EBC Markets Briefing | Loonie gains in the face of headwinds

The Canadian dollar rose on Monday as a drop in Treasury yields offset increased bets the BOC would begin cutting interest rates next week following the release of weaker-than-expected Canadian GDP data.

The economy expanded at a slower-than-expected annualised rate of 1.7% in Q1, while the pace of Q4 growth was revised to 0.1% from 1.0% reported initially. RBC said in a note that it sees little reason to wait and see.

But loonie cheered a weaker greenback that registered its first monthly decline in 2024 as US inflation rose in line with expectations in April. The PCE price index rose 0.3% last month as expected.

OPEC+ agreed at a meeting on Sunday to extend the total of 5.86 million bpd of output reductions. The is an acknowledgment that demand growth is still uncertain despite of the improving global economic outlook.

Ongoing tighter monetary policy to combat sticky inflation, continuing geopolitical conflicts and the US presidential election in November will probably blunt the effect of the cut.

The question for the market is whether a strong recovery in demand is likely in Asia. For crude oil, China's imports have been soft, and may even show a year-on-year decline for the first five months.

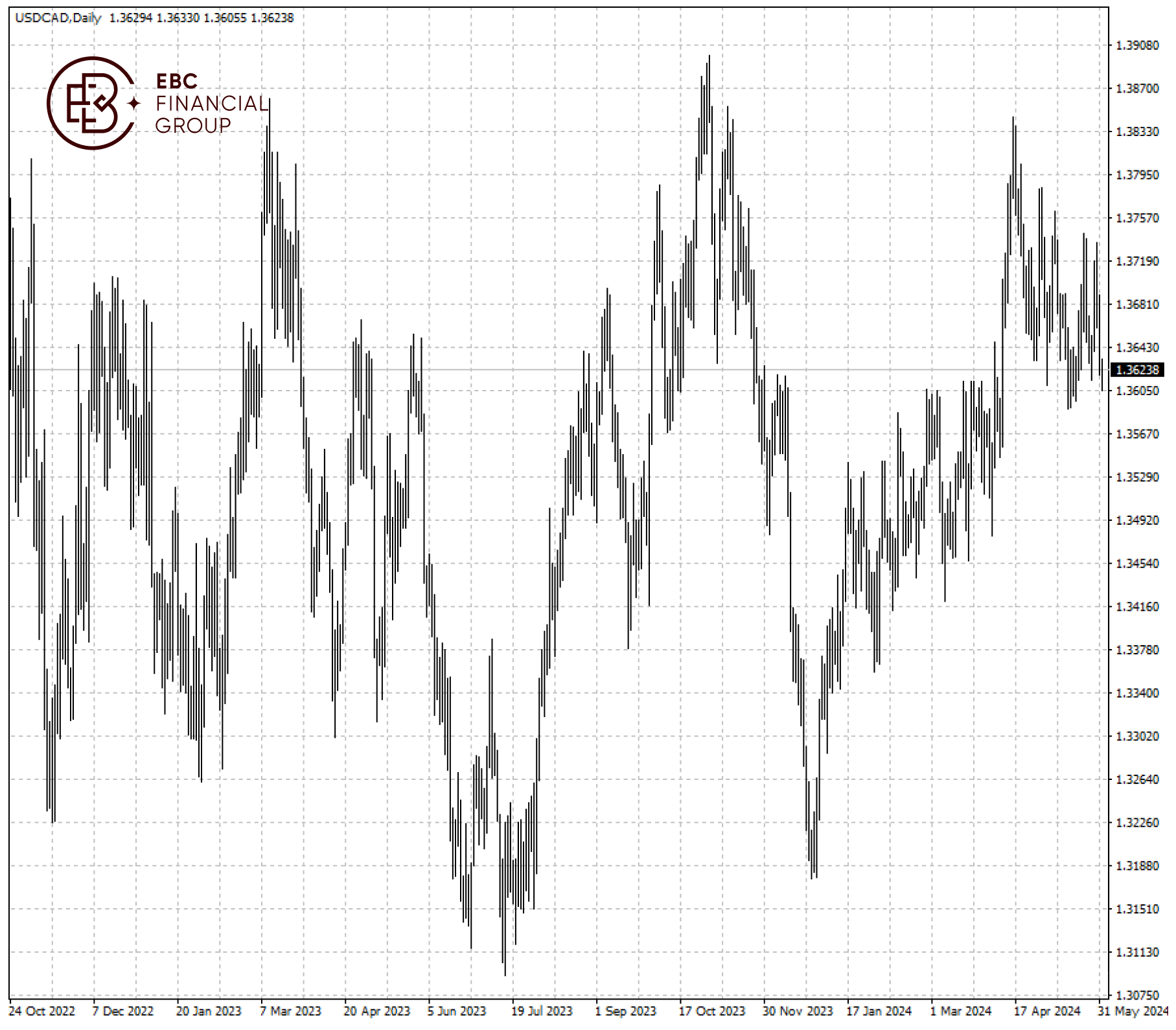

The US dollar traded around the 1.3620 against loonie where the pair had bottomed out at the end of May. Bears may continue to gain the upper hand and a dip below the level will expose 1.3600.

EBC Fintech Development Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Forex Trading Platform or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.