The US housing market remains volatile

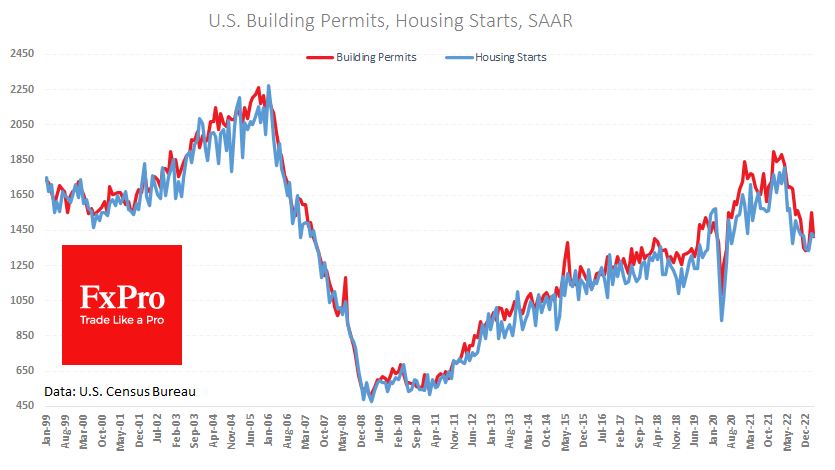

The number of US building permits issued in March fell 8.8% to 1,413K, erasing more than half of the 15.8% jump to 1,550K in the previous month. Last month's surge sparked speculation of a sharp reversal, but the latest pullback suggests that we saw little more than a short-lived spike in February, and high-interest rates continue to weigh on a market down nearly a quarter from a year ago.

New housing starts fell 0.8% to 1,420K, down 17.2% from March last year.

The housing market is often seen as a leading indicator of the economy, as it points to consumer confidence and influences many sectors of the economy. Since April last year, construction has declined due to rising interest rates and economic concerns. The performance of this sector over the coming months could be an important illustration of what is happening in the US economy.

A further decline will signal deterioration and be a factor against further rate hikes by the Fed. If we see a subsequent recovery in construction and sales, we should be prepared for a tighter monetary policy stance.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)