The Fed continues to kick the can down the road

The Fed continues to kick the can down the road

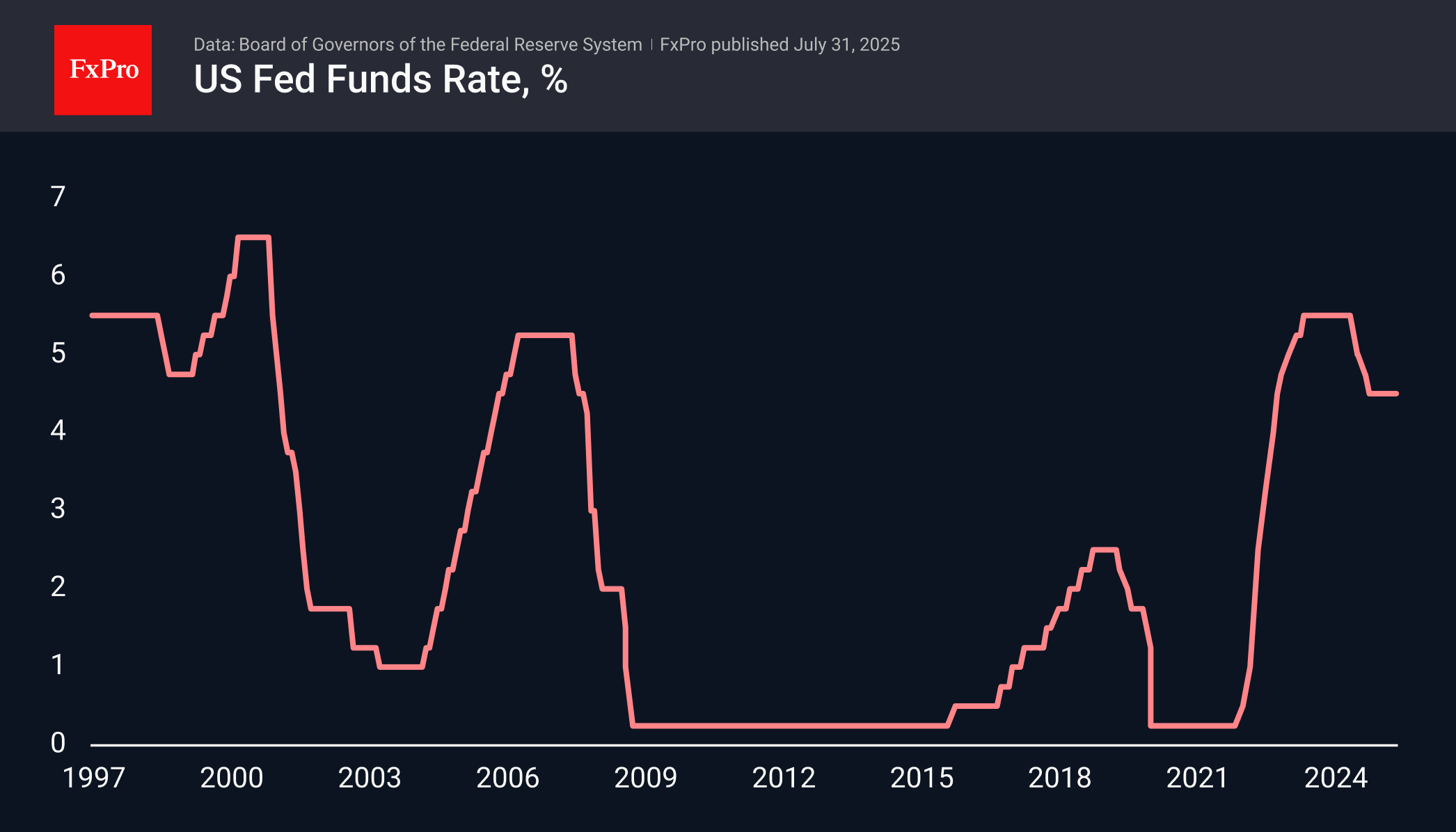

The Fed left the key rate unchanged and demonstrated a hawkish tone, forcing the markets to once again postpone the date of the expected easing. This is despite the first situation in 30 years when two committee members voted in favour of a reduction.

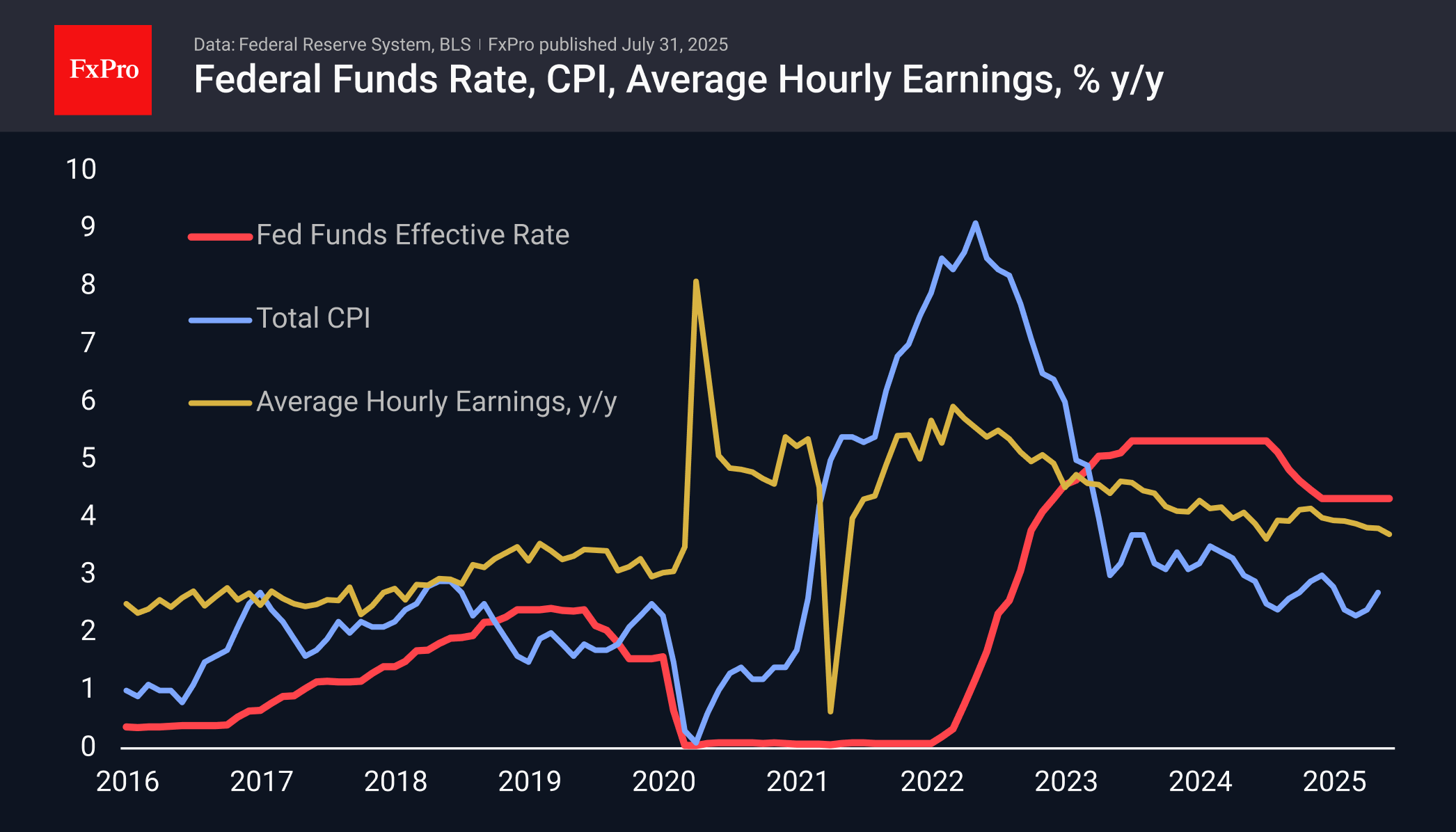

The Fed notes that inflation is still above target. Moreover, Powell also stressed that tariff-induced inflation is only beginning to manifest. This is a very sobering approach, contrary to expectations that the peak of tariff price increases is already behind us.

As expected, Powell noted that no decision has been made regarding September — central bank representatives rarely make such commitments. But even with such caveats, the tone of the comments was harsher than expected.

As a result, the market reduced the chances of a rate cut in September to just 45%, compared to 95% a month earlier and 60% a week earlier. Expectations for the end of the year have also tightened, balancing between forecasts of 1-2 cuts against 2-3 previously and giving a 15% probability of the key rate remaining unchanged.

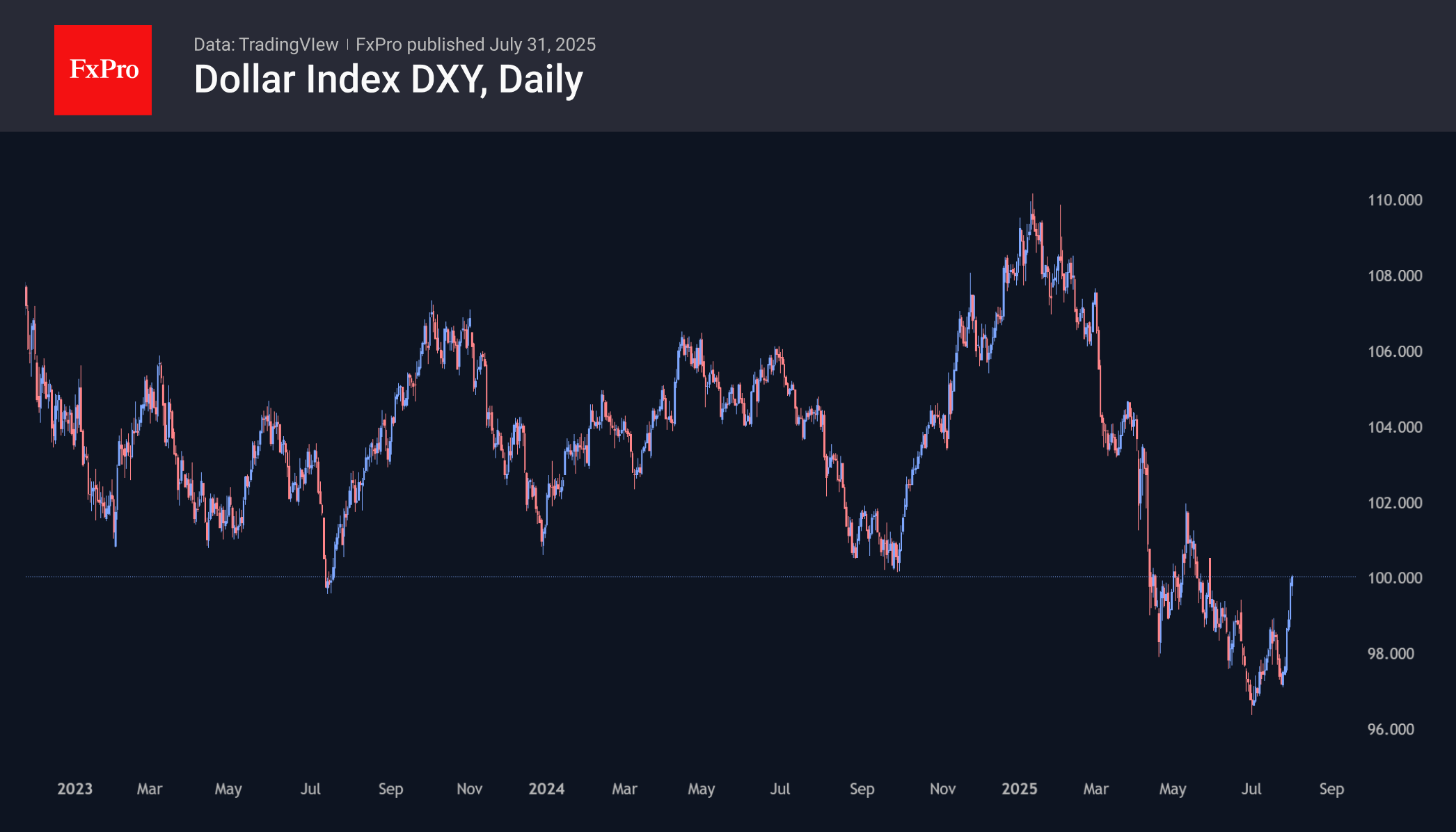

This shift brought the dollar index's intraday growth to 1% on Wednesday. On Thursday, its strengthening continued after a brief shakeout, bringing the DXY to its highest level since the end of May. The dollar is approaching the psychologically important round level of 100, which provided support in the previous two years but did not withstand the tariff wars earlier this year.

It would not be surprising if the dollar paused its growth at these levels, but overall, the Fed's tone and the normalisation of trade flows suggest that the US currency will continue to rise.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)