Crypto Market Retreats Due to Overhang of Sellers

Market picture

The crypto market has lost 3.3% in the last 24 hours to $2.3 trillion. The last time this level of capitalisation was on 19th April. Most worrying is the reversal of the trend from up to down last Wednesday. If the market easily pulls back below the previous local lows ($2.2 trillion), the downtrend in the market will be confirmed.

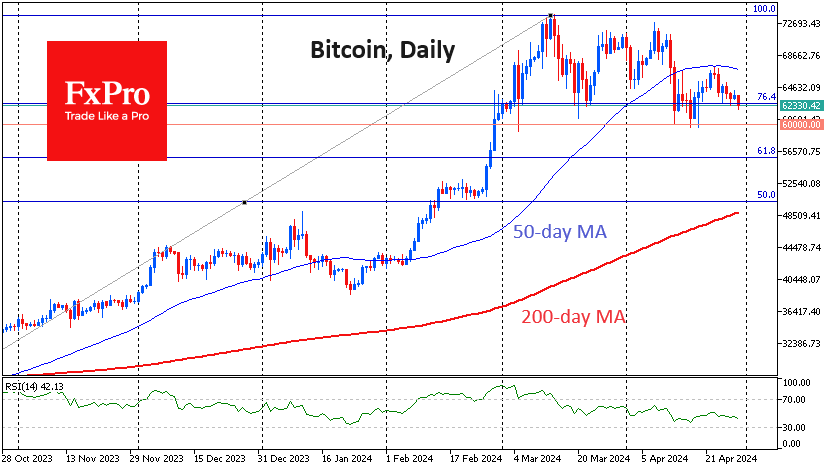

Bitcoin is developing its retreat after failing to climb above the 50-day moving average last Tuesday. With the current price near $62.2K, the first cryptocurrency is trading at the lower end of its trading range, setting up for another test of $60K.

The ability to attract new buyers, as it has since early March, will revitalise the entire crypto market. However, it is more likely that there is a high overhang of selling right now, including miner stocks. From the perspective of 1-2 weeks, we see more chance of a dip into $52-55K than staying above $60K.

News background

According to Watcher Guru, BNY Mellon Bank has officially notified the US SEC about its investments in the spot bitcoin-ETF market.

Former Ethereum team advisor Steven Nerayoff said ETH had been secure since the Initial Coin Offering (ICO) and accused the network’s co-founders of fraud.

The UK’s National Crime Agency and police have been given powers to ‘seize, freeze and destroy’ cryptocurrency used by criminals.

According to CoinShares, institutional investors have significantly increased their investments in altcoins, and one of the beneficiaries is Solana. Altcoin market capitalisation is poised to reach new records, and in general, a ‘cryptocurrency summer’ is coming, according to Real Vision CEO Raul Pal.

‘95 per cent of blockchains are just junk’, said DFINITY president Dominic Williams. He noted the usefulness of the Bitcoin, Ethereum, Solana, and Avalanche blockchains. He called the Internet Computer Protocol (ICP) ‘the only third-generation network’ that could create a new on-chain era of online interactions.

US payment service Stripe announced the resumption of cryptocurrency transactions after a six-year hiatus.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)