Advertisement

Analisis

Daily Global Market Update

Pound up 0.2%; Bitcoin drops 3.5%; Oil gains 1.4%; Aussie rises 0.3%. Cryptocurrency crime: $24.2B in 2023. Global markets up. Upcoming economic events.

Moneta Markets

|

660 days ago

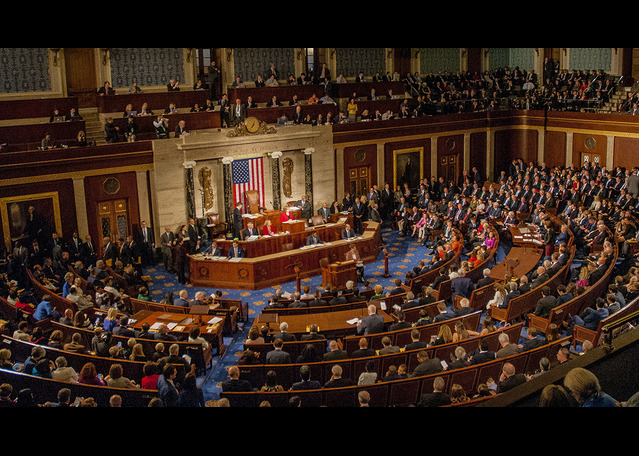

U.S. Government Shutdown Averts Fuels Risk-On Sentiment

The greenback experiences a slight easing as the U.S. Congress approves funding for government spending

PU Prime

|

661 days ago

GBP Climbs on CPI, EUR Stabilizes with ECB Talk, JPY, AUD, NZD Dynamics Assessed

The USD attempted to push higher overnight amidst continued "risk off" sentiment, but it stumbled a bit during the early European session. Equity markets are still in the red due to softer-than-expected China activity data, higher-than-expected UK inflation that might delay rate cuts, and warnings from the ECB about excessive easing expectations.

ACY Securities

|

661 days ago

Navigating the Dovish Waters: Luca Santos Discusses Fed's Stance and Euro Dollar Projections

The Fed has been leaning dovish, yet the US dollar has shown a hawkish tone since the last week of December. It brings us to the question: Why is this happening? Well, for those following my predictions, I've maintained a hawkish view on the dollar until the first quarter of this year, and the markets seem to be aligning with this outlook.

ACY Securities

|

661 days ago

EUR/USD finds support at the 200-day SMA

EURUSD had been rangebound before sliding lower - But the retreat ceases at the 200-day SMA - Momentum indicators remain tilted to the downside

XM Group

|

661 days ago

EUR/USD finds support at the 200-day SMA

EURUSD had been rangebound before sliding lower - But the retreat ceases at the 200-day SMA - Momentum indicators remain tilted to the downside

XM Group

|

661 days ago

Strong retail sales pour more cold water on Fed rate cut hopes

Dollar gains as US retail sales beat estimates - Probability for Fed rate cut in March declines further - Yen falls further ahead of Japan’s National CPI data - Pound and euro recover some lost ground

XM Group

|

662 days ago

Daily Global Market Update

Euro-Dollar steady, oversold; Dollar gains 0.6% vs Yen, overbought; Gold down 1%, bearish trend; Nike shares -0.2%, negative signal; US Dollar peaks, robust retail data; Global stocks fall, rate cut resistance; UK CPI at 4%, rate cut unlikely; Upcoming: Dutch, Australian unemployment, Euro account, Japan CPI, UK housing, Australian employment.

Moneta Markets

|

662 days ago

Dollar Gain on Upbeat Retail Sales Figure

The U.S. dollar secured its fifth consecutive session of gains, continuing its upward trajectory following a better-than-expected U.S. Retail Sales data. Robust economic indicators, including a rebound in the Consumer Price Index (CPI), have led to a recalibration of market expectations, reducing speculation about an imminent Federal Reserve rate cut.

PU Prime

|

662 days ago

The pound's revive

Expert market comment from senior analyst Alex Kuptsikevich of the FxPro Analyst Team: The pound doesn’t give up without a fight, thanks to CPI

FxPro

|

662 days ago

Stronger economy means softer stocks for now

Expert market comment from senior analyst Alex Kuptsikevich of the FxPro Analyst Team: Stronger economy means softer stocks for now

FxPro

|

662 days ago

AUDJPY, AUDUSD, EURGBP, EURJPY, EURUSD, GBPJPY, GBPUSD, NZDJPY, NZDUSD, USDCAD, USDCHF, USDJPY, USD Index, Gold, & S&P 500

Watch the video for the key trading levels for AUDJPY, AUDUSD, EURGBP, EURJPY, EURUSD, GBPJPY, GBPUSD, NZDJPY, NZDUSD, USDCAD, USDCHF, USDJPY, USD index, Gold, and the S&P 500.

ACY Securities

|

662 days ago

Testing the Upper Boundary of the Recent Narrow Range by USD

The US dollar made a comeback overnight, climbing toward the upper range of the recent tight bracket between 102.00 and 103.00. I observed that Asian currencies continued to weaken in response to the election results in Taiwan over the weekend.

ACY Securities

|

662 days ago

It’s All Over Now - Quantitative Tightening

The Federal Open Market Committee (FOMC) dedicated a significant portion of the year 2023 to allowing their balance sheet reduction plan to operate seamlessly, with minimal discourse on the ultimate strategy for its conclusion.

ACY Securities

|

662 days ago

USD Still Stuck in Tight Range as Fed Rate Cut Expectation Increase

The US dollar has maintained relative stability against other major currencies, trading in a narrow range of 102.00 to 103.00 in recent weeks. Last week's notable event for the US dollar was the release of a producer price inflation report, indicating weaker-than-expected results.

ACY Securities

|

662 days ago

Dollar rallies as market scales back Fed rate cut bets

Waller says Fed is in no rush to cut rates - March cut probability slips and dollar gains - Pound rebounds after hotter-than-expected UK CPI data - Yen and euro extend losses, Wall Street also slips

XM Group

|

662 days ago

USDJPY rallies ahead of key market events

USDJPY continues its upward trend; third consecutive green session; It now tries to overcome a very busy resistance area; Most momentum indicators support the current upleg

XM Group

|

663 days ago

Daily Global Market Update

Bitcoin up 2.2% on bullish signal; Facebook down 1.5% bearish. Aussie dollar fell 0.9%, gold down 1.2%. Oil stable; Grayscale Bitcoin signals sales. US dollar rose, pound, yen fell. Upcoming: US Industrial Production, Austria's HICP, UK's Core CPI, US Retail Sales, Japan's Foreign Investment, Machinery Orders.

Moneta Markets

|

663 days ago

Gold: preparing for a breakout or a reversal? The dollar will decide

Expert market comment from senior analyst Alex Kuptsikevich of the FxPro Analyst Team: Gold: preparing for a breakout or a reversal? The dollar will decide

FxPro

|

663 days ago

Dollar Strengthens as Fed Rate Cut Speculation Wanes

Despite a relatively dovish speech from Fed governor Christopher Waller, the U.S. dollar maintained its upward trajectory

PU Prime

|

663 days ago