EBC Markets Briefing | Crude oil slips with focus on demand

Oil prices slipped in early Asian trading on Friday, with weak demand in focus even after the OPEC+ postponed planned supply increases and extended output cuts to the end of 2026.

The cartel was planning to start unwinding cuts from October, but a slowdown in global demand - especially in China - and rising output elsewhere forced it to postpone the plan several times.

Banks are gearing up for US oil prices to fall below $60 a barrel by the middle of Trump’s new term in office when shale output is expected to grow, according to a survey from law firm Haynes Boone LLP.

Crude inventories fell by 5.1 million barrels in the week ended 29 Nov, the EIA said, compared with analysts’ expectations for a loss of 671,000 barrels. Meanwhile, US oil production rose to a record high.

For the first 11 months of the year, Asia's crude imports were 26.52 million bpd, down from the 26.89 million bpd tracked by LSEG Oil Research for the same period in 2023. That contradicted OPEC’s rosy forecast.

OPEC+'s biggest dilemma is that it can only keep the oil price around $75 a barrel by efforts, and other major oil producers are set to gain market shares if demand recovers somehow later.

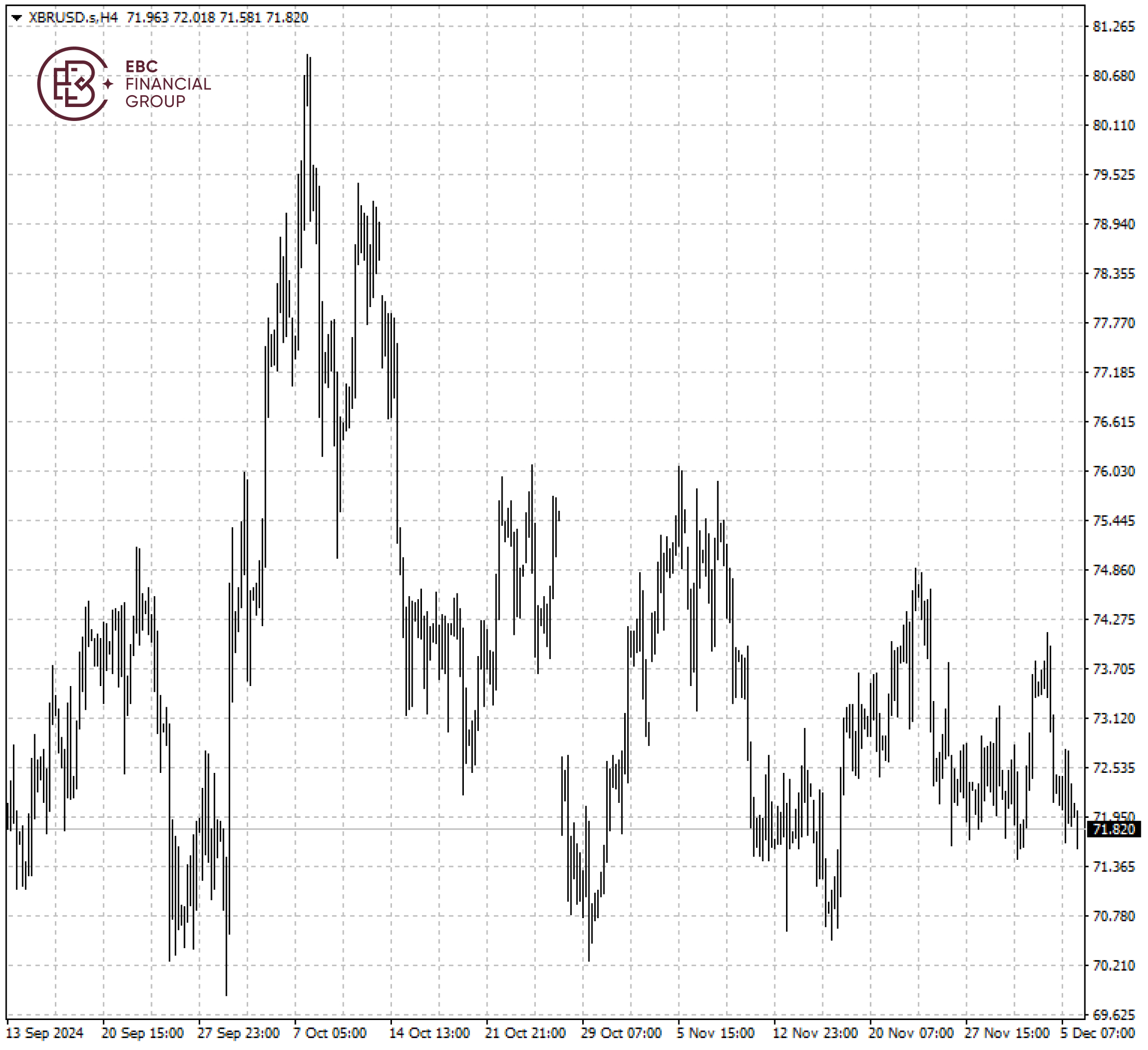

Brent crude remained stuck in a tight range from $71.4 to $74.1. A breakout which could be seen following today’s NFP report is needed for trend direction.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.