A sharp crypto market awakening

A sharp crypto market awakening

Market Picture

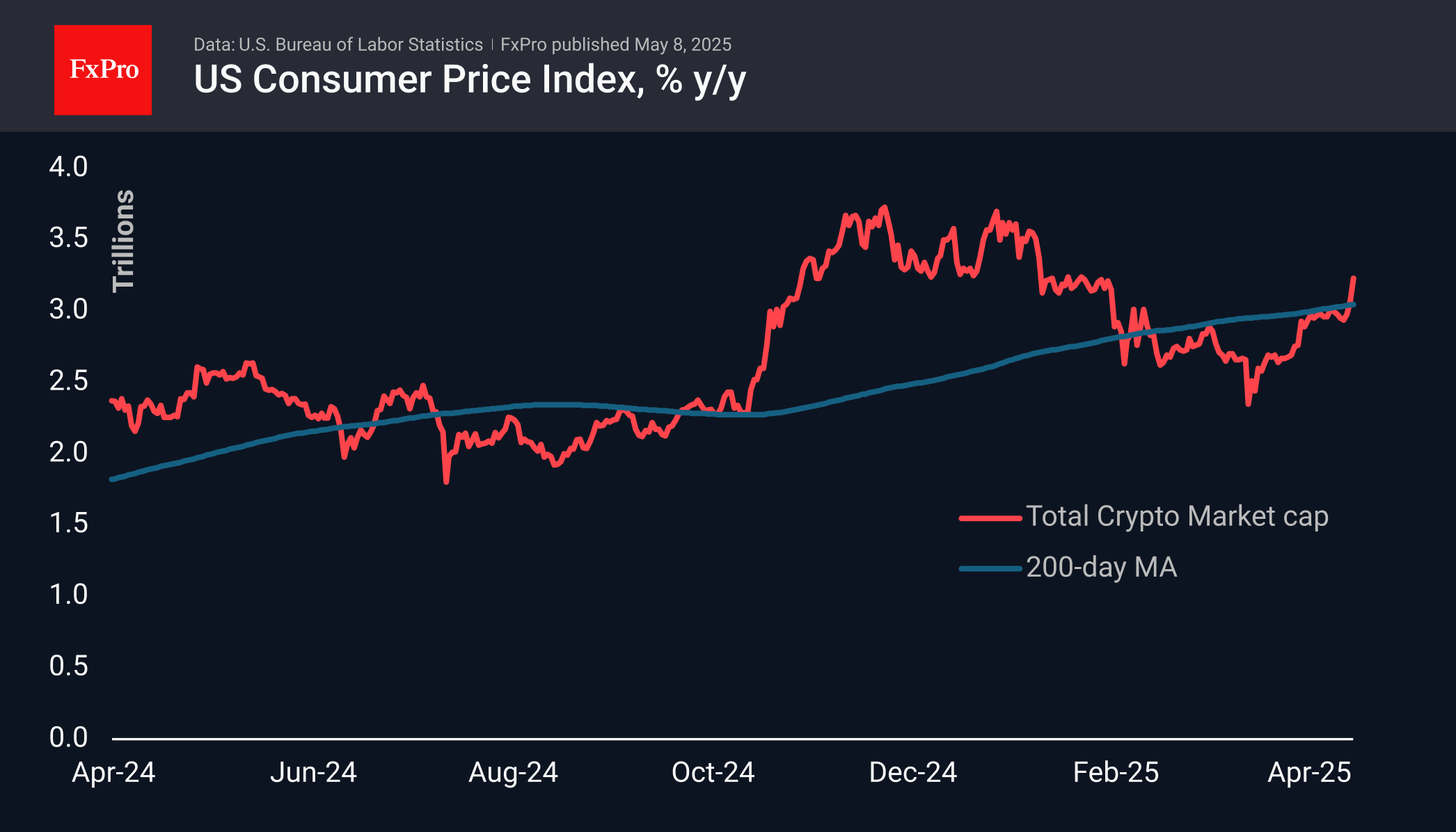

The crypto market has added about 5.8% to its capitalisation over the past 24 hours, bringing it to $3.24 trillion. This is roughly the area where the market has been consolidating for most of February. A pause halfway to the area of historical highs above 3.50 looks like a logical respite. Back in November, the market surged without major pauses—but this time, the momentum appears more measured, with less of the earlier excitement.

The crypto market sentiment index reached 73, which is only a couple of steps away from extreme greed and is the highest since late January. Often, this is a working sentiment for continued growth.

Bitcoin has been reaching levels above 104000 this morning, adding an impressive 5% in the last 24 hours and 33% in 30 days. At current highs, all eyes are on how soon it will reach the all-time highs, which are less than 6% away, and whether or not it can overcome them outright. While similar rallies have broken records in the past, we still expect some consolidation near the highs before any decisive move higher.

The rocket of the last few days has certainly been Ethereum, which has soared 23% in the last 24 hours, strengthening twice as fast as Bitcoin over the month. The technique worked perfectly. ETHUSD stomped around the 50-day moving average for a long time and rose in value by a third in less than two days to $2380. The rise to 2700 looks like an ‘easy part’ of the growth. Further upside will already have to be fought for.

News Background

On May 8, bitcoin's realised capitalisation reached a record $890.74 billion, which could indicate that BTC is poised for significant growth, CryptoQuant noted. The metric is the aggregate value of all coins in circulation based on the quotes at which they were last transferred.

Ethereum shows the best weekly performance in the top 20 cryptocurrencies. Nansen notes the accumulation of ‘smart money’ by institutions like Wintermute.

U.S. banks can perform crypto transactions on customer requests, provide custodial services through third parties, and generate tax returns on digital assets. This is stated in a clarification from the US Office of the Comptroller of the Currency (OCC).

Payments company Stripe has launched a product called Stablecoin Financial Accounts. It will allow businesses in 101 countries to hold balances in dollar-denominated Stablecoins and receive and send fiat and cryptocurrencies.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)