Strong inflation in the US revitalised interest in the dollar

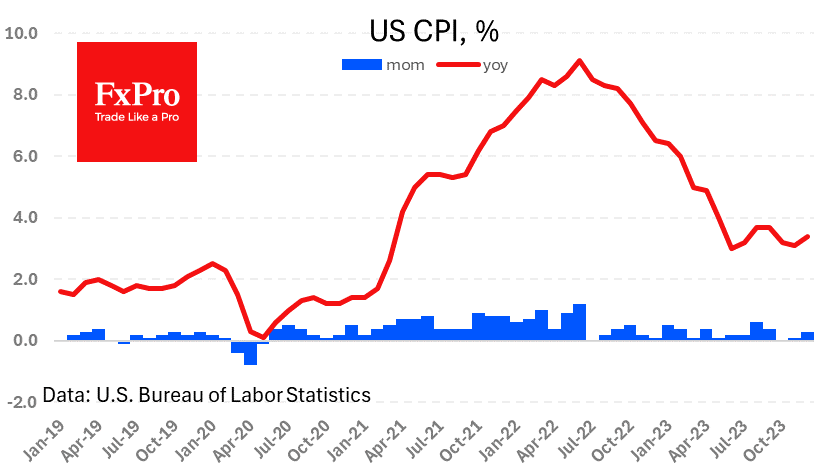

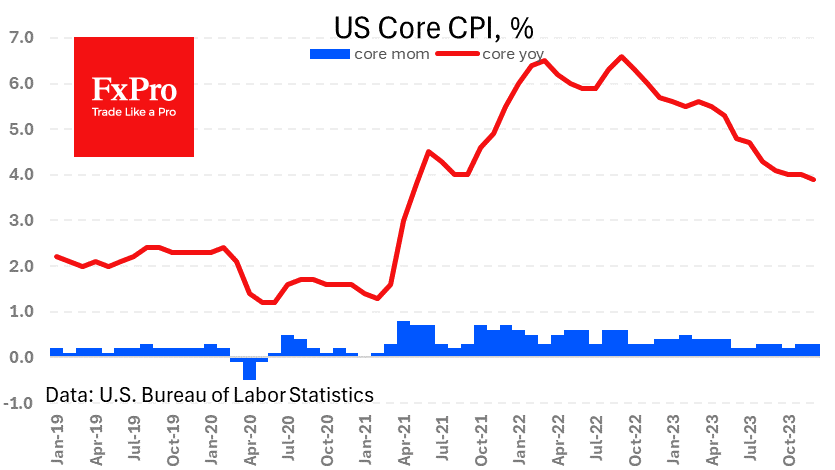

US consumer inflation exceeded expectations, adding 0.3% m/m and accelerating the annual pace from 3.1% to 3.4% in December, above the expected 3.2%. The core CPI also added 0.3% m/m, while its year-on-year gain slowed from 4.0% to 3.9% but above the expected 3.8%.

The more robust inflation data benefited the dollar, sending the DXY up 0.6% to highs since 5 January. Purchases are backed by falling chances of the Fed's rate cut cycle starting as early as March. The market now puts the chances of such a move at 67% versus over 90% just over a fortnight ago.

Notably, expectations are being revised following strong NFP and CPI. However, the market reaction is much less than similar deviations from expectations in the other direction we saw in November and December, as Fed officials have not yet massively changed their narrative after a couple of upbeat reports.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)