Edit Your Comment

UK ELECTIONS 2017

Jun 08, 2017 at 06:42

Sep 12, 2016 부터 멤버

게시물58

Hello all respected traders and visitors of this topic.

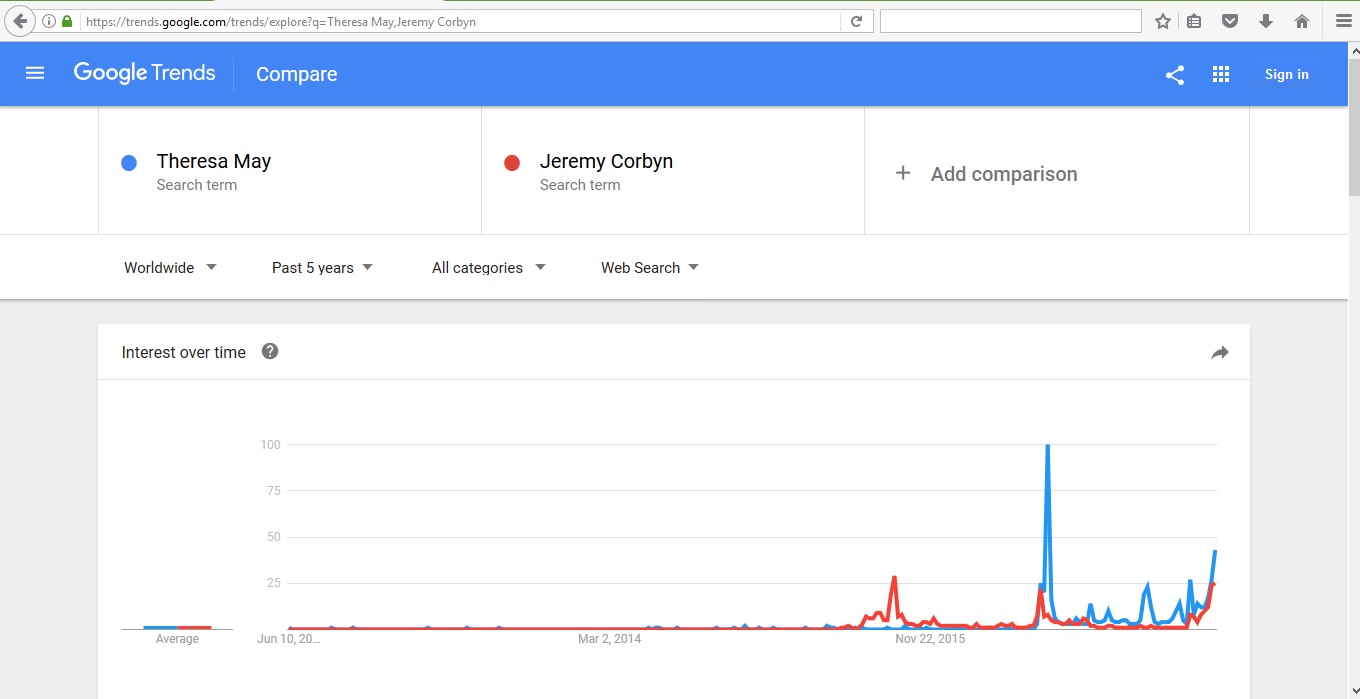

I think everyone wonder about the results of the upcoming UK elections, who wins and what would be the market reaction. I want to show you one method that was tested by me on several previous elections to predict the outcome. It is as simple as it may be. I analysed google trends statistics to check on the results tagged by Theresa May and Jeremy Corbyn. As you can see on the image, Theresa May has slightly more public interest, than Jeremy Corbyn.

So the question of the day is what does this mean for the market in general, and, particularly, for us?

To my mind this data shows us very well the balance of force in UK parliament wont change so all that play was just sucking money from Britain's pocket.

As a result, GBP, after a very high volatility, shooting down buy stops, should return to the pre-election mid April levels.

In case you opinion is different, please feel free to express it.

P.S.: All pm's would be answered after this weekend.

Zeiten Ändern Dich. email: ulrichmax@

Jun 09, 2017 at 08:53

Sep 12, 2016 부터 멤버

게시물58

BaldoN posted:

Very good approach to have some initial expectations. I personally would prefer to enter on "cable" after the reaction coming out of the elections.

"Cable" entering is indeed lowers some pressure, but may be much more risky overall.

First of all, it might be intentional movement to kick out the majority originated from the market itself, or from a smart-@ss broker. Also, due to low liquidity, most brokers decrease leverage and widen spreads immensely. Taking all that into account I think, that opening positions not prior, but during such important events is very inconvenient and may have heavy consequences.

Zeiten Ändern Dich. email: ulrichmax@

Jun 09, 2017 at 11:22

Feb 12, 2016 부터 멤버

게시물507

maxulr posted:BaldoN posted:

Very good approach to have some initial expectations. I personally would prefer to enter on "cable" after the reaction coming out of the elections.

"Cable" entering is indeed lowers some pressure, but may be much more risky overall.

First of all, it might be intentional movement to kick out the majority originated from the market itself, or from a smart-@ss broker. Also, due to low liquidity, most brokers decrease leverage and widen spreads immensely. Taking all that into account I think, that opening positions not prior, but during such important events is very inconvenient and may have heavy consequences.

Opening the positions prior event is more or less close to gambling. During the event may depend from market conditions, but still due to the high volatility and low liquidity the stops could be triggered quickly. After the event is much better, after the sharp market reaction :).

To be honest, I was missed last night UK election market party - being on another event :)

Feb 03, 2017 부터 멤버

게시물30

Sep 12, 2015 부터 멤버

게시물1933

Jun 12, 2017 at 06:03

Jan 18, 2017 부터 멤버

게시물1

what happen on monday opening. it is up or down ??

Jun 27, 2017 at 10:56

Apr 18, 2017 부터 멤버

게시물659

ANSHU870 posted:

what happen on monday opening. it is up or down ??

You already got your answer! Actually, these types of news events are too much critical! Only good skilled Forex traders are able to understand the actual movements of market! By the way, right now I am with EUR!

Sep 12, 2015 부터 멤버

게시물1933

Jun 29, 2017 at 13:48

Jun 29, 2017 부터 멤버

게시물10

mlawson71 posted:Forex_Villa posted:

Kind of expected it will be a hung parliament but never knew the retracements were so weak and GBP is still under pressure.

Wait until they actually do start working on Brexit, the pressure will only increase, I think.

Brexit negotiations are going to be a nightmare. The GBP could super volatile for 2 years as every politician wants to say something positive or negative about how they are going

Jul 01, 2017 at 11:56

Dec 11, 2015 부터 멤버

게시물1462

ZacThePac posted:mlawson71 posted:Forex_Villa posted:

Kind of expected it will be a hung parliament but never knew the retracements were so weak and GBP is still under pressure.

Wait until they actually do start working on Brexit, the pressure will only increase, I think.

Brexit negotiations are going to be a nightmare. The GBP could super volatile for 2 years as every politician wants to say something positive or negative about how they are going

Those are my thoughts exactly too. I don't know how am I going to trade the GBP, I might even avoid it altogether. It depends.

Sep 12, 2015 부터 멤버

게시물1933

Jul 01, 2017 at 13:45

Sep 12, 2015 부터 멤버

게시물1933

BaldoN posted:

As per my opinion, the end decision has been taken and already calculated in the price. The movement and volatility around different point of negotiation most likely will have similar to the "news" effect over the sterling in crosses.

We've never had a brexit before though, prices can be calculated for other events because they've happened before, two other things effecting the UK, inflation and wage growth .

"They mistook leverage with genius".

*상업적 사용 및 스팸은 허용되지 않으며 계정이 해지될 수 있습니다.

팁: 이미지/유튜브 URL을 게시하면 게시물에 자동으로 삽입됩니다!

팁: @기호를 입력하여 이 토론에 참여하는 사용자 이름을 자동으로 완성합니다.