Stocks perk up on Fed optimism, metals jump as dollar struggles

Equities stage post-Fed rebound

Shares on Wall Street put aside worries about lofty AI valuations to finish Thursday’s session broadly higher, just a day after the Fed signalled it may cut rates just once in 2026, and only after a pause. Investors continue to fully price in two 25-bps rate cuts next year, as they think the deteriorating labour market will force policymakers’ hands.

Yesterday’s uptick in initial jobless claims bolstered that view as weekly applications for unemployment benefits rose the most in four-and-a-half years last week, though the weekly total of 236k is only slightly above the average of the past 12 months. Investors also took comfort in the Fed’s upbeat projections of GDP growth over the forecast period to 2028.

However, this gives a sense that markets are choosing what to look at and are ignoring the fact that a weak labour market and strong economic growth don’t usually go together. More likely, it is the hope that Trump’s pick of who will replace Powell will steer the Fed towards a more dovish path from May 2026, and that the launch of a $40 billion scheme to purchase short-term Treasury bills will boost liquidity in the financial system.

No Fed boost for AI stocks as jitters persist

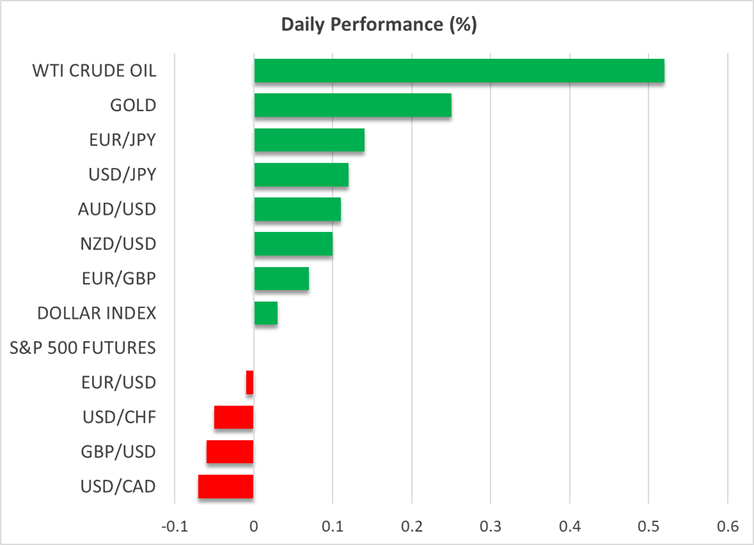

The S&P 500 ended the day 0.2% higher to close at a new all-time high, although it failed to hit a new intra-day record. The Dow Jones and Russell 2000 closed with gains of 1.3% and 1.2%, respectively, but the Nasdaq slid 0.35%.

Stocks in Asia also rallied and European indices are all positive today, but looking at US futures, the Nasdaq continues to underperform.

The tech-heavy index was mainly dragged lower by a 10.8% plunge in Oracle’s stock, following its earnings release that sparked worries about slowing growth in its cloud business. Broadcom was next to publish its quarterly earnings on Thursday. Even though the chipmaker reported very impressive results, declining margins hit sentiment for the stock, pushing it more than 4% lower in pre-market trading.

The Magnificent Seven also struggled, although they managed to pare some of their losses, with Microsoft and Meta closing in the green.

Dollar off lows, pound eyes BoE cut

In the FX sphere, the US dollar came under renewed pressure on Thursday before bouncing back slightly today as Treasury yields recover from the post-Fed lows. Still, the greenback is on course for a third straight weekly loss and is trading near two-month lows against a basket of currencies.

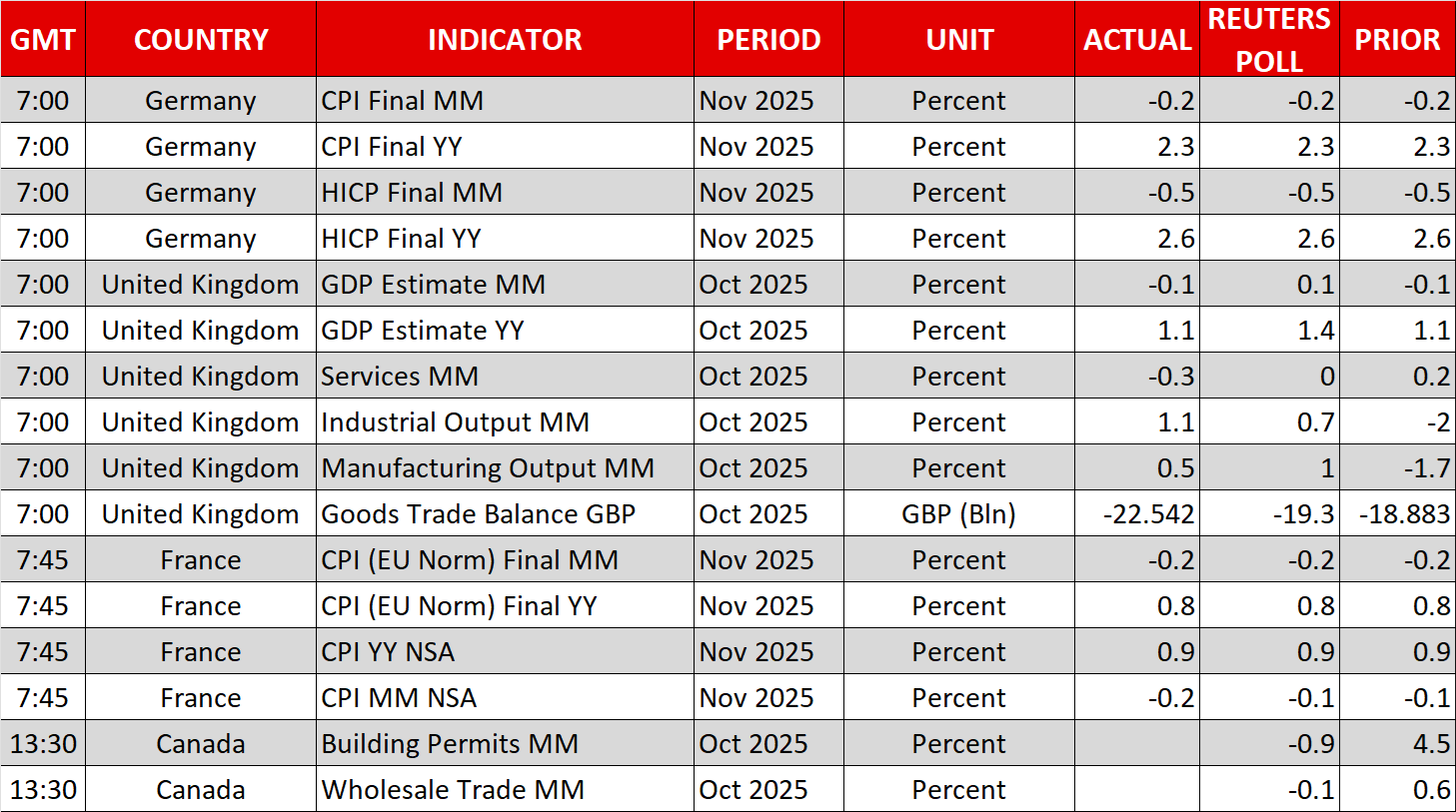

The pound dipped following monthly production data out of the UK today that showed the economy contracted by 0.1% for the second month in a row in October.

The British economy has barely grown since the summer, with worries about tax hikes ahead of the Autumn Budget weighing on consumers in October. Next week, the latest jobs and CPI numbers will be even more crucial for the Bank of England decision on December 18, but the GDP data has nevertheless pushed up the odds of a 25-bps rate cut at the meeting to just under 90%.

Yen slips again amid scepticism about BoJ hikes

In contrast, the Bank of Japan looks set to raise interest rates for the first time since January when it meets next week. The latest reveal from BoJ ‘sources’ suggest the Bank will no longer refer to estimates of the neutral rate, potentially giving policymakers more flexibility on rate increases.

But despite some very strong hints, not all investors are yet convinced that the BoJ will pull the trigger, and the yen continues to trade in the 155.00 region.

Precious metals and copper have strong week

It’s been a stronger week for the commodity-linked dollars, however, as aside from the growing expectations that the next moves of the RBA, RBNZ and Bank of Canada will be a hike, higher metal prices, particularly precious metals, have also helped lift those currencies.

Gold has picked up some steam over the past couple of days, cracking the $4,300 level today, while silver has notched up another record high, hitting $64.35. Copper futures have had a good week too, lifted by a renewed pledge by Chinese officials of more fiscal support next year.

US-Venezuela frictions offer only mild support to oil

It’s been a bumpier ride for oil, however, even as speculation intensifies that President Trump will order military strikes on Venezuelan soil to combat illegal drug smugglers. The US also wants to stop the shipment of Venezuelan oil and seized a sanctioned oil tanker on Wednesday.

Whilst it’s highly likely that Trump wanting regime change in Venezuela is a motivation behind these attacks, many think that the US also wants control of the country’s oil and other resources.

Still, there’s not a huge panic in the markets at the moment and oil futures could only manage short-lived spikes on the headlines as oversupply concerns dominate.