Bitcoin gets ready to move

Market picture

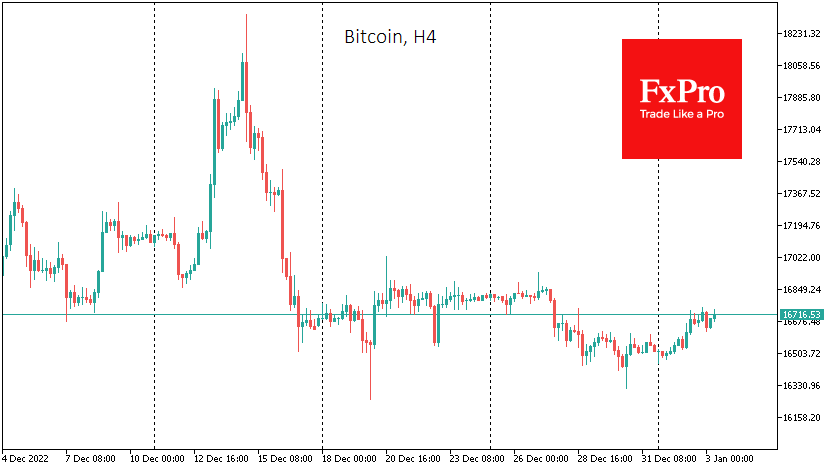

Bitcoin has declined slightly over the past 24 hours - the bulls have still not decided to go on the offensive. Perhaps it is because of an overhang of selling orders from struggling miners.

The first cryptocurrency is trading near $16.7K to start the day on Tuesday, having retreated from its 50-day moving average but maintaining a positive bias towards the upside within the trend of several trading days. US exchanges return to action today to increase liquidity, including in cryptocurrencies.

Traders should be prepared that there may be attempts to form new market trends from the new year. And it could be a decisive move upward or another sell-off after a lull.

Regarding seasonality, January is considered a neutral month for BTC. Over the past 12 years, Bitcoin has ended with growth on six occasions. The average growth over the last 12 years has been 22%, while the average decline has been 17%.

In the first case, BTC could end January at around $20,100. Second, it could finish at about $13,700, updating November's lows. Meanwhile, in the last eight years, bitcoin has declined in January on six occasions, giving buyers of the first cryptocurrency little chance.

News background

The popular YouTube blogger Coin Bureau believes that bitcoin still needs to bottom out. In his opinion, we should expect BTC to drop to $10,000 during the first three months of 2023.

Negative sentiment in the crypto market will dominate until spring 2023, said the crypto fund QCP Capital.

The Italian parliament passed a bill to tax cryptocurrency traders. Traders will now pay 26% on profits made from digital trading assets. On the other side of the coin, Britain is introducing tax breaks for foreigners trading through local brokers to make London a crypto trading hub, as it is now with currencies and metals.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)