EBC Markets Briefing | Yen not shaken by lower growth projection

The yen firmed on Monday as markets await Tuesday's key inflation report and focus on developments in trade talks between Washington and Beijing ahead of the deadline.

Japan's government cut its growth forecast for this fiscal year to 0.7% from 1.2% on Thursday as US tariffs slow capital expenditure and persistent inflation weighs on private consumption.

Tokyo maintained its outlook for delivering a primary budget surplus in fiscal 2026 for the first time in decades, predicting even a larger surplus of 3.6 trillion yen thanks to higher tax revenues.

But there is apprehension about potential tax cuts and cash handouts that the government has been considering amid growing pressure from the opposition for more aggressive spending to ease rising living costs.

The he Financial Times reported on Sunday that chip manufacturers Nvidia and AMD agreed to allocate 15% of their revenues from sales in China to the federal government for export licences.

The arrangement comes as Trump's tariffs continue to reverberate through the global economy, underscoring the White House's willingness to carve out exceptions as a bargaining tool.

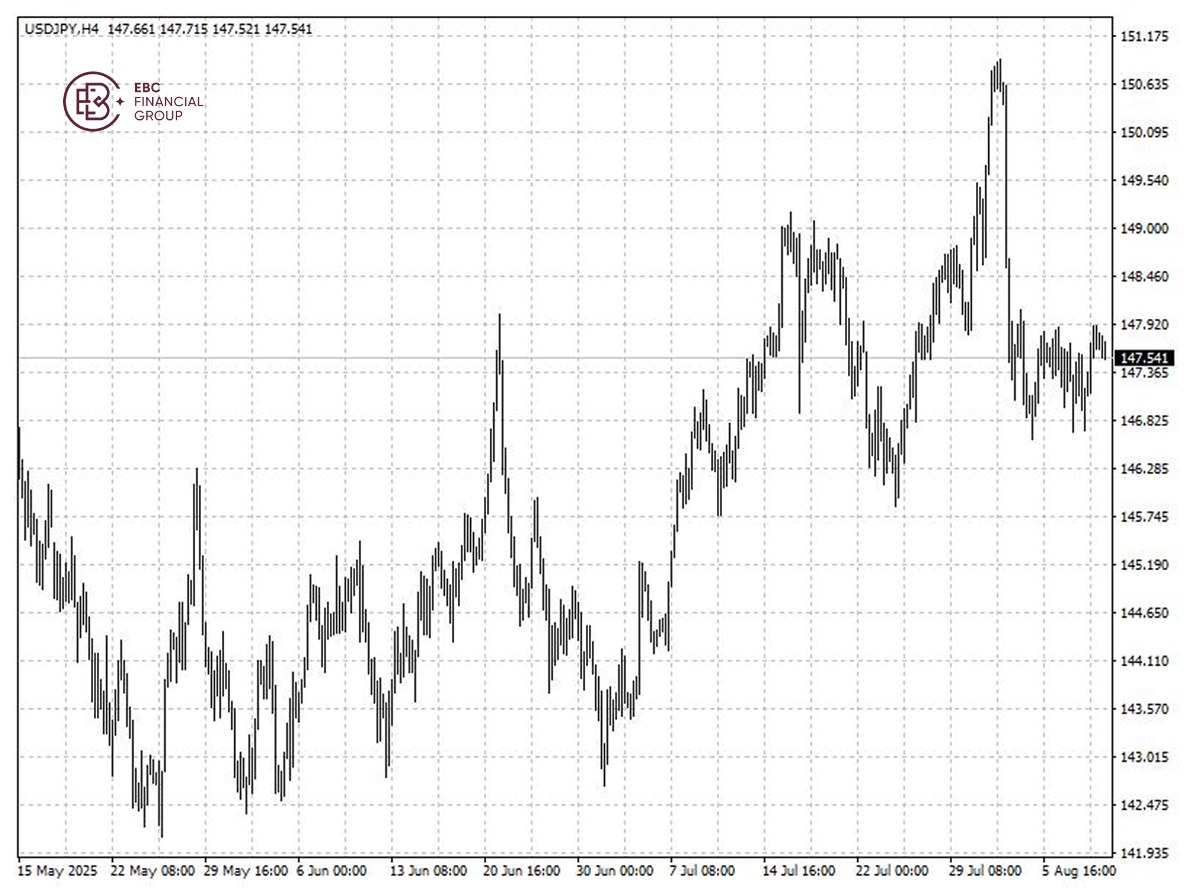

The yen looks set to strengthen further after its drop was capped around 150 per dollar. In the immediate term, 147.3 per dollar could be hit.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.