EBC Markets Briefing | Aussie firms ahead of RBA decision

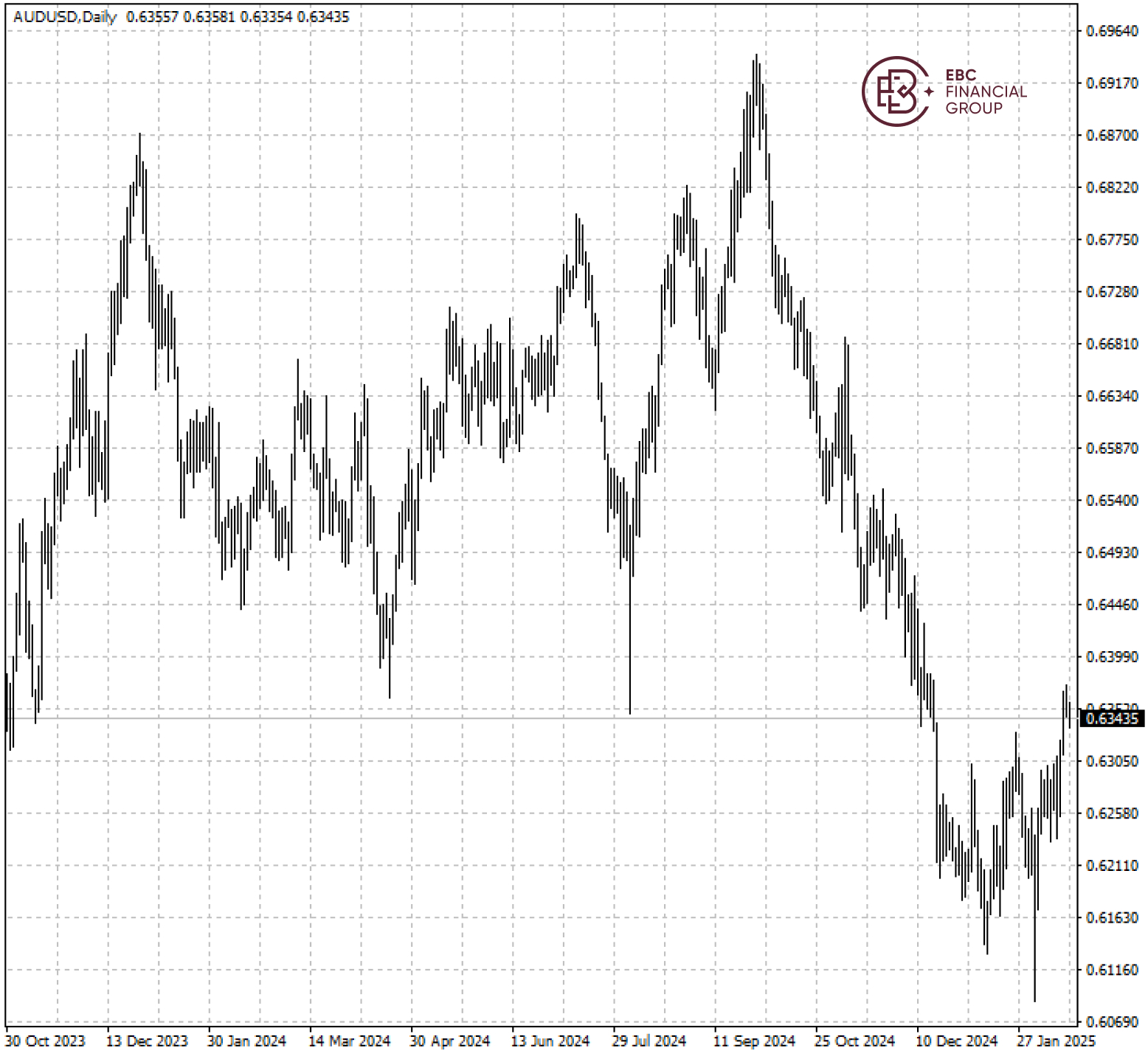

The Australian dollar managed to stay close to its highest level in two months. Hedge funds are in danger of losing money on their bearish positions as a lot of the negative news have been priced in.

While the RBA is poised to lower its benchmark rate for the first time since November 2020 on Tuesday, there is no guarantee that would spur any further Aussie weakness.

The economy has slowed sharply since 2023, but a pick up in consumer spending along with rising uncertainties about the impact of US trade policies may also convince policymakers to stay cautious.

The Aussie is benefiting from an easing of worst-case fears of US tariffs and may climb to as high as 0.6450 if the central bank surprises by keeping interest rates on hold this week, according to RBC Capital Markets.

The central bank’s level of policy restrictiveness remains broadly on par with major counterparts because it did not tighten as aggressively in 2022-2023.

Australia has confirmed they are seeking exemptions from Trump’s tariffs on steel and aluminium, though Trump’s senior counsellor Peter Navarro claimed that Australia was “killing” the US aluminium market.

The Aussie dollar has broken above its recent trading range and uptrend remains intact, so the risk is skewed towards the upside with the resistance around 0.6380.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.