Dollar gains after Fed decision; BoE looms

Fed boosts the dollar

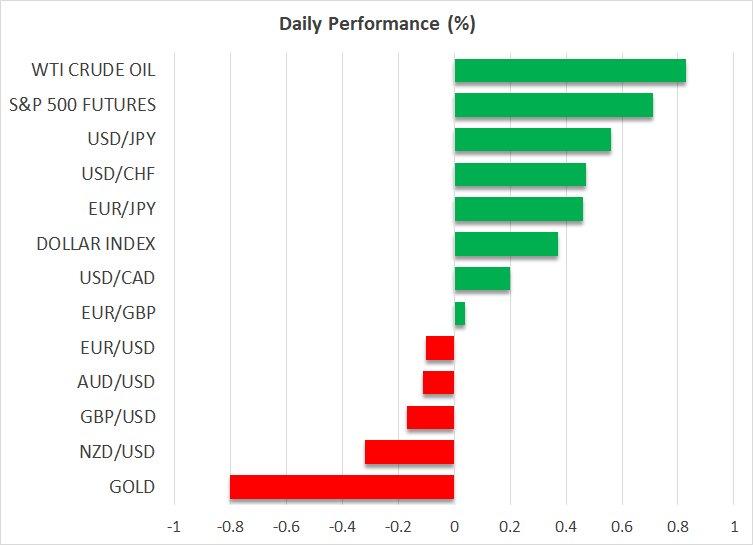

The US dollar outperformed all its major peers on Wednesday after the Fed decided to keep interest rates unchanged and sounded less dovish than expected. The greenback is extending its gains today, especially against the franc and the yen, both considered safe havens, as Trump’s remarks overnight about a potential trade deal further improved risk appetite.

Although the Fed was widely anticipated to remain sidelined, the statement and Powell’s press conference did not have the dovish flavor many market participants may have been anticipating. Officials highlighted the risk of higher inflation and acknowledged that unemployment had risen, with Fed Chair Powell noting at the press conference that the economy remains solid, despite the uncertain outlook and the sharp decline in surveys of households and businesses.

The outcome helped the dollar recover some more of its previously lost ground, though it falls short of suggesting that the prevailing downtrend is over. After all, there are signs that some investors remain nervous about the likelihood of a potential recession in the US, despite the improving risk appetite due to overnight remarks by President Trump about a trade deal. According to Fed funds futures, they are still penciling in 75bps worth of rate reductions by the end of the year, assigning a strong 80% chance of a quarter-point cut in July.

Wall Street gains, Trump to announce deal with Britain

Wall Street indices closed a volatile session in the green yesterday, with the Dow Jones posting the largest gains, perhaps due to Powell’s more-optimistic-than-expected assessment on the US economy and after Bloomberg reported that Trump is planning to withdraw curbs on artificial intelligence (AI) chips introduced by the Biden administration.

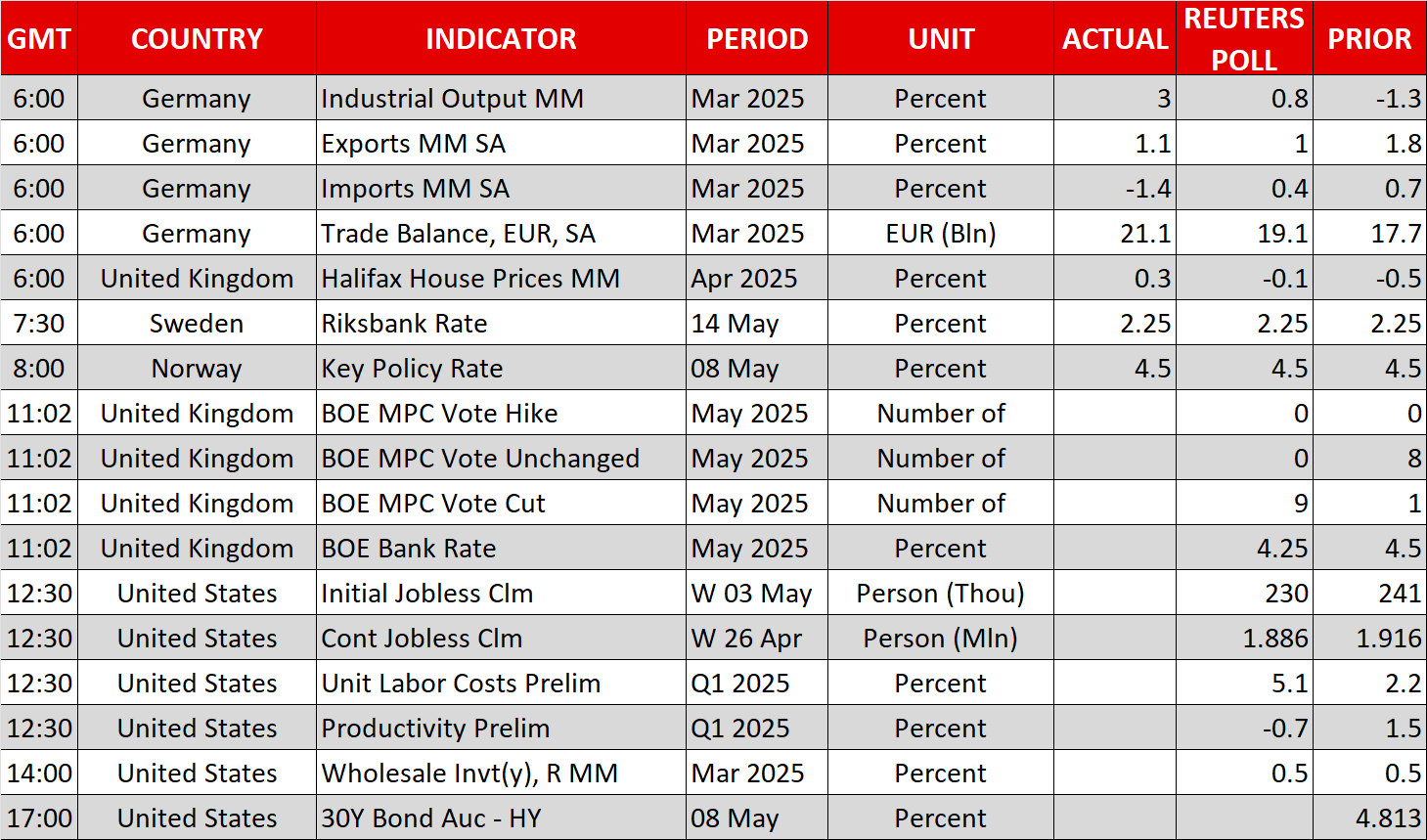

The futures market is pointing to additional gains perhaps following a post by US President Trump that he will hold a news conference today at 14:00 GMT to announce a major trade deal with "a big and highly respected country." The New York Times reported that the country is Britain, citing three people familiar with the matter.

BoE ready to cut interest rates

Speaking of Britain, the BoE will take the central bank torch today and announce its monetary policy decision. The Bank is widely expected to lower borrowing costs by 25bps, so the attention is likely to fall on hints and clues regarding how policymakers plan to proceed in the coming months.

Since the prior meeting, GDP data has shown that the UK economy grew 0.5% m/m in February, while inflation has remained well above the BoE’s objective of 2%. The PMIs for April raised concerns, as the composite index dropped into contractionary territory, reflecting the uncertainty among companies following Trump’s ‘Liberation Day’.

That said, although the PMIs justify expectations of a rate cut today, the broader outlook does not explain the very dovish market bets for the remainder of the year. Investors are expecting another 75bps worth of reductions after today’s cut.

Recent remarks by Governor Bailey that the UK economy is not close to a recession at the moment suggest that even if the Bank sounds somewhat more dovish than it did last time, the new economic projections are unlikely to paint a picture more worrisome than the market’s current pricing. Thus, a less-dovish-than-expected outcome could help the pound drift higher.

.jpg)