The Dow Jones has reached its top levels, but don’t rush to short it

The Dow Jones has reached its top levels, but don’t rush to short it

Dow Jones index futures opened the week with a 0.5% jump, exceeding 45,000. This is the area of highs from which the index reversed downward in December and January. The test of historical highs occurred about a month later than the S&P 500 and Nasdaq-100, underscoring the continued advantage of high-tech companies, which make up a large share of these indices.

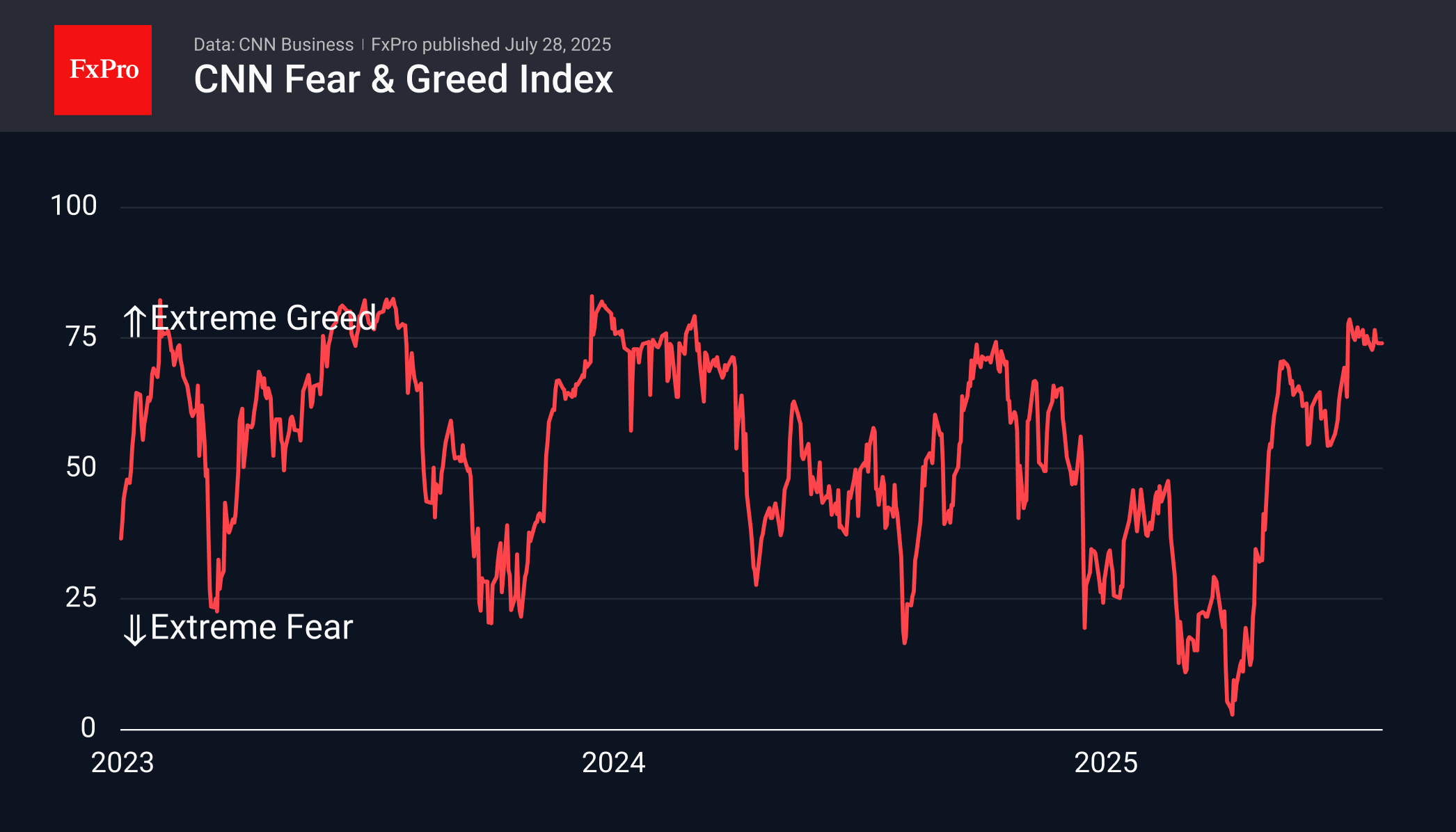

Since the beginning of July, the Greed and Fear Index has been hovering around the threshold of extreme greed, periodically entering this territory. On Monday morning, this indicator stood at 74. Of the seven components of the indicator, the VIX volatility index is in neutral territory, and the ratio of put and call options is in “greed” territory, while the other five are in extreme greed territory.

Long-term investors are also almost certainly aware that the “Buffett indicator” — the ratio of market capitalisation to GDP — has long since broken the records set in 2008 and 2000. But it has been in this mode for the last couple of years.

However, neither high fear and greed index values nor a prolonged stay in “extreme greed” are signals to sell. On the contrary, in such conditions, short squeezes occur more often when sellers capitulate. Last week's latest minor episode of meme mania was a stark reminder that the market can be irrational from a fundamental point of view, as technical factors sometimes drive it.

The rally has room to continue, as the market is far from overbought with an RSI of 64. Moreover, the failure in April cleared the way for further growth.

In the middle of the month, the 50-day moving average exceeded the 200-day moving average, a signal known as a “golden cross.” As a rule, the market maintains positive momentum for many months after this signal, as large funds and investors interpret it as the formation of a positive long-term trend.

In addition, it is important to understand that Trump's trade agreements remove some of the anxiety and uncertainty from market assessments. They also involve significant investments (Japan, EU) and orders for local products such as aircraft and energy carriers (in all known deals).

Thus, despite high market levels, it is still worth being prepared for sharp upward jumps in the short term. At the same time, if fundamental news confirms this, for long-term investors, this may be the ideal moment to close long positions. These could include the Fed's stubborn unwillingness to ease policy and a deterioration in macroeconomics. The coming week will be very important, with the Fed's rate decision on Wednesday and monthly employment data on Friday.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)