Bitcoin retreats for reset

Market picture

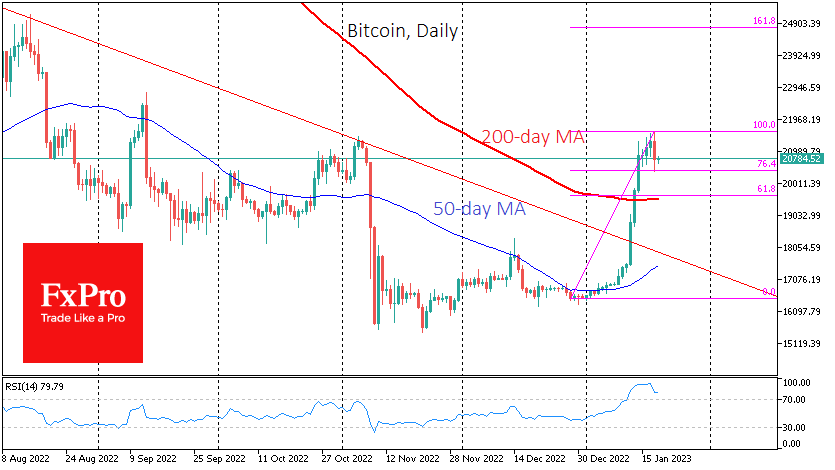

Bitcoin has lost 2% over the past 24 hours, pulling back to $20.77K, almost $1K below Wednesday's peak. The first cryptocurrency followed stock indices, which turned sharply lower on Fed officials’ continued hawkish rhetoric simultaneously with growing signals of weakness in consumer demand and business activity.

Technical analysis suggests that the latest pullback is a legitimate correction to the accumulated short-term overbought conditions after the rally since the beginning of the year. The correction can only be reclassified as a new downturn only after the BTCUSD consolidates below $19.5K, as the 200-day moving average and the 61.8% Fibonacci retracement level from the rally since the beginning of the year pass just above that level.

News background

According to research from infrastructure company Alchemy, Web3 development activity has increased over the past year, despite the severe challenges faced by the crypto industry. The number of smart contracts on the Ethereum core network deployed during the fourth quarter of 2022 increased by 453% to 4.6 million compared to the previous quarter.

According to the latest report from consulting firm Cornerstone Research, the US Securities and Exchange Commission (SEC) will continue to increase pressure on the cryptocurrency market, including through lawsuits. Last year, the SEC imposed a record number of enforcement actions against the industry, bringing 24 cases in US federal courts and six administrative proceedings.

Experts at the Bank for International Settlements (BIS) have proposed three main options for regulating the cryptocurrency industry. These include banning certain cryptocurrency transactions, isolating the industry from traditional finance and the real economy, and regulating cryptocurrencies like traditional markets.

The collapse of FTX was the first in a "long line" of collapses of unregulated cryptocurrency exchanges, said investor and star of the TV show Shark Tank Kevin O'Leary. He said all unregulated exchanges now face a massive outflow of customer funds. The refusal of some accounting firms to work with cryptocurrencies is also telling.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)