Crypto lacks bulls

Market picture

It seems that all the market bulls have moved on to US and Japanese equities, avoiding cryptocurrencies. The cryptocurrency market failed to break out of its consolidation, and its capitalisation rolled back 1.3% to $2.13 trillion, inside the range from last Friday. Fear remains the main driver of the market.

Bitcoin pulled back from its 200-day moving average, falling back below the $58K upper boundary of the last six-day range. The first cryptocurrency is under much more pressure than many altcoins, which are making a gradual recovery. A consolidation above $59K would be seen as a local victory for the Bulls.

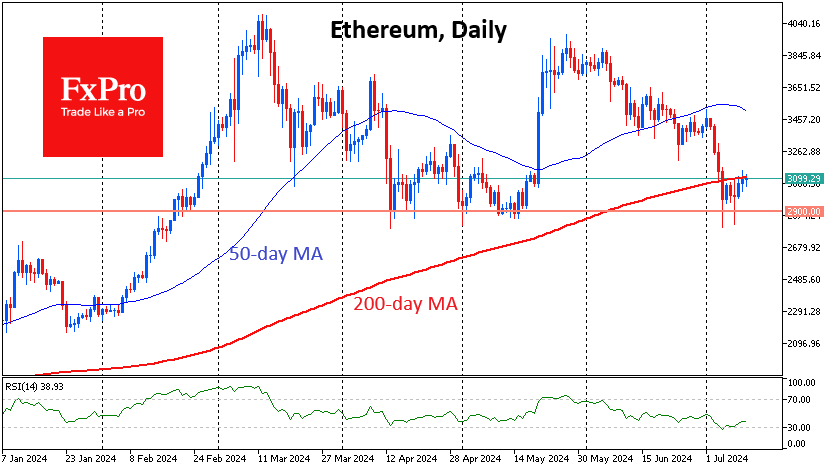

Ethereum is testing its 200-day MA near $3100 for the fourth day. So far, it has failed, but bullish candles are fixed for the third day in a row. Litecoin is also showing positive momentum, although, like Bitcoin, it is under pressure from expected payments to Mt. Gox creditors.

News background

Bitcoin's most significant correction since late 2022, with a dip below the 200-day moving average (200-DMA), has brought unrealised losses to a significant portion of short-term speculators. Glassnode valued it at $595 million, its highest value since the 2022 cycle low.

Anthony Scaramucci, SkyBridge Capital founder, expects Bitcoin to reach $100K by the end of the year. The growth factor may be the upcoming payment of $16bn to clients of the bankrupt crypto exchange FTX. Scaramucci believes a significant part of these funds will be invested in Bitcoin.

On 10 July, German authorities transferred another 5,103 BTC ($299.8 million) to trading platforms. The German Federal Criminal Police Office (BKA) has 18,860 BTC ($1.11bn) left in its wallet.

In January, German police seized 49,857 BTC from the administrators of the pirate film website Movie2k. Blockchain Research Lab noted that this is standard procedure for confiscated funds. The remaining coins will likely be realized soon.

Bitwise said it has reached "the finish line" on the Ethereum-ETF issue. By now, there are "fewer and fewer" issues related to the S-1 filing between the SEC and the eight potential ETF issuers.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)