Fed Powell’s moderate tone weighs on risk appetite

Dollar gains ground, equities try to recover from Tuesday’s decline

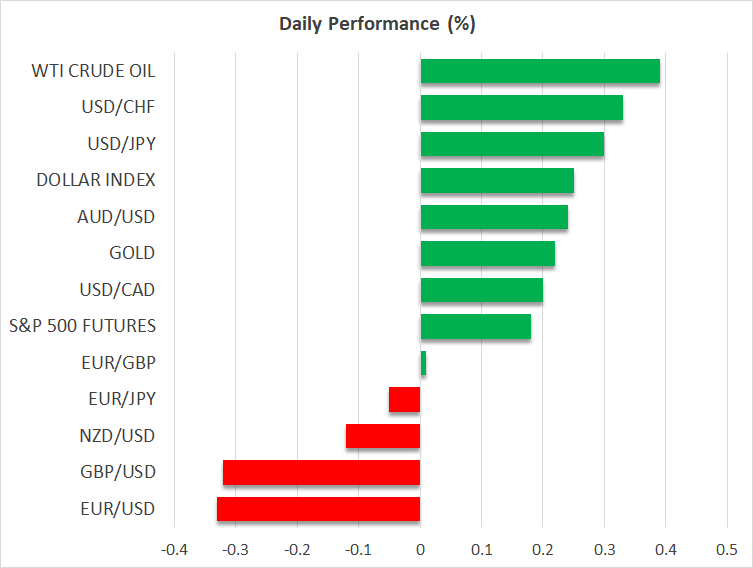

Risk appetite received a small hit yesterday following consecutive positive sessions, with the Nasdaq 100 index leading the sell-off and posting its strongest daily drop since September 2, and the dollar gaining a few pips against the mighty euro. Oddly, the same reason that fueled last week's equity rally – i.e. the FOMC rate cut despite the muffled message from Chair Powell – was the main factor behind yesterday’s correction in equities.

After the barrage of dovish remarks from Fed member Bowman and regional Fed Presidents Goolsbee and Bostic during the first part of yesterday’s session - which could be characterized as the “Attack of the Fed Doves”, paraphrasing a popular sci-fi movie title - Chair Powell chipped in, partly neutralizing the dovish Fedspeak.

Despite the market being fairly confident that the Fed will announce another 25bps rate cut in October, Powell struck a moderate tone again, aiming to control the ballooning rate cut expectations. He highlighted the divergence between inflation and employment risks, but also repeated the FOMC’s central scenario that tariffs are forecast to be a one-time passthrough, and stated that he “cannot say that the labor market is really solid anymore”. Powell even went off-script by expressing his opinion that “equity prices are fairly highly valued”, a subtle way of saying that stocks might be expensive at this stage.

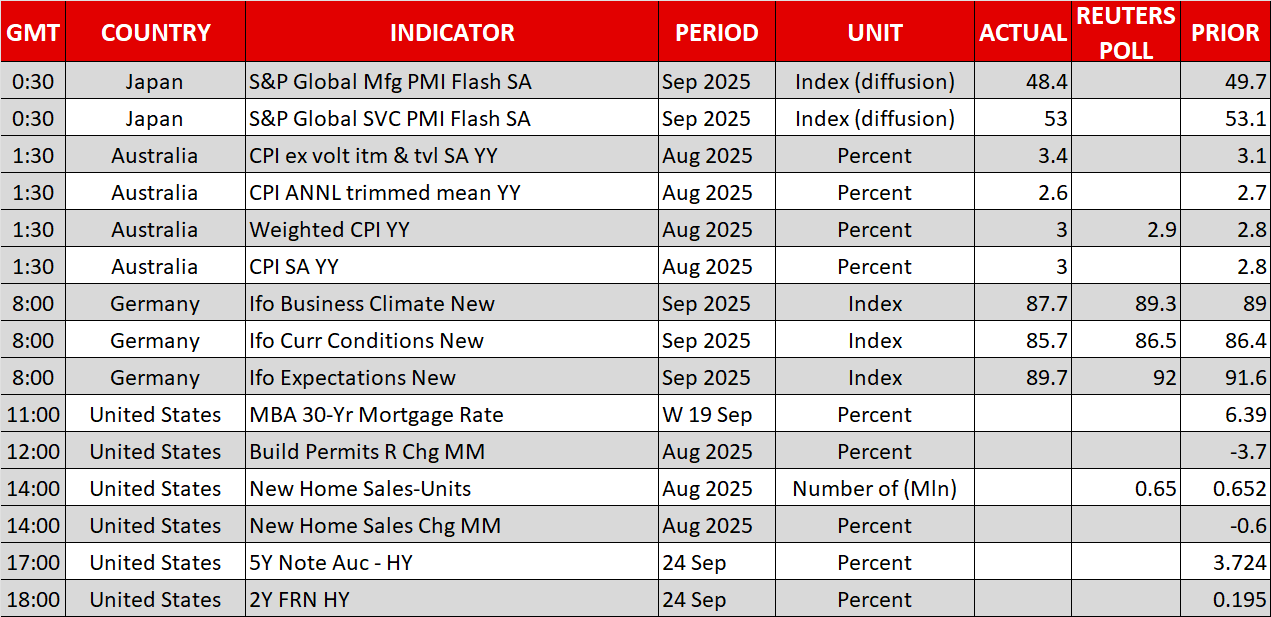

The ping-pong between hawks and doves is expected to continue, with San Francisco Fed President Daly being on the wires today, as markets are proving more sensitive to hawkish remarks. At the end of the day though, the data hold all the aces, either supporting muted calls for an October pause or confirming expectations and dovish Fedspeak for back-to-back rate cuts. Notably, following the decent S&P Global manufacturing and services PMIs, the focus is gradually shifting to tomorrow’s weekly jobless claims and durable goods report, with the main dish being Friday’s PCE report.

Today’s session could prove challenging for risk sentiment

An announcement from China's Alibaba that it is planning to increase AI spending to compete with US-based rivals could further upset risk appetite today, particularly as the US-China negotiations continue, with some progress achieved recently. Coupled with the fact that China is trying to ramp up its domestic chip production and innovation to directly challenge Nvidia’s dominance, there is a possibility down the line of more challenging discussions between the two economic superpowers, and a non-negligible chance of further trade-related risk-off market episodes.

Meanwhile, cryptocurrencies appear to have found a base. Bitcoin bounced off $111k and is now hovering around the $112.5k level, while Ether found strong support in the $4,200 zone. Should the current reaction prove to be part of an accumulation phase, a new rally might be on the cards, despite the challenging environment. Notably, the one-month daily correlation between ‘digital gold’ and gold has weakened aggressively lately, falling from a nine-month high.

Gold and oil gain on geopolitics

The main reason for this correlation dive is gold’s continued rally, regardless of market conditions. At the time of writing, the precious metal is trading at $3,775, a tad below its all-time high of $3,791, benefiting, along with oil, from a change of tune from the US President regarding the Ukraine-Russia conflict.

With Trump bashing Russia, sympathizing with Ukraine and telling Europeans to stop buying Russian gas and oil – most likely replacing these with US energy imports - oil recorded a decent green candle on Tuesday but failed to break its recent range. An initial move above $65 and a retest of the 200-day simple moving average at 67.30 are probably necessary for a trend reversal.

.jpg)