Oil sinks

Oil sinks

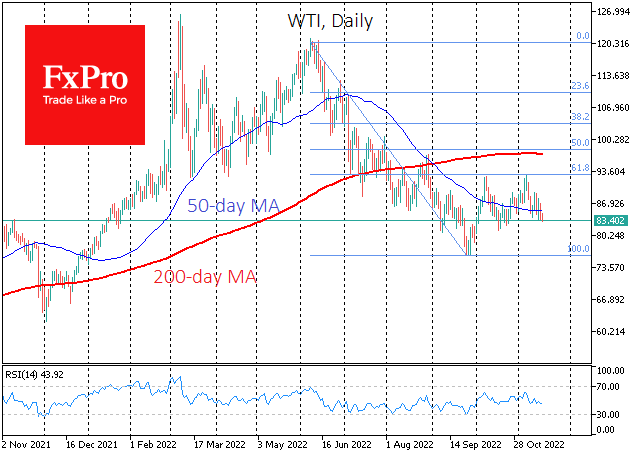

WTI oil is trading below $84, near last month's lows, having failed to experience a buying spurt following the week's inventory data.

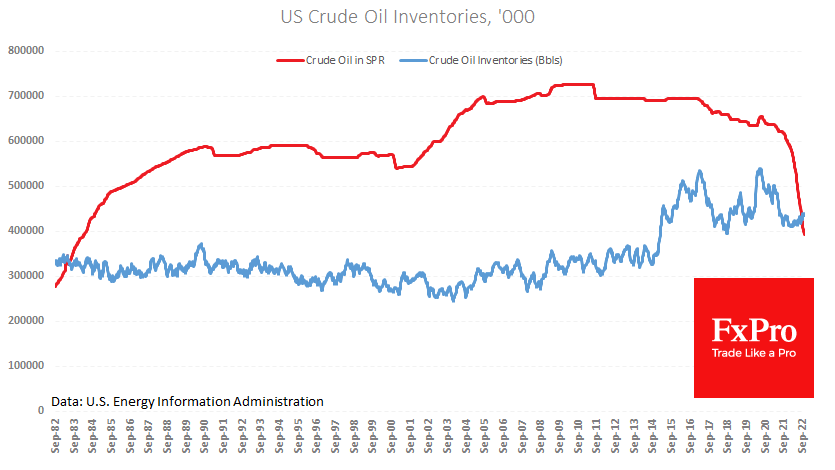

While commercial inventories were down 5.4Mln Barrels compared to an expected 2MB decline, oil sales from the Strategic Reserve did not slow but slightly accelerated to 4.1MB last week compared to 3.6MB and 1.9MB in the prior two weeks. Commercial inventories are now 0.5% higher than in the same week a year earlier, while strategic reserves are down 35%.

Also, retail sales data released yesterday noted a 4% rise in fuel spending for October, with higher expenditure seen only from May to July at the height of the motor holiday season.

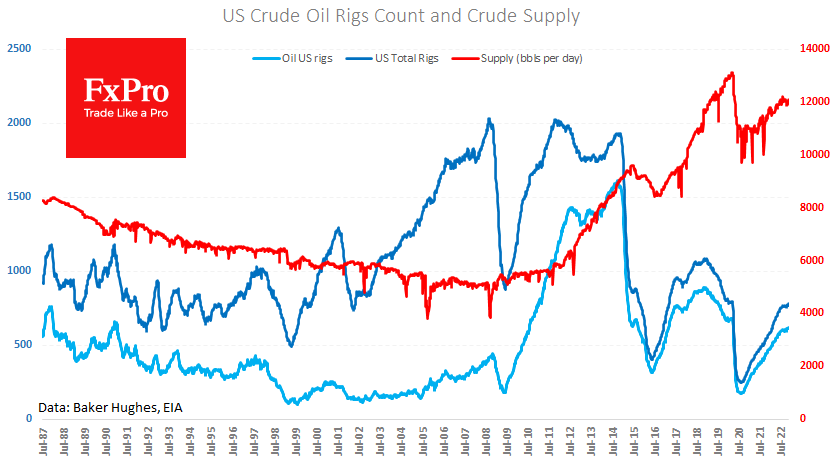

Meanwhile, US oil producers are holding production at 12.1M BPD. While they are up and updating the number of wells in operation, drilling activity is still working more to replace retiring capacity rather than ramping up production.

We should also add the OPEC+ production cuts to wonder further why the oil price is not rising. Quite the opposite, WTI closed below its 50-day average on Wednesday and is now developing a decline, testing lows from late October as part of the downtrend of the last ten days.

If we take a broader perspective, the decline since November 7 was a second failed attempt to break above $93, the 61.8% Fibonacci level of the June-September decline. The new slide down to the 50-day average is another argument favouring bearish dominance.

Fundamentally oil is weak because more and more countries are moving from slowing growth to a contractionary phase. And many are predicting more of them early next year when the effects of the rate hikes that have already taken place will begin to show their full force.

Because oil is so sensitive to the economic cycle, it may continue to fall to the lows of September ($75) even if the dollar does not return to where it was in late September. If an economic recession hits most of the eurozone and the US, China, and India slow sharply, oil risks plunging as low as $50, heading towards the 161.8% level of the original slump.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)