Ethereum’s overtaking

Market picture

The cryptocurrency market has gained over 3% in the last 24 hours, reaching $1.21 trillion. Interestingly, bitcoin has not kept pace with the overall growth, adding 2.3% to $28.55K over the same period. Ethereum, on the other hand, has risen by 5.5% to $1910.

The former cryptocurrency is stuck in local highs, above which it has been unable to consolidate since 19th March. This prolonged consolidation sets the stage for the next big move. The resolution of this consolidation is likely to be linked to the market's reaction to Friday's Non-Farm Payrolls. Technically, a pullback to the $27k level to correct the rally of the 10th of March is more likely at the moment.

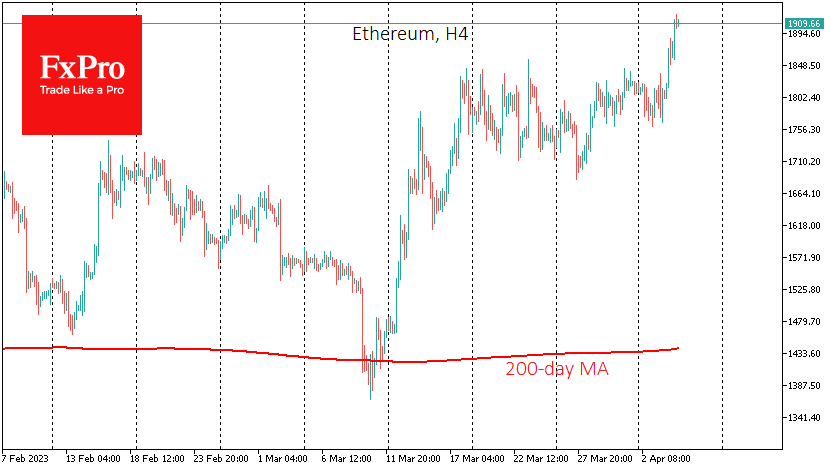

A more bullish scenario is offered by Ethereum, which broke through resistance in a sharp move yesterday and continues to gain traction, reaching an 8-month high. The dynamics within the Fibonacci theory suggest that a target near $2150 could be considered.

News background

According to Kaiko estimates, Binance's share of the spot crypto market fell by 16% to 54% in the first quarter. The decline was facilitated by the removal of commission-free trading on a number of instruments and the CFTC lawsuit.

The CFTC's lawsuit against Binance did not result in a significant outflow of users from the platform and reduced investor confidence in BTC, Glassnode noted. The transitional structure of the Bitcoin market continues to take shape after a bearish period. The number of addresses holding at least one BTC is approaching 1 million.

According to Brown Brothers Harriman (BBH) research, nearly 3/4 of institutional investors surveyed said they were "extremely or very interested" in cryptocurrency ETFs. Meanwhile, only 25% of respondents plan to increase their investments over the next year.

The US Department of Justice reported the seizure of some $112 million in digital assets from cryptocurrency fraud and money laundering perpetrators.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)