Bitcoin and Ether flirt with 50-day MA

Market picture

The cryptocurrency market capitalisation is marginally lower by 0.1% compared to 24 hours ago, recovering from a 2% drop at the end of the previous day. The Cryptocurrency Fear and Greed Index dropped 3 points overnight to 61 but remained at the Geed territory. Most of the top ten cryptocurrencies are losing ground over the last day, while Bitcoin and XRP are slightly gaining.

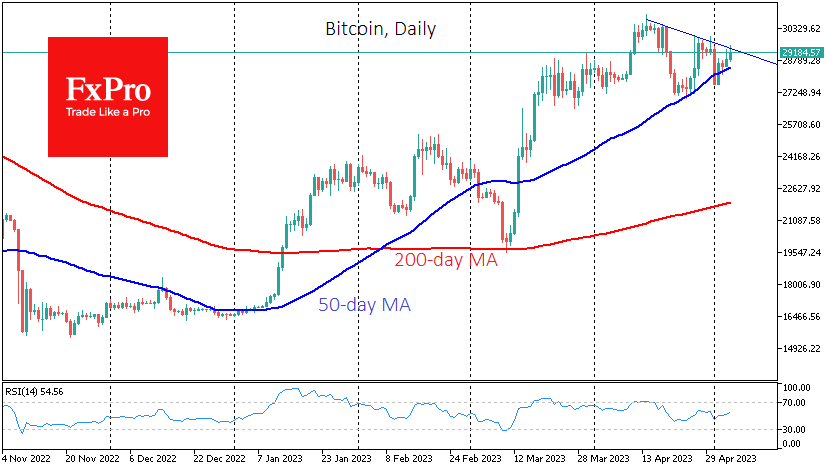

Bitcoin has risen 0.3% in the last 24 hours and more than 1% since the start of the day. In the early hours of this morning, the price slipped close to $29.5K, the highest level since the end of April. The first cryptocurrency overcame a sharp decline on May 1st and is now testing downside resistance through last month's local highs. A consolidation above this level would be a significant signal for buyers and could trigger a growth surge.

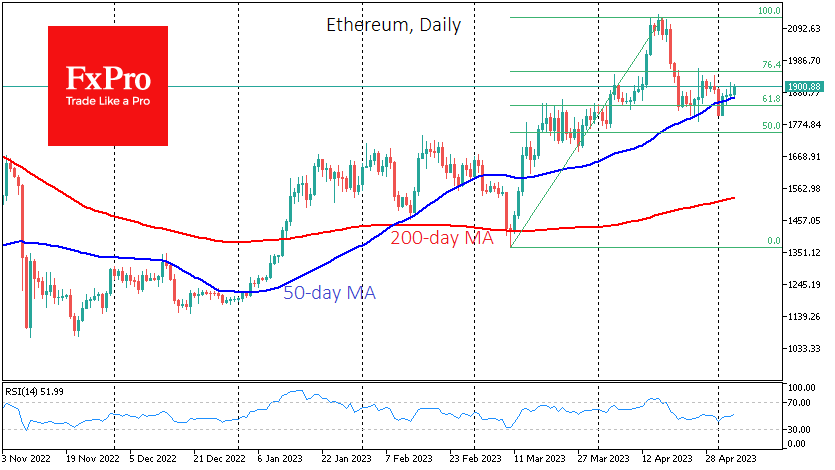

Ethereum’s upward-sloping 50-day moving average regularly supports local dips, as in Bitcoin. The 61.8% Fibonacci retracement of the March-April momentum was also a nominal support line. This is also where the former resistance area from March is located, which now becomes support.

The average commission per Ethereum transaction has reached the highest level since May 2022, above $15. This situation is mainly due to the rally around meme tokens such as PEPE. The problem is similar for Bitcoin; the average transaction fee has exceeded $7 due to the hype around the Ordinals.

News background

Cardano creator Charles Hoskinson warned that the collapse of American banks this year could repeat the 2008 financial crisis. However, cryptocurrencies are showing resilience in a challenging macroeconomic environment.

Michael van de Poppe, founder of trading platform Eight, urged market participants to "take money out of banks" and invest in hard assets such as gold, silver, bitcoin, and other cryptocurrencies. He said preparing for "a decade of cryptocurrencies and commodities" was necessary.

The collapse of FTX Group in November led to a shift in the share and influence of crypto exchanges in the digital asset market. According to Coingecko's research, Binance's market share has reached 62%, followed by Upbit (7%) and OKX (6.4%). The rest of the top 10 hold less than 6% of the global market.

Coinbase will stop lending against Bitcoin amid a crackdown by US authorities.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)