EBC Markets Briefing | Oil prices pull back as China data disappoint

Oil prices dipped on Wednesday after hitting seven-week highs as summer demand optimism and concerns over escalating conflicts offset an industry report that said US crude inventories unexpectedly rose.

Both benchmarks, having recovered strongly in the last two weeks, gained more than one dollar in the previous session after a Ukrainian drone strike led to an oil terminal fire at a major Russian port.

Russia’s four-week average crude exports rose for a second straight week in the period to June 16, even as Moscow said it would strictly comply with its OPEC+ output target this month.

China's May industrial output lagged expectations and a slowdown in the property sector showed no signs of easing despite policy support, adding pressure on the government to shore up growth.

The world’s second largest economy added more than 1 million bpd of crude oil to stockpiles in May as soft imports were outweighed by even weaker refinery processing volumes.

Crude demand is “on the rocks” and oil will “buckle” if global inventories continue to build, according to the BofA. It suggests demand is declining in both the OECD and non-OECD countries.

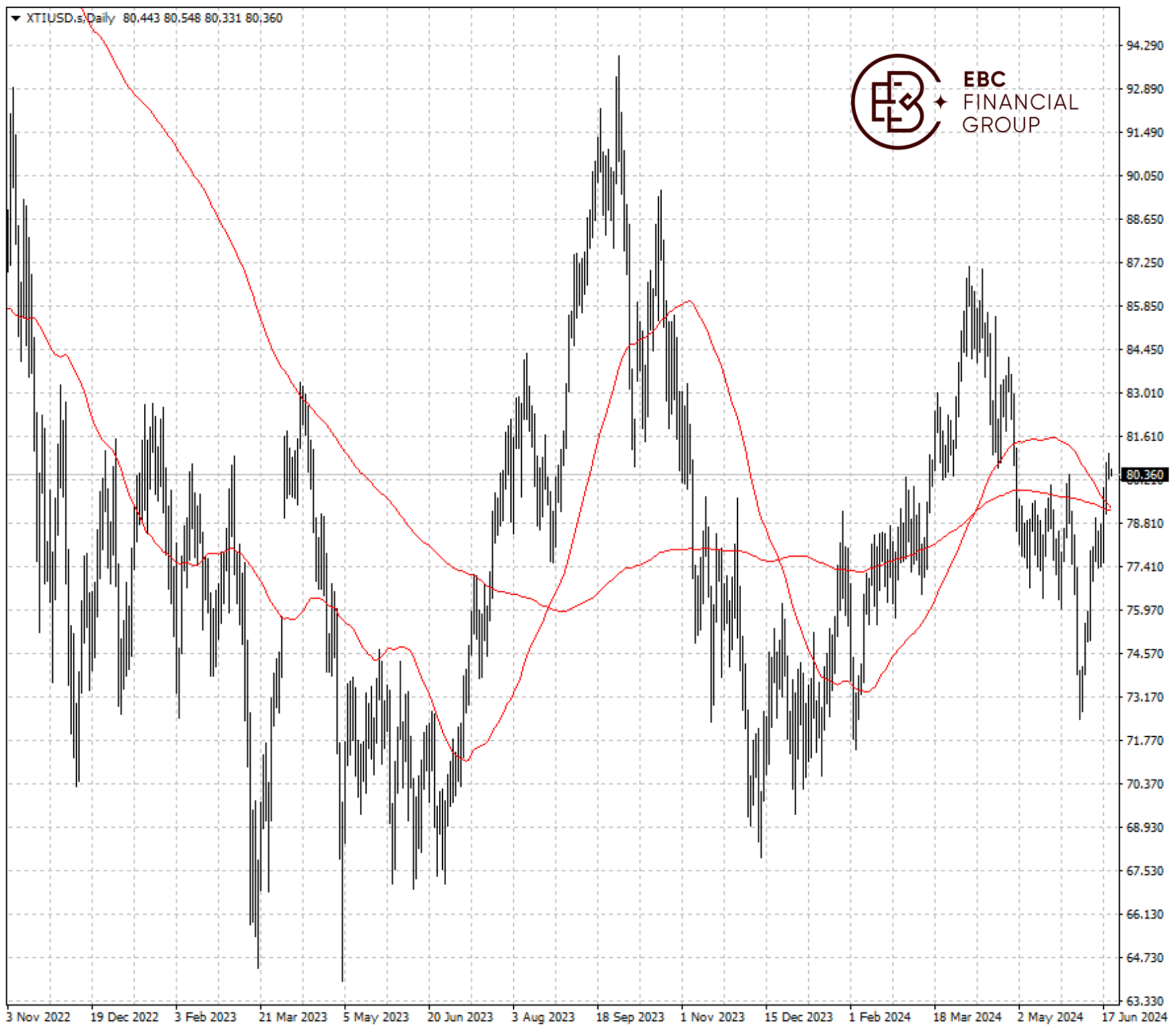

WTI crude is consolidating at the key $80 level with a death cross in sight. If we have the pattern in the upcoming days, a pullback towards $77 is in the cards.

EBC Economic Research Findings Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.