Edit Your Comment

UK ELECTIONS 2017

Jun 08, 2017 at 06:42

Uczestnik z Sep 12, 2016

58 postów

Hello all respected traders and visitors of this topic.

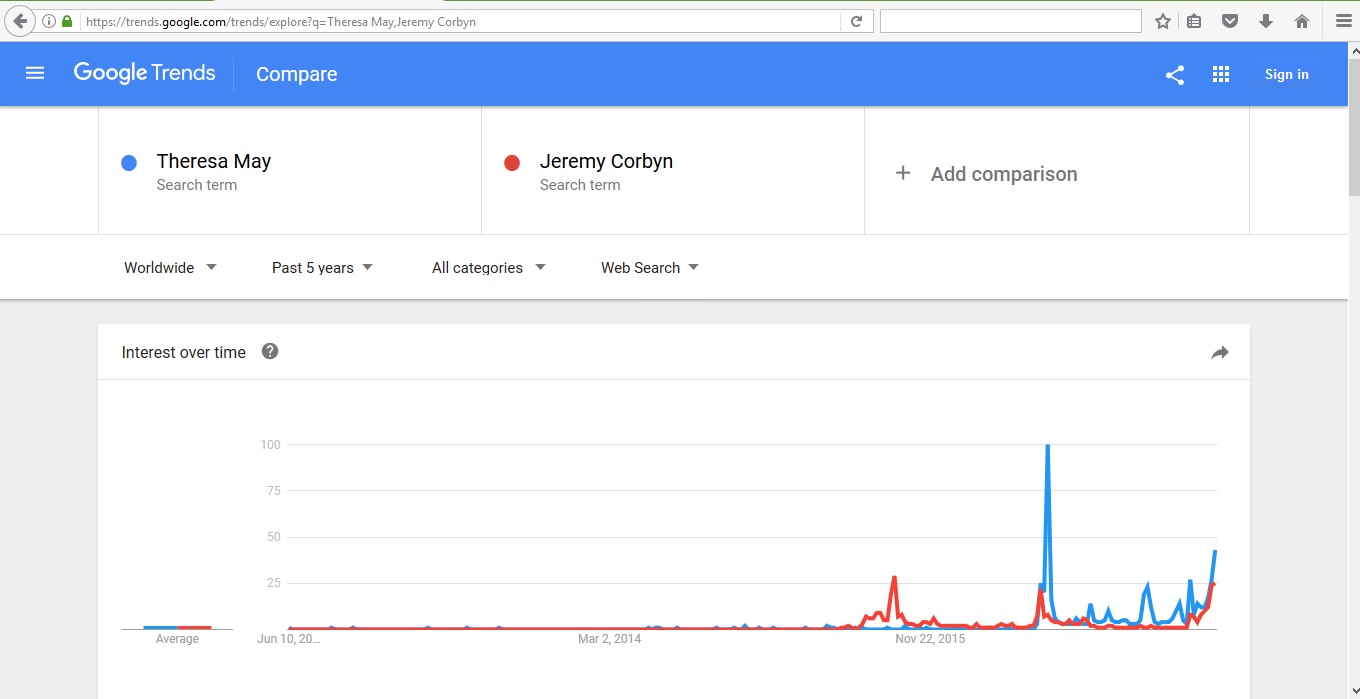

I think everyone wonder about the results of the upcoming UK elections, who wins and what would be the market reaction. I want to show you one method that was tested by me on several previous elections to predict the outcome. It is as simple as it may be. I analysed google trends statistics to check on the results tagged by Theresa May and Jeremy Corbyn. As you can see on the image, Theresa May has slightly more public interest, than Jeremy Corbyn.

So the question of the day is what does this mean for the market in general, and, particularly, for us?

To my mind this data shows us very well the balance of force in UK parliament wont change so all that play was just sucking money from Britain's pocket.

As a result, GBP, after a very high volatility, shooting down buy stops, should return to the pre-election mid April levels.

In case you opinion is different, please feel free to express it.

P.S.: All pm's would be answered after this weekend.

Zeiten Ändern Dich. email: ulrichmax@

Uczestnik z Feb 12, 2016

507 postów

Jun 08, 2017 at 13:48

Uczestnik z Feb 12, 2016

507 postów

Very good approach to have some initial expectations. I personally would prefer to enter on "cable" after the reaction coming out of the elections.

Uczestnik z Dec 16, 2011

268 postów

Jun 09, 2017 at 08:43

Uczestnik z Dec 16, 2011

268 postów

ha ha ha google trends statistics - please , its got nothing to do with forex ...waist of time

your results r set for 5 years . change it to 7 days

your results r set for 5 years . change it to 7 days

Jun 09, 2017 at 08:53

Uczestnik z Sep 12, 2016

58 postów

BaldoN posted:

Very good approach to have some initial expectations. I personally would prefer to enter on "cable" after the reaction coming out of the elections.

"Cable" entering is indeed lowers some pressure, but may be much more risky overall.

First of all, it might be intentional movement to kick out the majority originated from the market itself, or from a smart-@ss broker. Also, due to low liquidity, most brokers decrease leverage and widen spreads immensely. Taking all that into account I think, that opening positions not prior, but during such important events is very inconvenient and may have heavy consequences.

Zeiten Ändern Dich. email: ulrichmax@

Uczestnik z Feb 12, 2016

507 postów

Jun 09, 2017 at 11:22

Uczestnik z Feb 12, 2016

507 postów

maxulr posted:BaldoN posted:

Very good approach to have some initial expectations. I personally would prefer to enter on "cable" after the reaction coming out of the elections.

"Cable" entering is indeed lowers some pressure, but may be much more risky overall.

First of all, it might be intentional movement to kick out the majority originated from the market itself, or from a smart-@ss broker. Also, due to low liquidity, most brokers decrease leverage and widen spreads immensely. Taking all that into account I think, that opening positions not prior, but during such important events is very inconvenient and may have heavy consequences.

Opening the positions prior event is more or less close to gambling. During the event may depend from market conditions, but still due to the high volatility and low liquidity the stops could be triggered quickly. After the event is much better, after the sharp market reaction :).

To be honest, I was missed last night UK election market party - being on another event :)

Uczestnik z Feb 03, 2017

30 postów

Uczestnik z Dec 11, 2015

1462 postów

Jun 11, 2017 at 13:20

Uczestnik z Dec 11, 2015

1462 postów

Forex_Villa posted:

Kind of expected it will be a hung parliament but never knew the retracements were so weak and GBP is still under pressure.

Wait until they actually do start working on Brexit, the pressure will only increase, I think.

Uczestnik z Sep 12, 2015

1933 postów

Jun 11, 2017 at 16:24

Uczestnik z Sep 12, 2015

1933 postów

It will be a disaster if May forms any party with DUP in N.Ireland ,a through back to the dark ages, 300,000 have signed a petition against any such move in the first 12 hours.

"They mistook leverage with genius".

Jun 12, 2017 at 06:03

Uczestnik z Jan 18, 2017

1 postów

what happen on monday opening. it is up or down ??

Uczestnik z Apr 18, 2017

659 postów

Jun 27, 2017 at 10:56

Uczestnik z Apr 18, 2017

659 postów

ANSHU870 posted:

what happen on monday opening. it is up or down ??

You already got your answer! Actually, these types of news events are too much critical! Only good skilled Forex traders are able to understand the actual movements of market! By the way, right now I am with EUR!

Uczestnik z Sep 12, 2015

1933 postów

Jun 27, 2017 at 12:31

Uczestnik z Sep 12, 2015

1933 postów

There was a bullish hint earlier this morning at London open.

"They mistook leverage with genius".

Jun 29, 2017 at 13:48

Uczestnik z Jun 29, 2017

10 postów

mlawson71 posted:Forex_Villa posted:

Kind of expected it will be a hung parliament but never knew the retracements were so weak and GBP is still under pressure.

Wait until they actually do start working on Brexit, the pressure will only increase, I think.

Brexit negotiations are going to be a nightmare. The GBP could super volatile for 2 years as every politician wants to say something positive or negative about how they are going

Uczestnik z Feb 12, 2016

507 postów

Jun 29, 2017 at 14:08

Uczestnik z Feb 12, 2016

507 postów

As per my opinion, the end decision has been taken and already calculated in the price. The movement and volatility around different point of negotiation most likely will have similar to the "news" effect over the sterling in crosses.

Uczestnik z Dec 11, 2015

1462 postów

Jul 01, 2017 at 11:56

Uczestnik z Dec 11, 2015

1462 postów

ZacThePac posted:mlawson71 posted:Forex_Villa posted:

Kind of expected it will be a hung parliament but never knew the retracements were so weak and GBP is still under pressure.

Wait until they actually do start working on Brexit, the pressure will only increase, I think.

Brexit negotiations are going to be a nightmare. The GBP could super volatile for 2 years as every politician wants to say something positive or negative about how they are going

Those are my thoughts exactly too. I don't know how am I going to trade the GBP, I might even avoid it altogether. It depends.

Uczestnik z Sep 12, 2015

1933 postów

Jul 01, 2017 at 13:45

Uczestnik z Sep 12, 2015

1933 postów

BaldoN posted:

As per my opinion, the end decision has been taken and already calculated in the price. The movement and volatility around different point of negotiation most likely will have similar to the "news" effect over the sterling in crosses.

We've never had a brexit before though, prices can be calculated for other events because they've happened before, two other things effecting the UK, inflation and wage growth .

"They mistook leverage with genius".

Uczestnik z Dec 11, 2015

1462 postów

Jul 11, 2017 at 09:36

Uczestnik z Dec 11, 2015

1462 postów

MyNewBank posted:

Both of those indicators are pointing towards a recession in my view. I have a very dark out look for the UK over the next few years

I agree. I think the question is how long that will last before the UK begins to recuperate.

*Komercyjne wykorzystanie i spam są nieprawidłowe i mogą spowodować zamknięcie konta.

Wskazówka: opublikowanie adresu URL obrazu / YouTube automatycznie wstawi go do twojego postu!

Wskazówka: wpisz znak@, aby automatycznie wypełnić nazwę użytkownika uczestniczącego w tej dyskusji.