Bitcoin Has Surfaced Following a Dive

Market picture

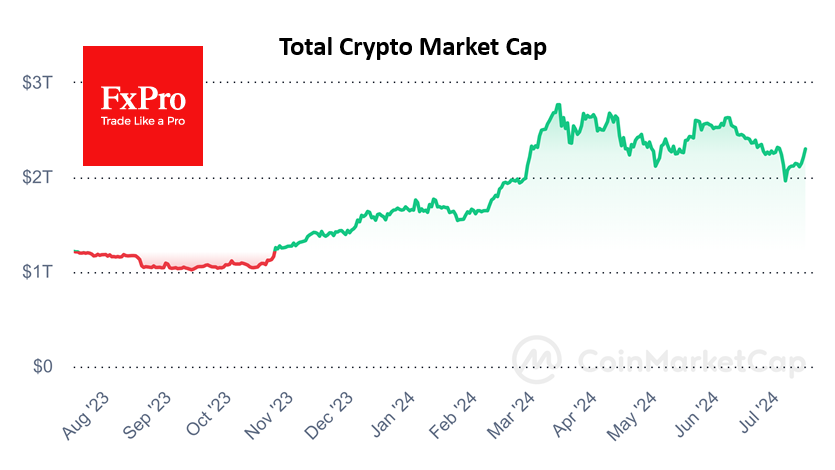

On Sunday, the cryptocurrency market moved to a rapid rise, completing a consolidation after a correction. Cryptocurrencies positively played off the strengthening chances of Trump’s victory after the assassination attempt. In addition, buyers were clearly encouraged by how the market stood up to the roughly $2.9bn sell-off in bitcoin by German authorities. The appetite for cryptocurrencies was clearly higher.

The technical picture in Bitcoin is promising as it has managed to make a sharp move back into territory above the 200-day moving average after 8 days of fluctuating below. At the time of writing, the price is back at $62.9K, the area of the highs at the start of July. The next milestones will be the 50-day moving average near $64K and the upper boundary of the descending channel near $67K by the end of the month.

Price dips below $55K plunged the price below the 61.8% level from the rise of the September lows to the March highs, realising a classic Fibonacci retracement. Bitcoin’s ability to overcome $71.5K would trigger an upside scenario with a potential target of $104K (161.8%).

News background

On 12th July, German authorities sold off another 2,700 BTC worth about $154.6 million. Later, reports emerged that the German Criminal Police (BKA) sold all 49,860 BTC worth about $2.9 billion seized in January from piracy portal Movie2k.

CryptoQuant recorded an increase in exchange balances but ruled out the impact of the German authorities’ action on the metric. The reason may be the increased trading activity of speculators spooked by the distribution of bitcoins to Mt.Gox clients and sales from the BKA wallet. The crypto market will start to recover in August, JPMorgan expects.

The SEC has dropped its investigation into BUSD. Paxos, the issuer of Binance’s stablecoin, has been notified by the SEC that there are no plans for enforcement action.

The institutional adoption of XRP and ICP is getting a boost from CME’s new benchmarks. XRP and Internet Computer (ICP) have been rising sharply since the second part of last week. North America’s largest derivatives exchange, CME. and leading cryptocurrency benchmark index provider, CF Benchmark, will launch real-time ICP and XRP indices on 29th July.

The Hamster Kombat team announced a second airdrop. The developers were optimistic about the game’s prospects after the first airdrop, which is scheduled for the end of July.

Since 2019, crypto platforms have received about $100bn worth of digital assets from known illicit wallets, Chainalysis estimated.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)