Crypto didn't dare to grow

Market picture

The crypto market failed to get on a growth path, with its capitalisation falling 1.5% to $2.35 trillion in the last 24 hours. Cryptocurrencies have had their wings clipped by the sell-off in equity markets, reflecting a downturn in risk appetite in global finance. Due to the link to traditional finance, the largest coins came under pressure. Bitcoin lost 1.3%, Ethereum lost 1.9% and BNB lost 2.9%. Meanwhile, TON added 1%, and TRON is up 0.6%.

Bitcoin was actively rising to $66.4K on Thursday, where it reversed just as rapidly to the downside. Local resistance was the 50-day moving average, another important signal of a shift from bullish to bearish sentiment in the cryptocurrency market in addition to the two-week downward trend.

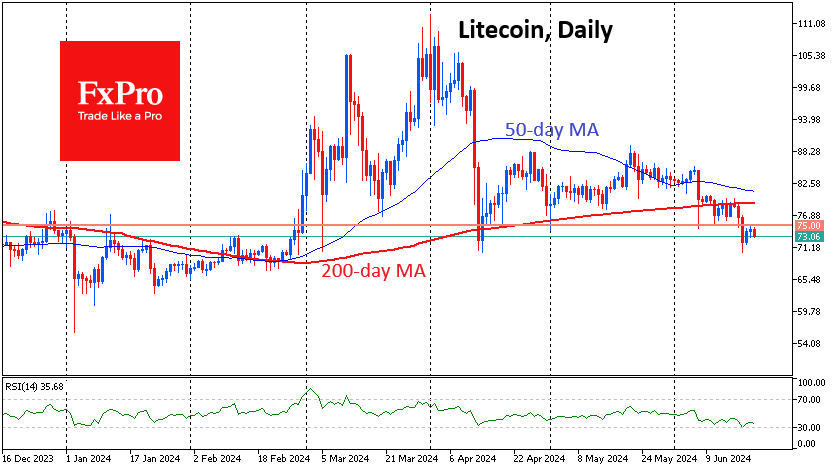

Litecoin has failed in its attempt to get back above $75 and has been trading around lows since early March. So far, the market has been ruthless on older altcoins, favouring new promising projects or heavyweights like Bitcoin and Ethereum benefiting from actual or potential ETF launches.

News background

CryptoQuant estimates that large bitcoin holders, including miners, have reduced positions through OTC platforms by $1.2bn in the past two weeks. Bitcoin miners' reserves have fallen below 2021 levels. Net outflows from BTC-ETFs totalled $460 million in the same two weeks.

“If this nearly $1.7bn in sell-side BTC is not redeemed OTC, brokers may take bitcoins to the CEX, negatively impacting the market,” commented CryptoQuant CEO Ki Yoon Ju.

MicroStrategy acquired an additional 11,931 BTC for $786 million (~$65,883 per coin) using proceeds from bonds issued and excess cash. MicroStrategy said it sold $800 million worth of bonds. In total, the company now owns 226,331 BTC, acquired for approximately $8.33 billion.

According to QCP Capital, the options market is betting on Ethereum rising towards $4800. Bullish sentiment is supported by the conclusion of the SEC's investigation into Ethereum 2.0, where the regulator did not recognise ETH sales as securities transactions.

The BNB Chain ecosystem activated the BEP 336 Haber hardfork, which reduced transaction costs for L2 solutions by 90%.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)