- Domov

- Komunita

- Obchodné systémy

- Beta J18

Advertisement

Beta J18

| Zisk : | +15.86% |

| Čerpanie | 17.32% |

| Pipy: | 548.9 |

| Obchodníci | 315 |

| Vyhrané: |

|

| Prehrané: |

|

| Typ: | Reálny |

| Páka: | 1:50 |

| Obchodovanie: | Neznáme |

Edit Your Comment

Beta J18 Diskusia

Členom od Jul 26, 2012

30 príspevkov

May 14, 2017 at 06:55

Členom od Jul 26, 2012

30 príspevkov

TGIF Report Week Ending May 12th Ended Positive +243 pips For The Week.

What a great week it was, especially late in the week getting that hedge signal coming in for the EURUSD pair to go long while I was short on the other 3 pairs GBPUSD, AUDUSD,NZDUSD and it paid off nicely adding another 79pips to what was already a great week of trading. Once the data updates on here it should be me into the double digit club at just over a 11% which is a great feeling as my hard work is stating to payoff.

Have a great weekend and stay tunred for next week TGIF Report.

dannydigitalFX

What a great week it was, especially late in the week getting that hedge signal coming in for the EURUSD pair to go long while I was short on the other 3 pairs GBPUSD, AUDUSD,NZDUSD and it paid off nicely adding another 79pips to what was already a great week of trading. Once the data updates on here it should be me into the double digit club at just over a 11% which is a great feeling as my hard work is stating to payoff.

Have a great weekend and stay tunred for next week TGIF Report.

dannydigitalFX

Členom od Jul 26, 2012

30 príspevkov

May 21, 2017 at 08:48

Členom od Jul 26, 2012

30 príspevkov

TGIF Report Week Ending May 19th Ended Positive -229 pips For The Week.

What a week of disappointment, up enjoying the highs of what looked like another great week for an unsuspected sell off in the GBPUSD on Thursday erasing 100 pips to end flat in that pair(the algo adjusted the SL prior to reducing risk to Break-Even). With no current hedge any more(short on the other pairs) the market continued going against me with the dollar weakening. I'm not pissed that I ended the week negative that's part of trading, what pissed me off is how it ended. A 100 pips erased just like that late in the afternoon with no major scheduled news event that I was aware of. Pull up the GBPUSD chart for 5/18/2017 and reference time period 17:30 and you'll see what I'm talking about. Anyways I'm not going to dwell on this anymore, we got plenty of trading ahead till we reach the end of the month.

Enjoy your weekend and I'll see you next week for another TGIF Report

dannydigitalfx

What a week of disappointment, up enjoying the highs of what looked like another great week for an unsuspected sell off in the GBPUSD on Thursday erasing 100 pips to end flat in that pair(the algo adjusted the SL prior to reducing risk to Break-Even). With no current hedge any more(short on the other pairs) the market continued going against me with the dollar weakening. I'm not pissed that I ended the week negative that's part of trading, what pissed me off is how it ended. A 100 pips erased just like that late in the afternoon with no major scheduled news event that I was aware of. Pull up the GBPUSD chart for 5/18/2017 and reference time period 17:30 and you'll see what I'm talking about. Anyways I'm not going to dwell on this anymore, we got plenty of trading ahead till we reach the end of the month.

Enjoy your weekend and I'll see you next week for another TGIF Report

dannydigitalfx

Členom od Jul 26, 2012

30 príspevkov

May 28, 2017 at 07:41

Členom od Jul 26, 2012

30 príspevkov

TGIF Report Week Ending May 26th Ended Positive -1.5 pips For The Week

What a bumpy ride it was this week. I found myself down 119pips mid week with it not looking good but wait there was a signal late Thursday for the NZDUSDpair that broke to the upside for 43 pips which at the same time EURUSD finally weekend against the dollars for 49.5 pips and allitle help from the rest of the pairs and I was able to close the gap coming in short -1.5pips for the week. Great to see the portfolio bounce back and finish strong. Well next week will be a short week with the US markets closed on Monday and the week and month coming to a close on Wednesday, till then Happy Memorial day and a big Thank you to all the men and women who have served this great country.

Enjoy your weekend and I'll see you next week for another TGIF Report

dannydigitalFX

What a bumpy ride it was this week. I found myself down 119pips mid week with it not looking good but wait there was a signal late Thursday for the NZDUSDpair that broke to the upside for 43 pips which at the same time EURUSD finally weekend against the dollars for 49.5 pips and allitle help from the rest of the pairs and I was able to close the gap coming in short -1.5pips for the week. Great to see the portfolio bounce back and finish strong. Well next week will be a short week with the US markets closed on Monday and the week and month coming to a close on Wednesday, till then Happy Memorial day and a big Thank you to all the men and women who have served this great country.

Enjoy your weekend and I'll see you next week for another TGIF Report

dannydigitalFX

Členom od Jul 26, 2012

30 príspevkov

Jun 04, 2017 at 06:59

Členom od Jul 26, 2012

30 príspevkov

TGIF Report Week Ending June 2nd, Loss For The week -.15bps (Negative -10) pips

Yes the subtitle has changed to compensate for the difference in lot sizes for the pairs being traded as not are all pips are valued the same.

As for the week of trading it was another comeback story, I was down about 1-1.5% Thursday late afternoon(it was not looking good to end the week in the green) when I had a buy signal for NZDUSD come in at 5:30pm. Still not much action for the rest of the evening as I knew it was going to have to come down to Friday. Well Friday morning things got kicked off with that disappointing jobs number, the dollar weakened, the charts lite up, erasing most of the 1.5% deficit to finishing down just -15bps. It wasn't a huge victory for the week but it beats ending the week down 1.5%.

Well this TGIF Report was a bit longer than usual, Thank you for making it down this far, enjoy your weekend and I'll see you next week for another TGIF Report.

Regards,

dannydigitalFX

Yes the subtitle has changed to compensate for the difference in lot sizes for the pairs being traded as not are all pips are valued the same.

As for the week of trading it was another comeback story, I was down about 1-1.5% Thursday late afternoon(it was not looking good to end the week in the green) when I had a buy signal for NZDUSD come in at 5:30pm. Still not much action for the rest of the evening as I knew it was going to have to come down to Friday. Well Friday morning things got kicked off with that disappointing jobs number, the dollar weakened, the charts lite up, erasing most of the 1.5% deficit to finishing down just -15bps. It wasn't a huge victory for the week but it beats ending the week down 1.5%.

Well this TGIF Report was a bit longer than usual, Thank you for making it down this far, enjoy your weekend and I'll see you next week for another TGIF Report.

Regards,

dannydigitalFX

Členom od Jul 26, 2012

30 príspevkov

Jun 11, 2017 at 06:45

Členom od Jul 26, 2012

30 príspevkov

TGIF Report week ending June 9th for a Gain of +1.62%, Net 78 pips.

Thursday was a busy day "Super Thursday" we had allot of information to deal with from James Comey testifying to the exit poll from Britains general election. I was glad I didn't have to have my hand on the pulse but instead watched the events unfold as they happened and watched the Algo's trade through it at the same time.

This weeks trade of the week goes to the GBPUSD. I started off entering the pair earlier in the week(selling into strength) at 1.2879 and for the most part was in the red as much as -83pips entering into Thursday. As it traded around 1.2960 late Thursday evening before it had an explosive move to the downside erasing all my previous losses in the pair. The downward pressure continued throughout the night with a few bounces for which I was closed out today at 1.2739 for 140 pip gain.

I'll post the chart this Sunday once the closed trades have been updated.

Regards,

dannydigitalFX

Thursday was a busy day "Super Thursday" we had allot of information to deal with from James Comey testifying to the exit poll from Britains general election. I was glad I didn't have to have my hand on the pulse but instead watched the events unfold as they happened and watched the Algo's trade through it at the same time.

This weeks trade of the week goes to the GBPUSD. I started off entering the pair earlier in the week(selling into strength) at 1.2879 and for the most part was in the red as much as -83pips entering into Thursday. As it traded around 1.2960 late Thursday evening before it had an explosive move to the downside erasing all my previous losses in the pair. The downward pressure continued throughout the night with a few bounces for which I was closed out today at 1.2739 for 140 pip gain.

I'll post the chart this Sunday once the closed trades have been updated.

Regards,

dannydigitalFX

Členom od Jul 26, 2012

30 príspevkov

Jun 25, 2017 at 07:58

Členom od Jul 26, 2012

30 príspevkov

TGIF REPORT 6/23/2017 a Gain of +16.3%, Net 280 pips

I have to say this week has been the best week of the portfolio performance since the launch. This week’s gain of over 16% pushed me through to the double digit club, erasing all previous losses and creating a new high. We still have one week left in the month to build upon this momentum of a 20% month. You will notice the lot sizes are not a fixed amount anymore as the correct money management strategy is being applied. Allowing larger lots to be applied in winning streaks as the account value increases and smaller lots taken in drawdown periods as the account size reduces.

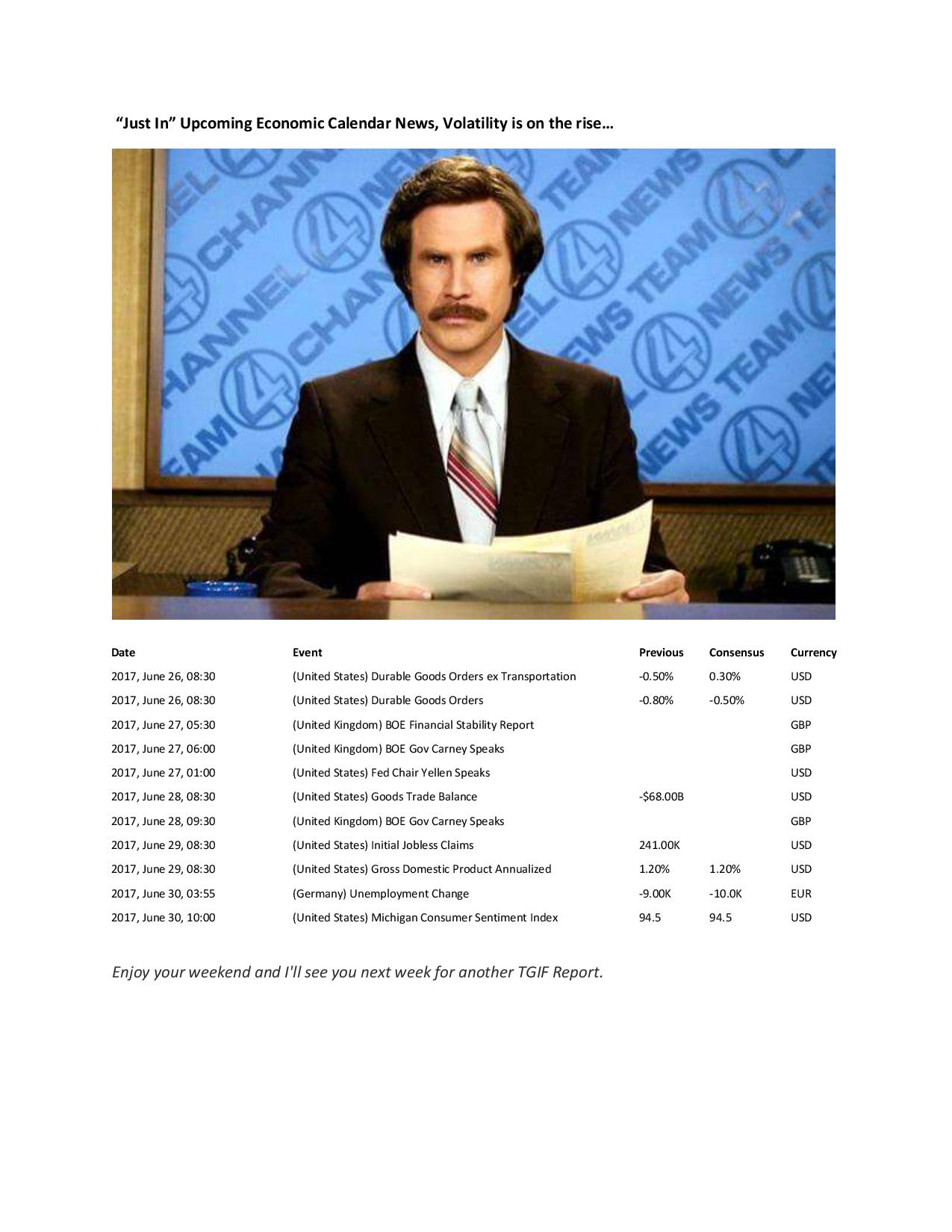

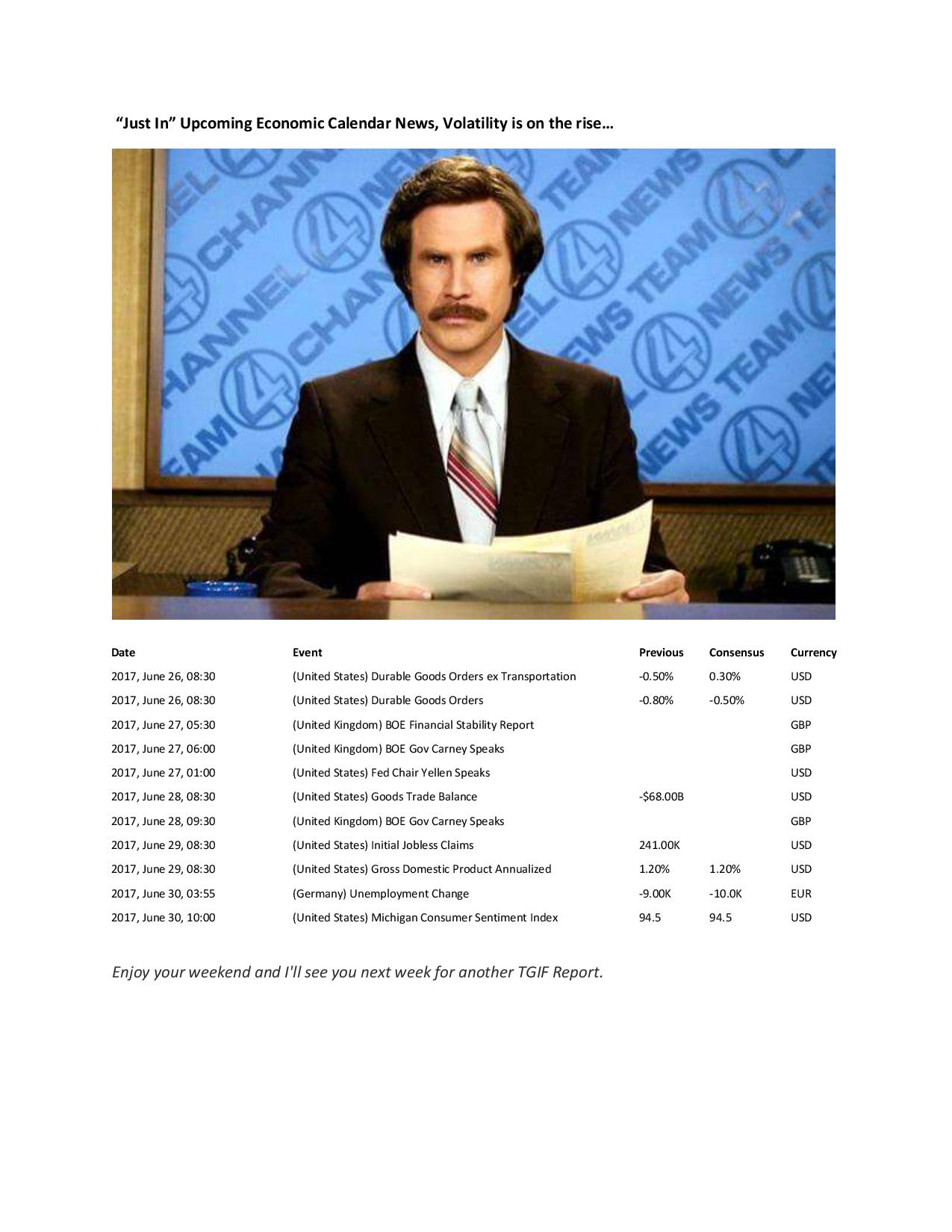

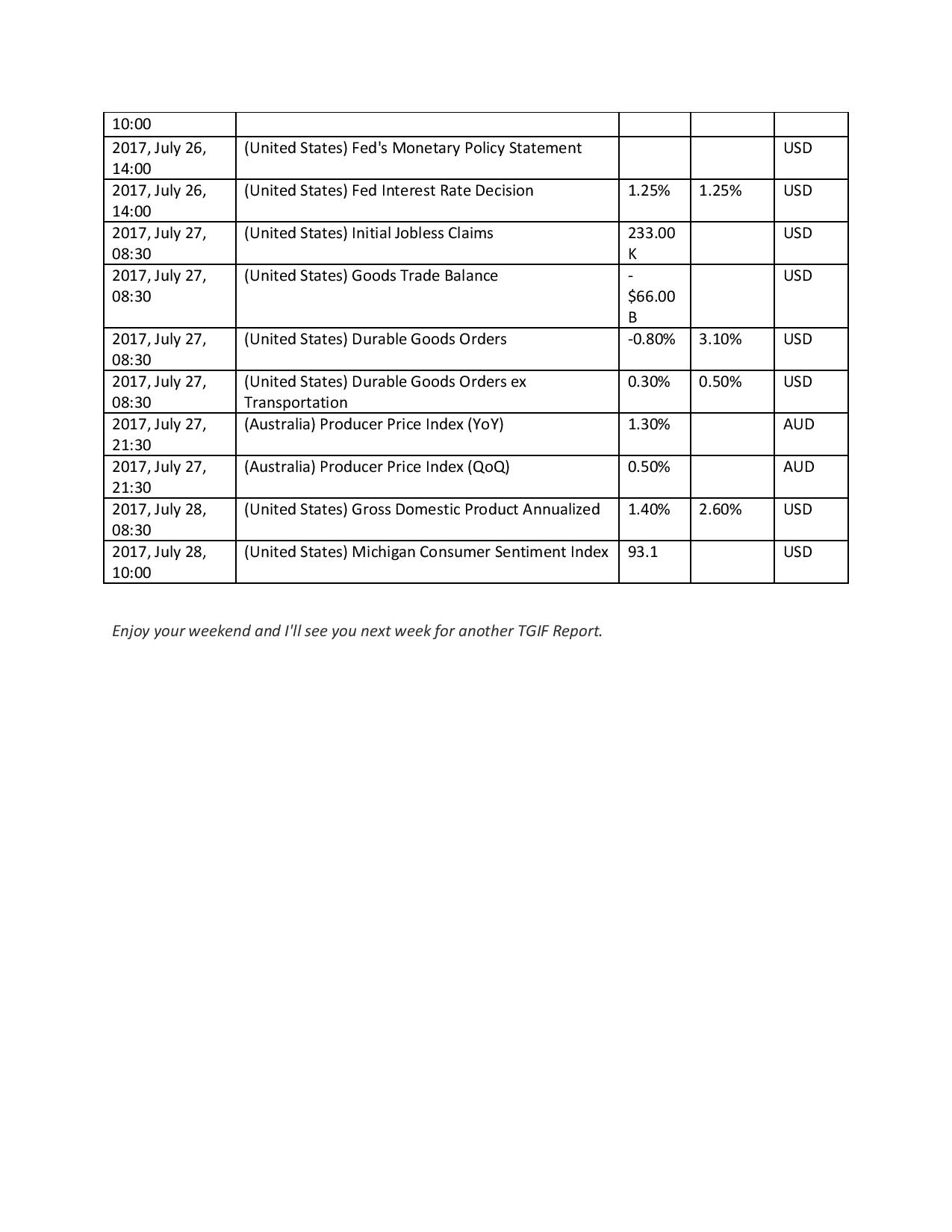

I’m giving the TGIF Report a facelift and adding some new features to make it more informative not only as it relates to the performance but in other aspects of the trading strategy. To start I’ve added a weekly calendar of events and news for the currency pairs in the portfolio. Even though there is no discretion in the portfolio the news brings the necessary volatility each week.

“Just In” Upcoming Economic Calendar News, Volatility is on the rise…

Enjoy your weekend and I'll see you next week for another TGIF Report.

dannydigitalFX

I have to say this week has been the best week of the portfolio performance since the launch. This week’s gain of over 16% pushed me through to the double digit club, erasing all previous losses and creating a new high. We still have one week left in the month to build upon this momentum of a 20% month. You will notice the lot sizes are not a fixed amount anymore as the correct money management strategy is being applied. Allowing larger lots to be applied in winning streaks as the account value increases and smaller lots taken in drawdown periods as the account size reduces.

I’m giving the TGIF Report a facelift and adding some new features to make it more informative not only as it relates to the performance but in other aspects of the trading strategy. To start I’ve added a weekly calendar of events and news for the currency pairs in the portfolio. Even though there is no discretion in the portfolio the news brings the necessary volatility each week.

“Just In” Upcoming Economic Calendar News, Volatility is on the rise…

Enjoy your weekend and I'll see you next week for another TGIF Report.

dannydigitalFX

Členom od Jul 26, 2012

30 príspevkov

Jun 25, 2017 at 07:59

Členom od Jul 26, 2012

30 príspevkov

TGIF REPORT 6/23/2017 a Gain of +4.63%, Net 275 pips

PLEASE DISREGARD THE ABOVE POST FOR 6/23-AS THE RETURN FOR THAT WEEK WAS 4.63%(NOT 16.3%)FOR 275 PIPS, SORRY FOR THE MIX UP.

PLEASE DISREGARD THE ABOVE POST FOR 6/23-AS THE RETURN FOR THAT WEEK WAS 4.63%(NOT 16.3%)FOR 275 PIPS, SORRY FOR THE MIX UP.

Členom od Jul 26, 2012

30 príspevkov

Jul 23, 2017 at 06:14

Členom od Jul 26, 2012

30 príspevkov

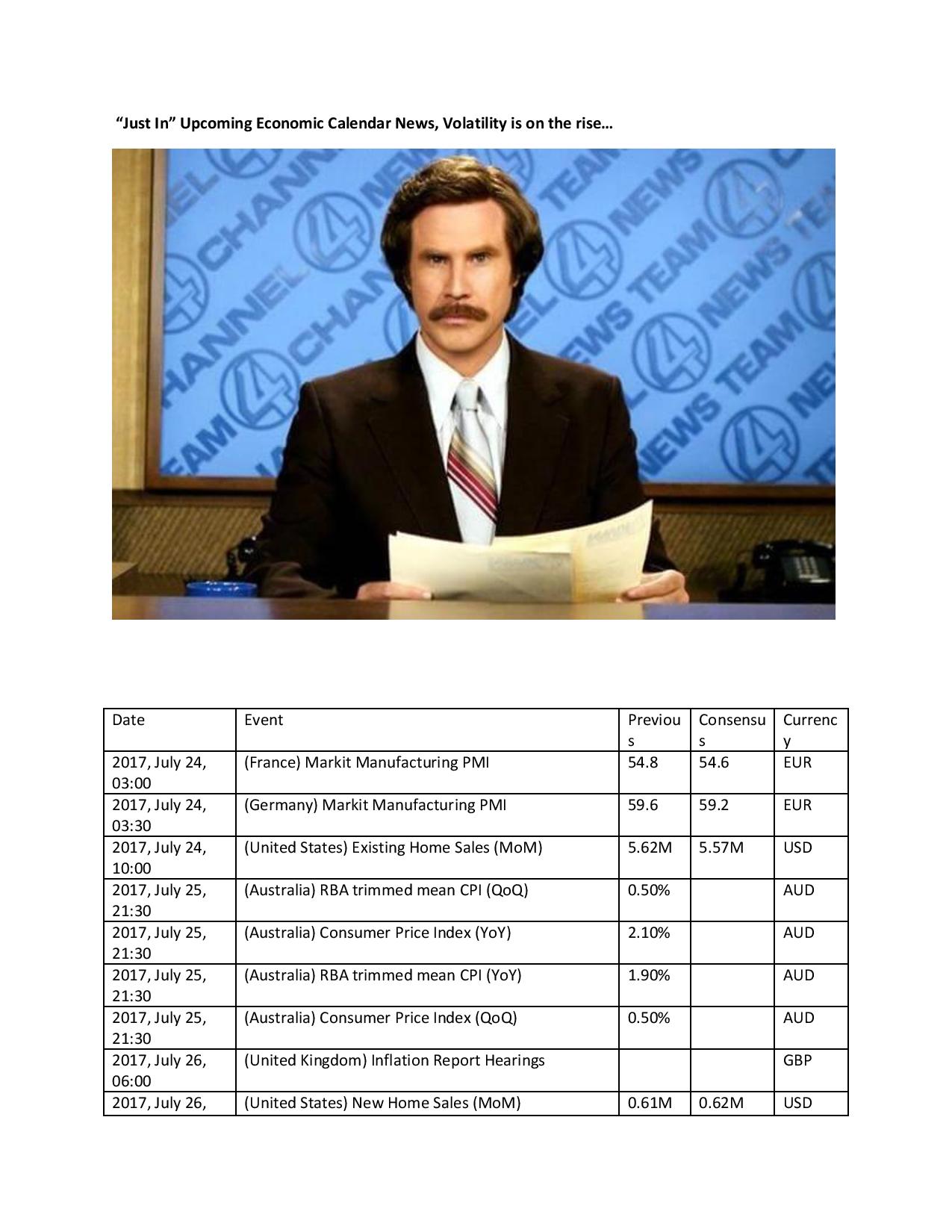

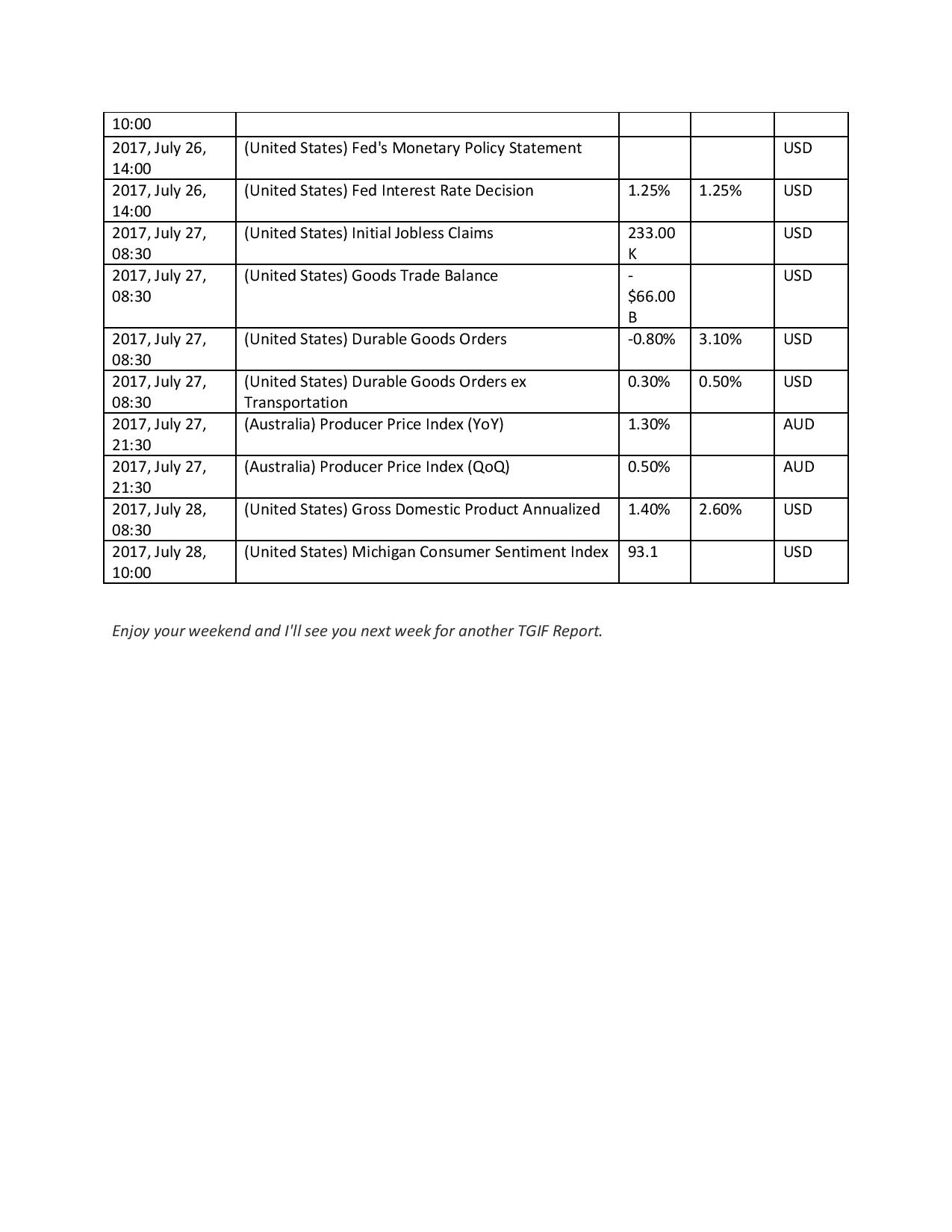

TGIF REPORT FOR THE WEEK OF -7/21/2017 +105 pips for a Gain of +1.22%/MTD +11.17% / YTD +43.07%

Another great week of trading in the books. What made this a great week wasn’t a huge gain for the week but instead with a 50% Win ratio for the week(3 Wins and 3 Losses) I was still able to net 107 pips for a gain of over 1%. You can still profit with half of your trades being losses. You know the old saying cut your losses short and let your winners ride. Fortunately for me I don’t have to struggle emotionally to make those decision as my trading portfolio is completely 100% algorithmic trading, systematic, rules based, no discretion.

See below for the upcoming week Economic Calendar as it relates to the currency pairs traded in the portfolio

dannydigitalFX

Another great week of trading in the books. What made this a great week wasn’t a huge gain for the week but instead with a 50% Win ratio for the week(3 Wins and 3 Losses) I was still able to net 107 pips for a gain of over 1%. You can still profit with half of your trades being losses. You know the old saying cut your losses short and let your winners ride. Fortunately for me I don’t have to struggle emotionally to make those decision as my trading portfolio is completely 100% algorithmic trading, systematic, rules based, no discretion.

See below for the upcoming week Economic Calendar as it relates to the currency pairs traded in the portfolio

dannydigitalFX

Členom od Jul 26, 2012

30 príspevkov

Aug 01, 2017 at 06:42

Členom od Jul 26, 2012

30 príspevkov

TGIF Report on a Monday WHAT?? Yes it’s coming to you on a Monday as today is the last trading in the month so we have a combined report not just including current week stats but also the MTD and YTD. So we here go:

YTD stats for this strategy as of January 2017- to current.

•Total Return 40%

Jan-Feb. 25th strategy traded at FXCM before they sold and transferred the account to forex.com(GAIN) https://www.myfxbook.com/members/dannydigitalFX/quantfxopeninstnot-active-switched-broker/1501276/3YPnGOp4qaIs40RHDGg7

•Total Pips 1,624

MTD stats for July

•Total Return 9.12%

•Total Pips 508

TGIF Report WTD(7/24-7/29)

•Total Return -2.26%

•Total Pips -143

dannydigitalFX

YTD stats for this strategy as of January 2017- to current.

•Total Return 40%

Jan-Feb. 25th strategy traded at FXCM before they sold and transferred the account to forex.com(GAIN) https://www.myfxbook.com/members/dannydigitalFX/quantfxopeninstnot-active-switched-broker/1501276/3YPnGOp4qaIs40RHDGg7

•Total Pips 1,624

MTD stats for July

•Total Return 9.12%

•Total Pips 508

TGIF Report WTD(7/24-7/29)

•Total Return -2.26%

•Total Pips -143

dannydigitalFX

Členom od Jul 26, 2012

30 príspevkov

Aug 07, 2017 at 17:57

Členom od Jul 26, 2012

30 príspevkov

It was a busy a week lots of trades for the week. We had good volatility with multiple news events to keep things moving in the market, see below

TGIF Report WTD(7/30-8/4)

•A Gain of 1.39%

•Net pips 74

MTD stats for August

•A Gain of 1.07%

•Net pips 59

YTD stats since inception(January 2017) to Current(including FXCM Jan-Feb)

•Total Return 40.43%

•Total pips 1,683

This weeks Economic Calendar as it relates to the currency pairs traded in the portfolio, see the attached.

dannydigitalFX

TGIF Report WTD(7/30-8/4)

•A Gain of 1.39%

•Net pips 74

MTD stats for August

•A Gain of 1.07%

•Net pips 59

YTD stats since inception(January 2017) to Current(including FXCM Jan-Feb)

•Total Return 40.43%

•Total pips 1,683

This weeks Economic Calendar as it relates to the currency pairs traded in the portfolio, see the attached.

dannydigitalFX

Členom od Jul 26, 2012

30 príspevkov

Aug 09, 2017 at 13:58

Členom od Jul 26, 2012

30 príspevkov

Strategy Description Page

The strategy uses a systematic approach that is fully automated to analyze market data with a set of pre-programmed instructions to execute trades once certain price movement patterns have been identified. The Buy and Sell signals generated do not take into consideration any fundamental analysis or macroeconomic views. Instead are based on a proprietary technical trading system to identify profitable trading opportunities in the FX market. The portfolio seeks an absolute return regardless of direction and uncorrelated to other market activities

Q-Why did you create a fully automated trading system and don't manually trade with discretion instead?

A-I wanted to avoid some of the pitfalls that come along with manually trading such as, human emotions which can overcome a trader into making poor decisions which can lead to very large losses that in most cases can't be recovered.

Q-What Risk Management do you have set in place?

A-ALL TRADES ARE PLACED WITH A STOP LOSS. System also uses additional software to monitor all open positions account floating % values and total closed % values with key levels to close out all trades if any of them are hit.

-Q-What Trade Management do you have set in place?

A-System uses several different trade management strategies individually and in combination with each other.

Q- What Money Management strategy do you use?

A-I use a fixed percent per trade. Do not use fixed lots ie .01 for all trades with this strategy as you will not have positive long-term results. Each Algo has Its own risk/reward profile and different trading frequency. There are many times where you could end up negative net pips for the week and still have a profit. How is that? Because those pips that were profitable were of a larger trade size therefore having a larger impact netting a profit even though the total net pips was negative. If you had used a fixed lot size with the above example you would’ve had a loss. Bottom line follow the suggested money management strategy (fixed % per trade) for this strategy and you should be fine.

Q-How much leverage do you use.

A-1:5(All in-max trades opened)

Q-Max open positions.

A-Currently max opened positions would be 4 trades.

Q-What Pairs do you trade?

A-Currently EUR/USD, GBP/USD, AUD/USD, NZD/USD more pairs will be added to the portfolio in 2018

Q-How long do you hold positions?

A-Positions are held anywhere from several minutes/hours to several days, with all positions being closed by the end of the trading day on Friday. There are no positions held over the weekend. Currently the average trading period is 2days.

Q-Do you use any grid techniques in your portfolio?

A-No not at all!

Q-Who would you recommend to follow this strategy?

A- If you don’t have a time frame of at least a year and don’t have the maturity to understand that there will be drawdowns which is part of trading then I would tell you don’t bother subscribing. If you want to throw away the effects of compounding because you want to use this as a personal piggy bank every month then I would say pass as well. This is also not for the gamblers, you know who you are out there. If you've been burnt, got caught up in the lure of profits over risk, had your account blown up, followed a strategy that didn't use a Stop Loss, was full discretionary with no actual trading strategy then this portfolio is for you. It's about steady growth, with reasonable risk vs return.

There is a substantial risk of loss in trading commodity futures, equities, options and off-exchange foreign currency products. Past performance is not indicative of future results

The strategy uses a systematic approach that is fully automated to analyze market data with a set of pre-programmed instructions to execute trades once certain price movement patterns have been identified. The Buy and Sell signals generated do not take into consideration any fundamental analysis or macroeconomic views. Instead are based on a proprietary technical trading system to identify profitable trading opportunities in the FX market. The portfolio seeks an absolute return regardless of direction and uncorrelated to other market activities

Q-Why did you create a fully automated trading system and don't manually trade with discretion instead?

A-I wanted to avoid some of the pitfalls that come along with manually trading such as, human emotions which can overcome a trader into making poor decisions which can lead to very large losses that in most cases can't be recovered.

Q-What Risk Management do you have set in place?

A-ALL TRADES ARE PLACED WITH A STOP LOSS. System also uses additional software to monitor all open positions account floating % values and total closed % values with key levels to close out all trades if any of them are hit.

-Q-What Trade Management do you have set in place?

A-System uses several different trade management strategies individually and in combination with each other.

Q- What Money Management strategy do you use?

A-I use a fixed percent per trade. Do not use fixed lots ie .01 for all trades with this strategy as you will not have positive long-term results. Each Algo has Its own risk/reward profile and different trading frequency. There are many times where you could end up negative net pips for the week and still have a profit. How is that? Because those pips that were profitable were of a larger trade size therefore having a larger impact netting a profit even though the total net pips was negative. If you had used a fixed lot size with the above example you would’ve had a loss. Bottom line follow the suggested money management strategy (fixed % per trade) for this strategy and you should be fine.

Q-How much leverage do you use.

A-1:5(All in-max trades opened)

Q-Max open positions.

A-Currently max opened positions would be 4 trades.

Q-What Pairs do you trade?

A-Currently EUR/USD, GBP/USD, AUD/USD, NZD/USD more pairs will be added to the portfolio in 2018

Q-How long do you hold positions?

A-Positions are held anywhere from several minutes/hours to several days, with all positions being closed by the end of the trading day on Friday. There are no positions held over the weekend. Currently the average trading period is 2days.

Q-Do you use any grid techniques in your portfolio?

A-No not at all!

Q-Who would you recommend to follow this strategy?

A- If you don’t have a time frame of at least a year and don’t have the maturity to understand that there will be drawdowns which is part of trading then I would tell you don’t bother subscribing. If you want to throw away the effects of compounding because you want to use this as a personal piggy bank every month then I would say pass as well. This is also not for the gamblers, you know who you are out there. If you've been burnt, got caught up in the lure of profits over risk, had your account blown up, followed a strategy that didn't use a Stop Loss, was full discretionary with no actual trading strategy then this portfolio is for you. It's about steady growth, with reasonable risk vs return.

There is a substantial risk of loss in trading commodity futures, equities, options and off-exchange foreign currency products. Past performance is not indicative of future results

*Komerčné použitie a spam nebudú tolerované a môžu viesť k zrušeniu účtu.

Tip: Uverejnením adresy URL obrázku /služby YouTube sa automaticky vloží do vášho príspevku!

Tip: Zadajte znak @, aby ste automaticky vyplnili meno používateľa, ktorý sa zúčastňuje tejto diskusie.

.jpg)