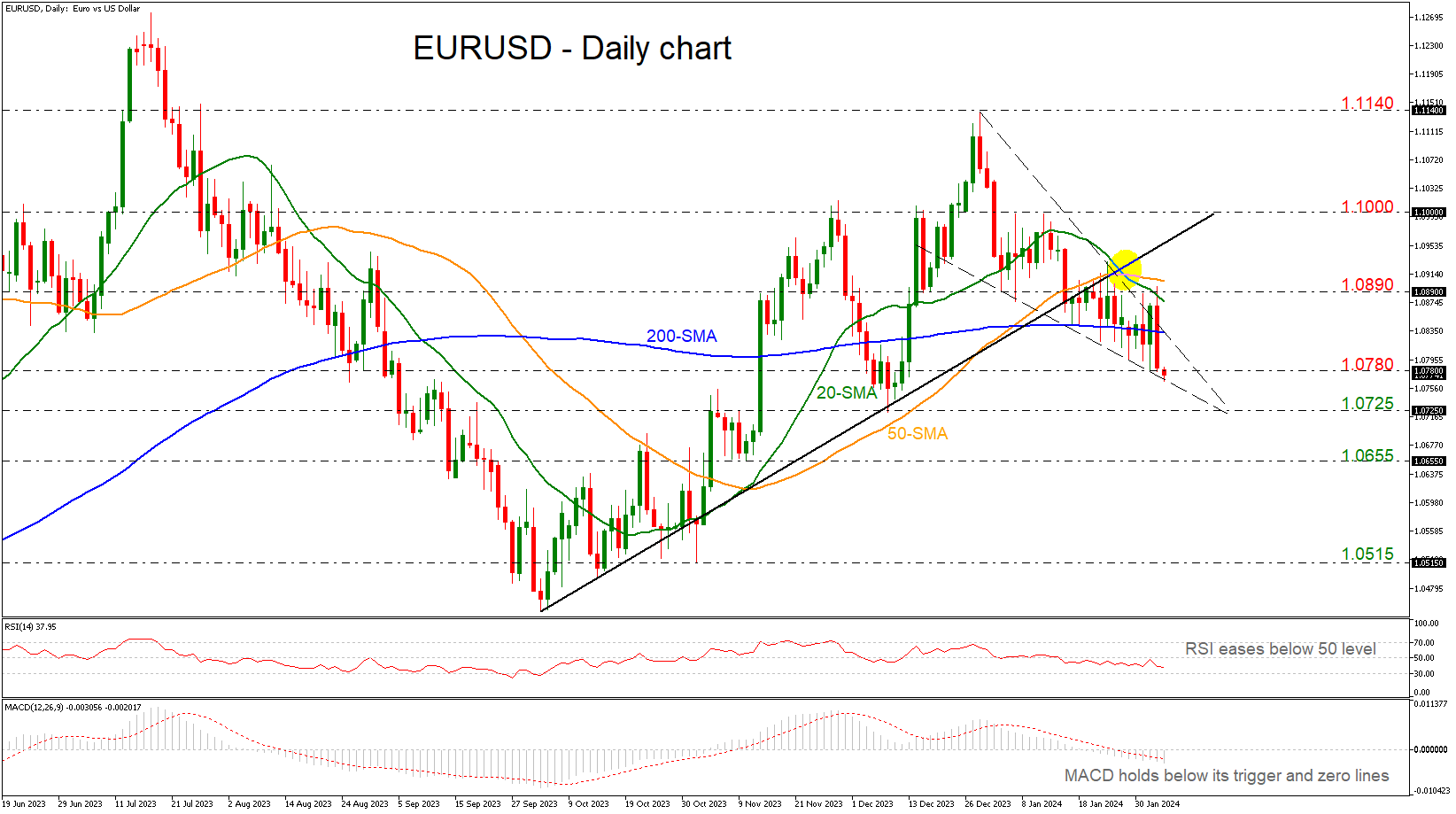

EURUSD unlocks 2-month low below 1.0800

· EURUSD meets lower boundary of bearish triangle

· Market is in descending tendency

· MACD and RSI strengthen bearish bias

EURUSD plummeted more than 1% on Friday after the release of the NFP report and posted a fresh almost two-month high of 1.0766 earlier today, meeting the lower boundary of the bearish triangle.

The price is also developing beneath the 200-day simple moving average (SMA) and the 20- and 50-day SMAs act as strong resistance levels as well, after the bearish crossover that occurred in the preceding sessions. The RSI is standing beneath the neutral threshold of 50 and is moving lower, while the MACD is strengthening its negative momentum below its trigger and zero lines.

Further losses should see the December 8 low of 1.0725, endorsing the descending tendency in the market. A drop lower would take the price towards the 1.0655 support ahead of the 1.0515 barricade, taken from the bottom on November 1.

In the event of an upside reversal, the 200-day SMA at 1.0835 could act as a barrier before being able to re-challenge the 1.0890 resistance which holds between the short-term SMAs. A break above this region would shift the short-term outlook to a more neutral one as it would take the pair above the 1.1000 round number. Further gains would lead the way towards the 1.1140 high.

All in all, EURUSD seems to be in bearish mode with the technical oscillators endorsing this view. However, a climb above 1.1000 may raise some optimism for a bullish retracement.

.jpg)