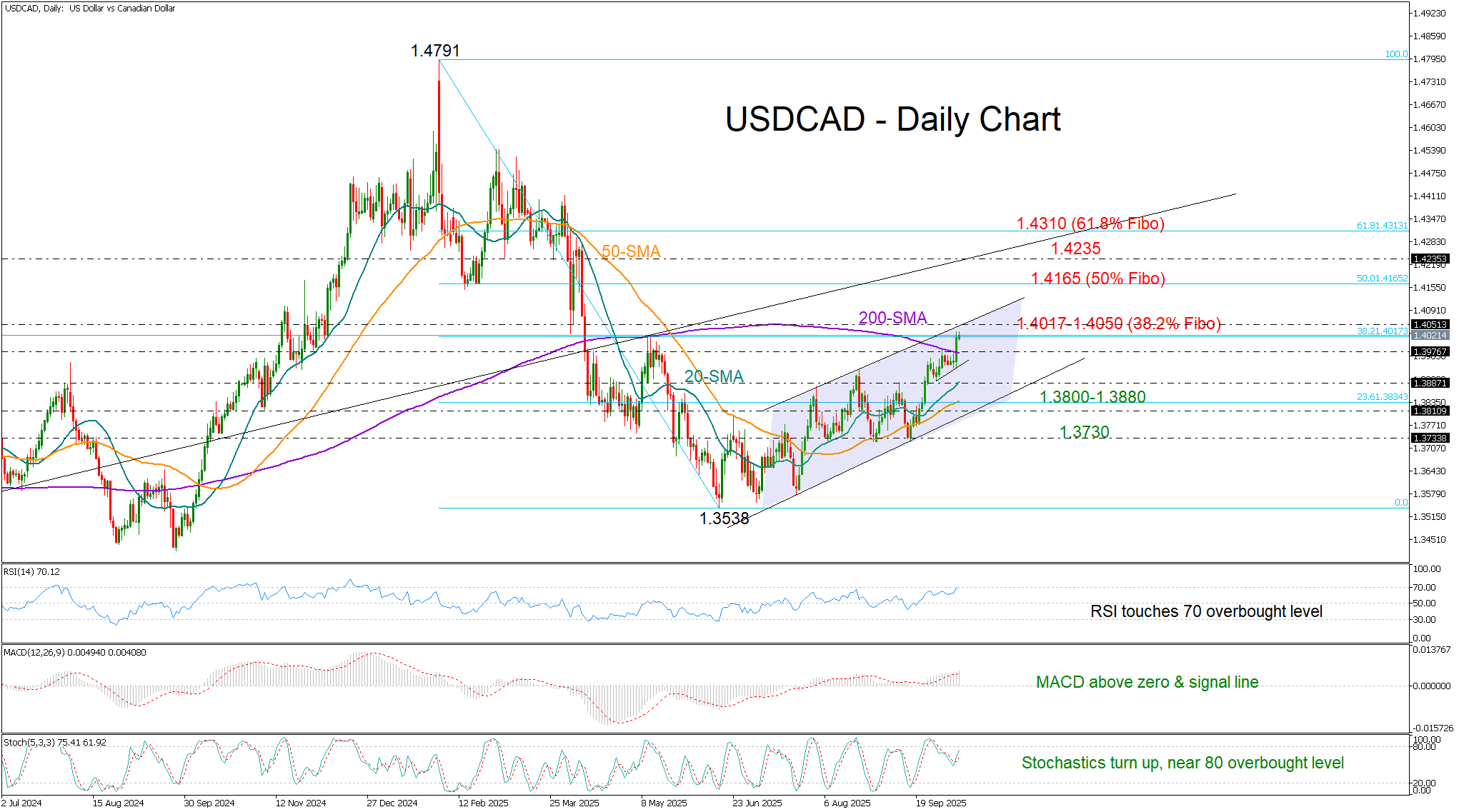

USD/CAD closes above 1.40 after six months

USD/CAD returned to its bullish path on Thursday after an almost two-week period of consolidation around the 1.3900 area, as rising political uncertainty outside the U.S. fueled safe-haven demand for the greenback.

The price broke above its 200-day simple moving average (SMA) and extended the uptrend that began from June’s low of 1.3538 to a six-month high of 1.4032. Notably, the pair appears to have exited a symmetrical triangle to the upside on the four-hour chart, signaling potential for further gains as the simple moving averages (SMAs) remain positively aligned.

Still, some caution is warranted given the congestion around the 38.2% Fibonacci retracement level of the January–June downleg, which previously capped upside pressures in May near 1.4017. The upper boundary of the upward-sloping channel is also within close range, raising the risk of a pullback as the RSI on the daily chart is hanging near its 70 overbought level.

Hence, a decisive close above 1.4050 could be key to extending the advance towards the 50% Fibonacci retracement at 1.4165. Beyond that, the pair could challenge the long-term ascending line drawn from the pandemic lows around 1.4230 before testing the 61.8% Fibonacci level at 1.4313.

In the bearish scenario, if the pair falls back below the 200-day SMA at 1.3976, attention will shift to the 20- and 50-day SMAs at 1.3887 and 1.3830, respectively. Should selling pressures intensify there, pushing the price below the channel at 1.3800, support could emerge around the double-bottom area near 1.3730.

Overall, the latest spike in USD/CAD has improved its bullish potential, though the pair may remain vulnerable unless it decisively breaks above the 1.4050 barrier. Canadian employment figures could trigger the next round of volatility at 12:30 GMT in the absence of key U.S. data releases.