Canada PPI unlikely to wake hawks

Canada PPI unlikely to wake hawks

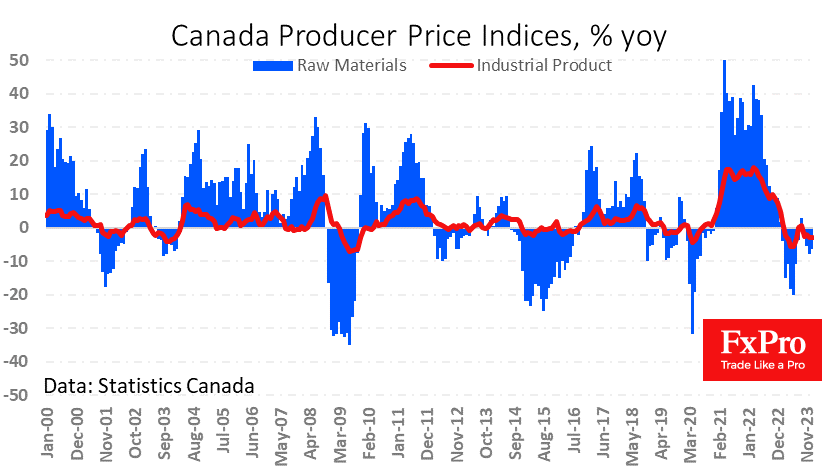

Producer prices in Canada fell by 0.1% in January after a cumulative drop of 2.9% in the previous three months. Prices are now 2.9% lower than a year ago, picking up the pace of decline.

Looking through all these large swings since the start of the pandemic, the PPI has shown a typical annual growth rate of 4% over these four years, above the average of 2.3% since 2000 but close to the average rate for the whole observation period since 1956.

The raw commodity price index was up 1.2% for the month, but that shouldn't worry the Bank of Canada’s hawks, as the index had lost 12.5% in the previous three months. In January last year, prices were down 6.4%. The average annual increase since the start of 2020 is a more impressive 8%, compared with an average of 5.3% since 2000 and 3.7% since 1981.

Canada's equally important CPI data will be released on Tuesday. The annual rate is expected to slow from 3.4% to 3.2% for the headline index and from 2.6% to 2.5% for the core index.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)