German industrial orders support hawkish ECB stance

Europe continues to surprise with statistics, suggesting more room for a hawkish tone from the ECB next week. In addition to hawkish inflation readings, data from Germany today highlighted a continued recovery in industrial orders.

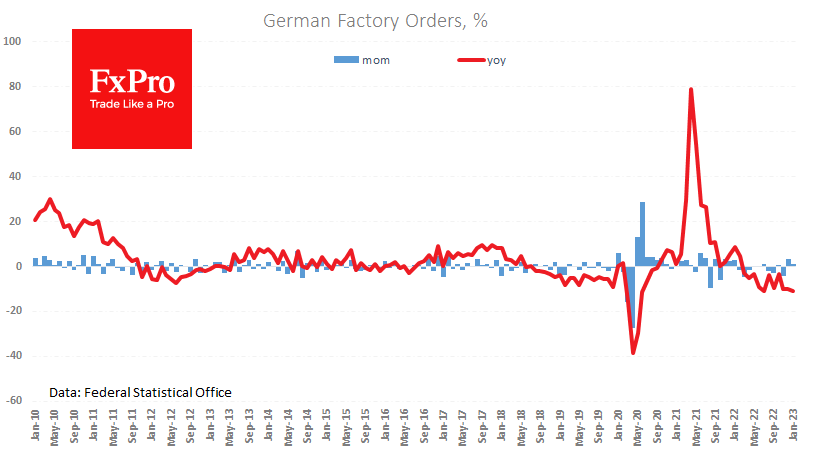

Destatis reported a 1% rise in manufacturing orders in January, after +3.4% in the previous month. This sharply contrasts the expected 0.6% m/m correction and adds to market optimism. The new orders index has returned to the level of August last year, although it is still down 10.9% year-on-year. However, the worrying pattern of year-on-year declines is primarily a high base effect. The post-squeeze recovery coincides with a rush to place orders on fears that the military conflict in Ukraine could soon disrupt supplies.

Strong Eurozone data strengthens the hawkish case for the ECB Governing Council, which meets next week for another policy decision. Options for a 50 or 25-basis-point rate hike will likely be on the table for the ECB. On Monday, Holzmann said four more 50-point hikes and an accelerated sell-off of assets from the balance sheet would be needed. Such a scenario is hardly a base case, but the general tone of commentary continues to shift in favour of further tightening.

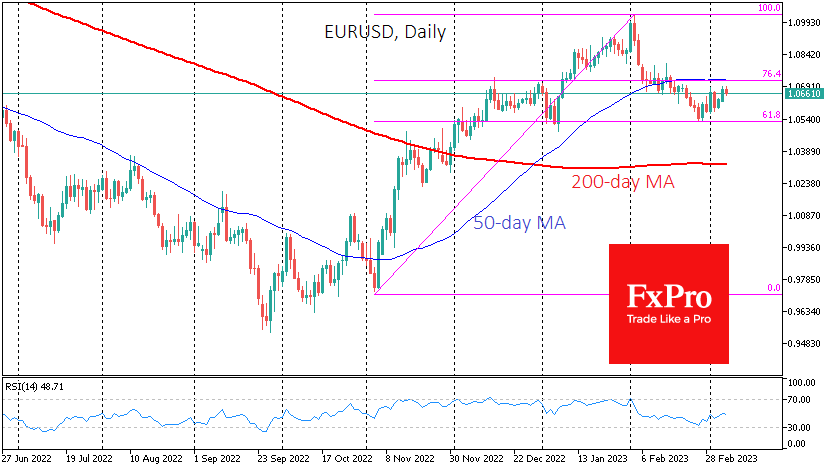

This is probably the most critical driver for the FX market. Throughout 2021 and 2022, the dollar has rallied as the Fed's tone has become more hawkish round after round. Now it is the ECB's turn, and the fundamentals are in place for EURUSD to rise.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)