US CPI release: a bullish chance for the dollar

US CPI release: a bullish chance for the dollar

On Tuesday, US consumer inflation data for July will be released, which will largely determine the fate of the key rate cut in September.

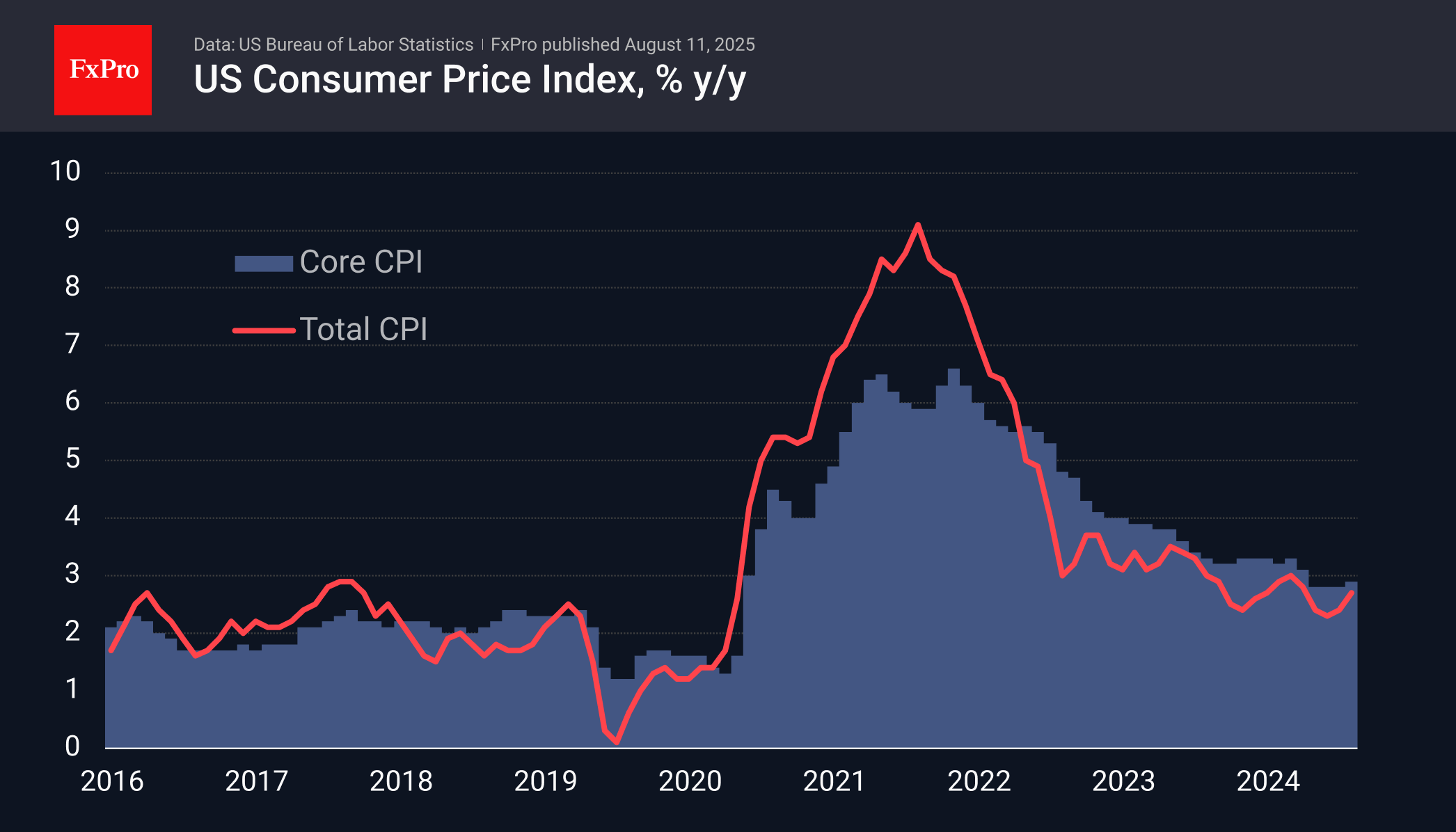

The overall consumer price index in the US accelerated its annual growth from 2.3% to 2.7% in June, and analysts expect it to accelerate to 2.8%. Excluding food and energy prices, it is anticipated to accelerate to 3.0% y/y. In both cases, this will be the highest rate since February.

Since the beginning of the year, inflation reports have been below expectations, which could potentially negatively affect the dollar if this trend continues.

But it is also worth considering Powell's warning at the end of July that the tariff-induced surge in prices has only just begun to gain momentum. An acceleration above expectations could bring back trading on the markets based on expectations of a rate cut in September.

Interest rate futures are pricing in an 86% chance of easing in September (up from over 90% a week ago). Still, an acceleration in headline CPI to 3% could well reduce that chance to 50%, providing a foundation for a dollar recovery.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)