside risks to inflation appear to be in the minority for now.

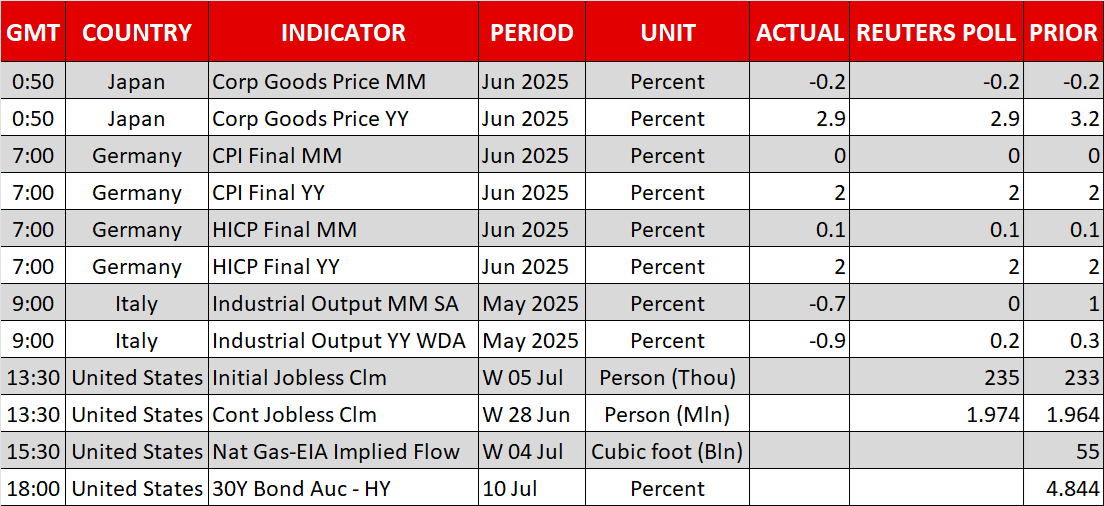

The dollar held near two-week highs against a basket of currencies yesterday and is trading slightly softer today. A rate cut in July has been pretty much taken off the table after the minutes, although cumulative bets for 2025 were little changed. The focus later in the day will be on the weekly jobless claims.

In crypto markets, Bitcoin came close to breaking above the $112,000 level for the first time on Wednesday amid strong institutional demand. The gains on Wall Street likely helped too. On the whole, Bitcoin has been consolidating since late May and cracking this key level is essential if the positive momentum is to prevail.

.jpg)