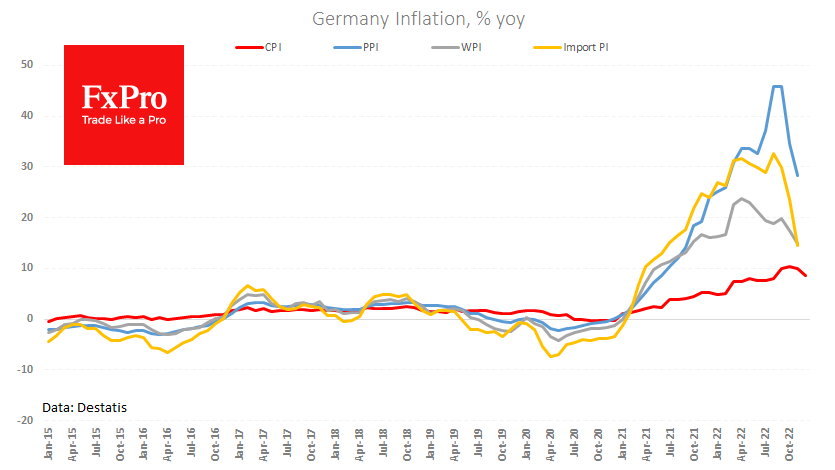

Falling prices in Germany

Inflation data from Germany yesterday and today reinforce hopes that the inflation wave is rolling back faster than expected. Whilst the early success does not promise a quick win, it does raise prospects that high inflation expectations have been avoided.

According to a provisional estimate, consumer prices for December in Germany fell by 0.8% after falling by 0.5% the month before. Notably, we are seeing a fall rather than simple exhaustion of growth. Vendors have begun to reduce prices actively following the fall in raw materials and energy costs. Annual inflation has slowed from 10.4% in October to 8.6%. However, the high-base effect will begin to be felt in February.

Import prices, an early indicator of inflation, accelerated their fall in November, losing 4.5% after decreasing by 1.2% and 0.9% in the previous two months. Import prices are 14.9% higher than a year earlier - a significant retreat after staying close to 20% y/y for the seven months to September.

Generally, weak inflation figures are bearish news for the currency as they suggest a sluggish economy and lead to lower interest rate forecasts. In this case, however, such an essential sigh of relief could support capital inflows into the euro. With lower inflation, the single currency retains more purchasing power. Furthermore, assuming less shock therapy from the ECB, investors may look more closely at purchases of European assets, expecting less dramatic degradation of local company earnings and not so steep a rise of debt service costs.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)