EURUSD eyes 2023 top after quick rally

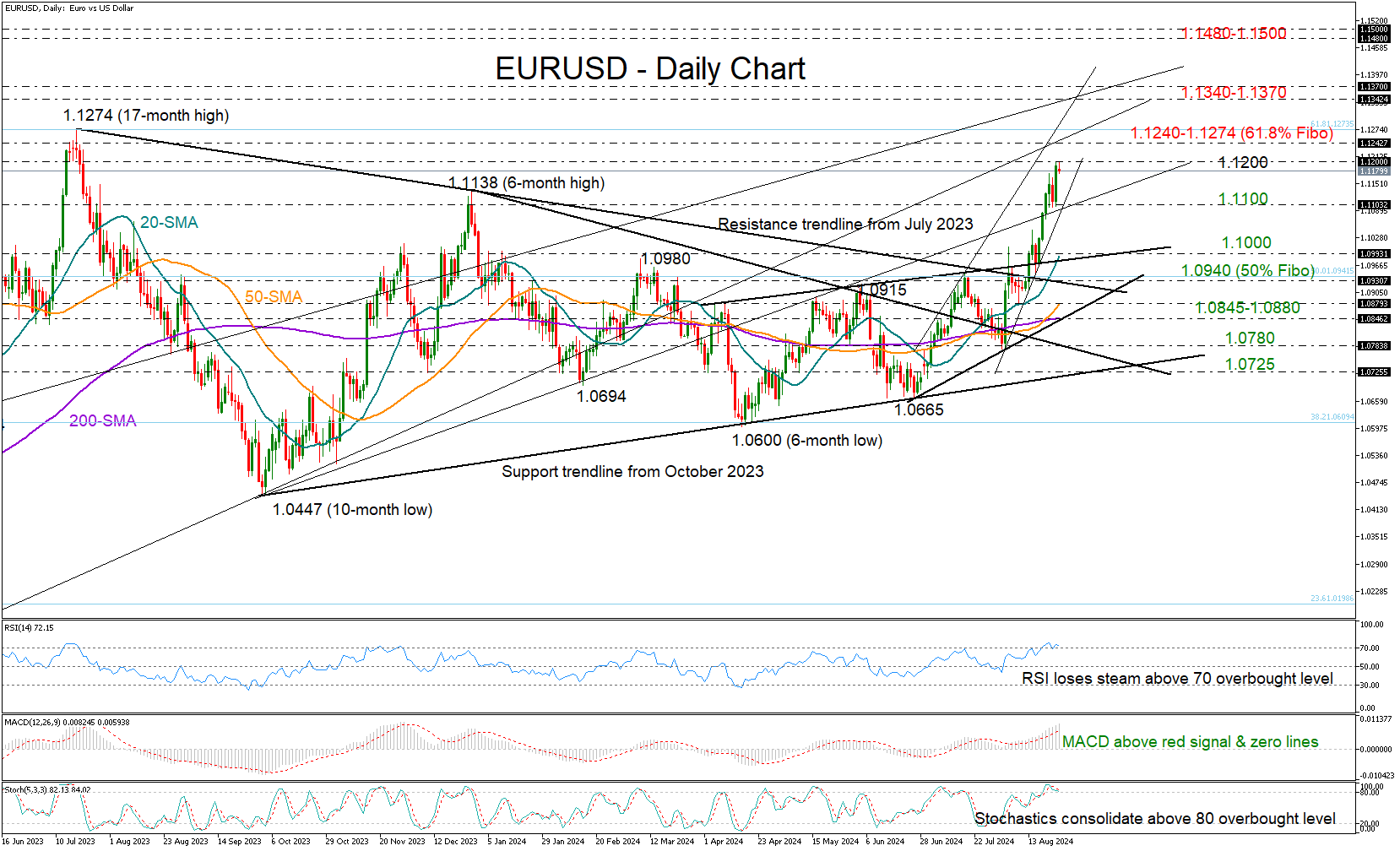

EURUSD has had a great August so far, rising sharply from 1.0776 to nearly 1.1200 to mark its best monthly performance since November 2022.

The pair violated a bearish engulfing candlestick pattern after refusing to close below 1.1100 on Friday, increasing optimism that the rally might have more room to run. Nevertheless, it is crucial to be cautious as the RSI and stochastic oscillator display weakness in the overbought zone, indicating that selling interest persists.

The 1.1240-1.1274 area, which includes the 61.8% Fibonacci retracement of the 2021-2022 downtrend and the trendline from the 2022 trough, could keep the bulls busy in the short term. A move higher could hit a wall somewhere between 1.1340 and 1.1370, with the latter being a tough obstacle during November 2021-February 2022. If the battle there is won, it could trigger substantial buying up to the 2022 double top region of 1.1480.

Looking to the downside, a close below 1.1100 might lead the price towards the 20-day simple moving average (SMA) seen near 1.1000. A move lower could shift all the attention to the 50% Fibonacci of 1.0940 and the broken resistance trendline from July 2023. Then, the 50- and 200-day SMAs at 1.0880 and 1.0845 respectively could block an extension to 1.0780. If this does not occur, selling pressure could stretch towards the 1.0725 region.

All in all, EURUSD exited its 2024 sideways trajectory and might aim for new higher highs, though for a meaningful rally, it might need to cross above the 2023 barrier of 1.1240-1.1274.

.jpg)