EBC Markets Briefing | Aussie dollar firmed despite China concerns

The Australian dollar inched up on Monday as the RBA stayed hawkish. The central bank said stimulus launched by the Chinese government may only have a “modest” impact on Aussies this time around.

Uncertainties around the US may slow global economic growth modestly in 2025, according to major brokerages. They expect Trump's proposed tariffs to fuel volatility across global markets, and to spur inflationary pressures.

The concerns chimed with a new Fed survey pointing to risks to global trade as among the top threats to the stability of the financial sector. It also said asset values "remained elevated" and subject to a shift in sentiment.

Washington could impose nearly 40% tariffs on imports from China early next year, a Reuters poll of economists showed, potentially slicing growth in the world's second-biggest economy by up to 1 ppt.

Chinese policymakers face increased pressure next year to spur domestic demand to offset an expected drop in exports, analysts say. Still government advisers recommend Beijing should maintain the 5% growth target next year.

Iron ore prices are forecast to maintain an average of $100 per tonne in 2025 as China’s sluggish property sector continues to subdue demand, says BMI. That could continue to weigh on the Australian economy.

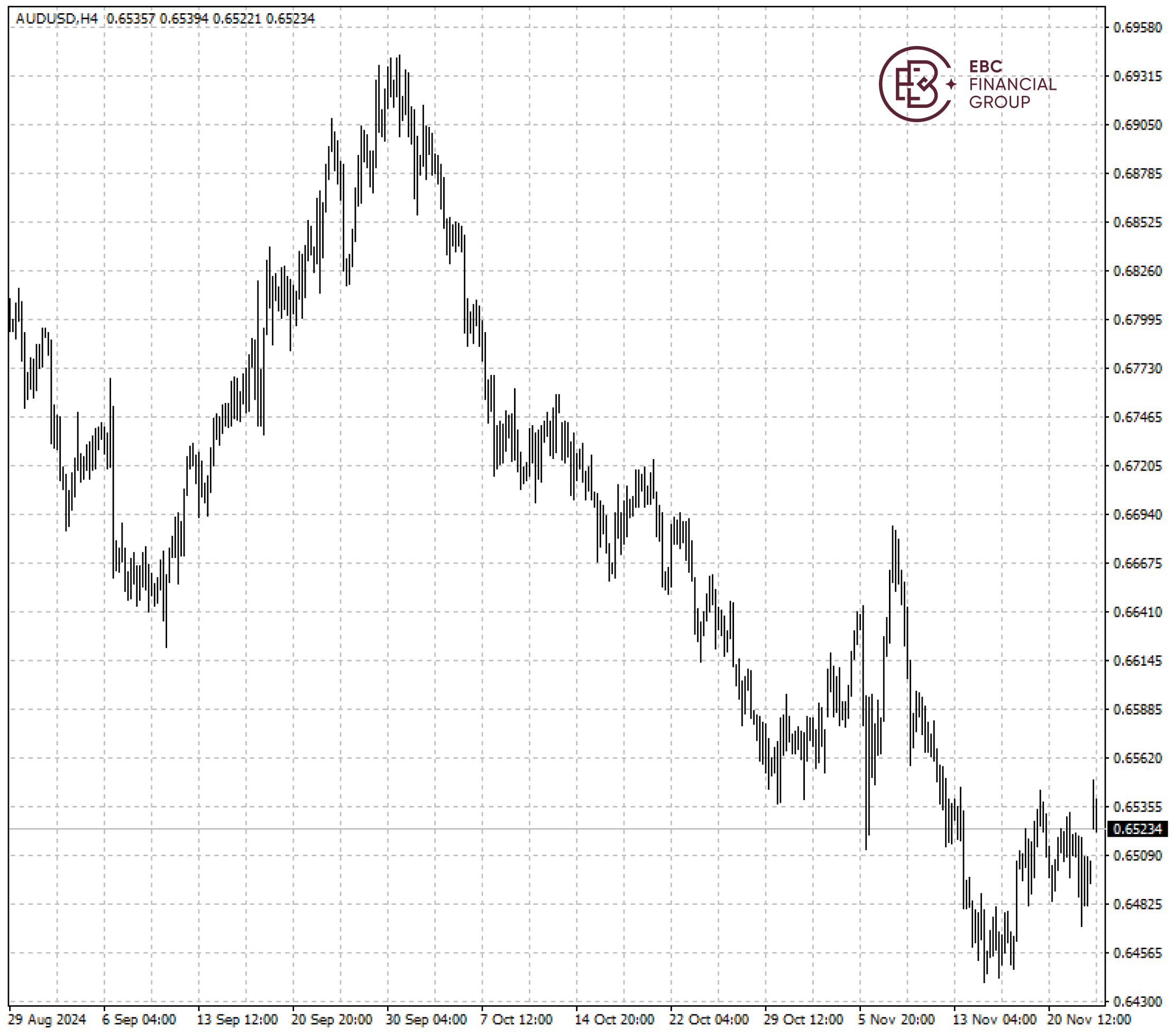

The Aussie staged a comeback after reaching 0.6440. But the gains could be limited given economic fundamentals, and thus the uptrend will could end towards the resistance of 0.6600.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.